Exam 7: Replacement Decisions

Exam 1: Engineering Decision Making42 Questions

Exam 2: Time Value of Money67 Questions

Exam 3: Cash Flow Analysis66 Questions

Exam 4: Comparison Methods: Part I51 Questions

Exam 5: Comparison Methods: Part Ii50 Questions

Exam 6: Financial Accounting and Business Plans42 Questions

Exam 7: Replacement Decisions52 Questions

Exam 8: Taxes49 Questions

Exam 9: Inflation52 Questions

Exam 10: Public Sector Decision Making49 Questions

Exam 11: Project Management50 Questions

Exam 12: Dealing With Uncertainty and Risk48 Questions

Select questions type

Stan bought a car three years ago for $20 000. Recently he got a promotion and is deciding whether to keep his old car or to buy a new one. His dealer told him that the current market price of his old car is $15 000. The car maintenance costs are $1 000 now, and they are going to increase each year by at least $500. Stan compares his old car with a new one that, he calculates, would have an equivalent annual cost of $4 100. What is Stan's optimal decision if his current interest rate is 7%?

(Essay)

4.9/5  (40)

(40)

What is the difference between replacement of an existing physical asset and its retirement?

(Essay)

4.8/5  (39)

(39)

You buy a new car for $20 000. Its salvage value declines by declining-balance depreciation of 10% per year, while its maintenance costs are $500 in the first year and go up by $400 a year. If your MARR is 5%, what is the EAC to you of keeping it until it reaches the end of its economic life?

(Multiple Choice)

4.7/5  (40)

(40)

A transportation company has bought a truck 5 years ago for $60 000. Currently its market value is  Maintenance costs of the truck are

Maintenance costs of the truck are  per year, increasing by $500 with each year. A new truck of the same capacity costs

per year, increasing by $500 with each year. A new truck of the same capacity costs  with constant maintenance costs of $500 for the duration of its service life of 10 years. Assuming 10% depreciation rate for both trucks and 5% annual interest rate, should the company buy the new truck now?

with constant maintenance costs of $500 for the duration of its service life of 10 years. Assuming 10% depreciation rate for both trucks and 5% annual interest rate, should the company buy the new truck now?

(Essay)

4.9/5  (28)

(28)

What are the two reasons that a large portion of capacity cost is usually incurred early in the life of the capacity?

(Multiple Choice)

4.8/5  (39)

(39)

An old asset-a piece of equipment-has a current market value of $10 000. Its purchase price 5 years ago was $15 000. Installation costs were $2 000 in year 1 with some adjustment costs in year 2. If you are to calculate the EAC (Capital)to keep this asset in operation, what value should be assigned to P in the formula EAC(Capital)= (P - S)*(A/P, i, N)+ iS?

(Essay)

4.7/5  (37)

(37)

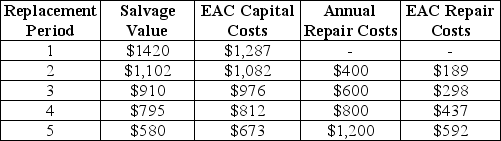

This table gives the data relevant to a replacement decision:  If the MARR is 8.0%, what is the purchase price of this equipment?

If the MARR is 8.0%, what is the purchase price of this equipment?

(Multiple Choice)

4.8/5  (36)

(36)

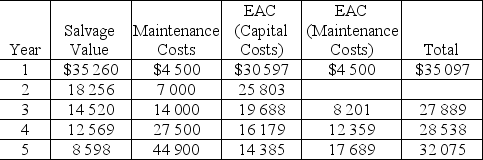

Currently a firm replaces its equipment every year. It has calculated the equivalent annual cost of replacement as follows:  How much can the firm save by making a replacement decision based on the economic life criterion?

How much can the firm save by making a replacement decision based on the economic life criterion?

(Multiple Choice)

4.8/5  (36)

(36)

A printing and duplicating company owns ten photocopying machines. Which of the following associated expenses is a variable cost?

(Multiple Choice)

4.9/5  (42)

(42)

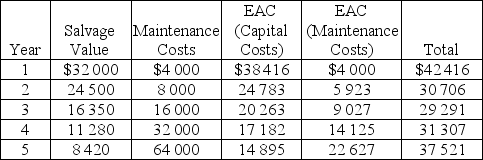

This table gives the data relevant to a replacement decision:  What is the EAC (Maintenance Costs )for year 2 at the MARR of 10%?

What is the EAC (Maintenance Costs )for year 2 at the MARR of 10%?

(Multiple Choice)

4.7/5  (37)

(37)

A communication system cost $65 000 to buy and $4 000 to install ten years ago. Currently the ten-year-old system can be sold for $7 000, but it will cost $1 000 to remove it. If it's sold in a year's time, the net income, after paying removal costs, will be $1 000. A new communication system costs $50 000 plus $500 to install it. Assuming 5% depreciation rate for the new system, 7% annual interest rate, by how much would the operating costs of the old system have to exceed operating costs of the new one for the old system to be replaced immediately?

(Essay)

4.9/5  (37)

(37)

What are the three basic replacement schemes discussed in Chapter 7 in the text?

(Essay)

4.9/5  (36)

(36)

Showing 41 - 52 of 52

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)