Exam 7: Replacement Decisions

Exam 1: Engineering Decision Making42 Questions

Exam 2: Time Value of Money67 Questions

Exam 3: Cash Flow Analysis66 Questions

Exam 4: Comparison Methods: Part I51 Questions

Exam 5: Comparison Methods: Part Ii50 Questions

Exam 6: Financial Accounting and Business Plans42 Questions

Exam 7: Replacement Decisions52 Questions

Exam 8: Taxes49 Questions

Exam 9: Inflation52 Questions

Exam 10: Public Sector Decision Making49 Questions

Exam 11: Project Management50 Questions

Exam 12: Dealing With Uncertainty and Risk48 Questions

Select questions type

This table gives the data relevant to a replacement decision:  What is the EAC (Capital Costs)for year 3 at the MARR of 10%?

What is the EAC (Capital Costs)for year 3 at the MARR of 10%?

(Multiple Choice)

4.7/5  (29)

(29)

The salvage value of an electric generator is $10 000, while its purchase price five years ago was $20 000. It produces 45.5 megawatt-hours of electricity per year and requires $800 in annual maintenance costs. A new generator can produce electricity at $0.05 per kilowatt-hour. Should the new generator be purchased if the annual interest rate is 7%?

(Essay)

4.7/5  (40)

(40)

NB Power is considering replacing its existing electricity generator. The current market value of the generator is $15 000. It depreciates at 25% per year. The generator produces 153 megawatt-hours of electricity annually and requires $3 000 in maintenance costs per year. Moreover, the maintenance costs are expected to increase by $1 200 per year in the future. On the other hand, there is another generator in the market that provides electricity at $0.059 per kilowatt-hour. What should NB Power do if the MARR is 8%?

(Essay)

4.9/5  (43)

(43)

Shultz Ltd. produces portable electric band saws. Currently Shultz Ltd. pays its subcontractor $6.14 per power unit excluding material costs. It is expected that sales of the electric band saws will be as high as 7 500 per year. Should Shultz Ltd. produce power units itself if the equivalent annual cost for the company to install and run the production equipment would be $49 568?

(Multiple Choice)

4.9/5  (40)

(40)

If it is said that the economic life of a challenger is four years it means that

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following can be treated as a part of installation costs?

(Multiple Choice)

4.9/5  (40)

(40)

A BMW costs $35 000, its salvage value declines by declining-balance depreciation of 10% per year, and its maintenance costs are $100 in the first year and go up by $500 a year. Mary and Tom both like to drive BMWs. Mary trades her car in for a new model every year, whereas Tom keeps his until it reaches its economic life, then trades it in. Mary and Tom both have MARRs of 5%. How much more does Mary pay for her car per year, on average, than Tom?

(Multiple Choice)

4.7/5  (36)

(36)

If the interest rate is 10%, the depreciation rate of an asset is 10%, its service life is 10 years and its first cost is $10 million then EAC(Capital)for a ten-year life is

(Multiple Choice)

4.9/5  (30)

(30)

TRINITY Ltd. produces different pieces of furniture. A set of electric drills used in the production of furniture wears out rapidly, after which the firm scraps them. Calculate the equivalent annual cost (capital costs)of a set of electric drills if the firm buys the set for $4 500 and uses it for 5 years. Assume an annual interest rate of 8%.

(Multiple Choice)

4.9/5  (38)

(38)

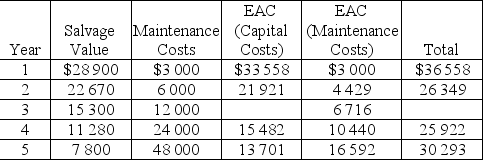

A replacement study showed that the components of the total costs of an asset are as follows:  What is the economic life of an asset?

What is the economic life of an asset?

(Multiple Choice)

4.8/5  (37)

(37)

A new computer costs $4 000. It depreciates at 15% annually. The computer maintenance costs are $200 in the first year increasing by 50% per year thereafter. Calculate the EAC over the first five years of the computer's life, assuming a 20% interest rate. What is the economic life of the computer?

(Essay)

4.9/5  (44)

(44)

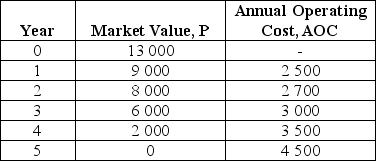

A three-year-old small crane is being considered for early replacement. Its current market value is $13 000. Estimated future market values and annual operating costs for the next five years are given in the following table:

What is the economic life for this crane if the interest rate is 10% per year?

What is the economic life for this crane if the interest rate is 10% per year?

(Essay)

4.9/5  (38)

(38)

If the challenger is different from the defender, and the challenger does not repeat, what should one do to make an educated decision about replacement?

(Multiple Choice)

4.7/5  (40)

(40)

Showing 21 - 40 of 52

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)