Exam 26: Derivatives and Hedging Risk

Exam 1: Introduction to Corporate Finance38 Questions

Exam 2: Accounting Statements and Cash Flow59 Questions

Exam 3: Financial Planning and Growth39 Questions

Exam 4: Financial Markets and Net Present Value: First Principles of Finance36 Questions

Exam 5: The Time Value of Money73 Questions

Exam 6: How to Value Bonds and Stocks81 Questions

Exam 7: Net Present Value and Other Investment Rules57 Questions

Exam 8: Net Present Value and Capital Budgeting48 Questions

Exam 9: Risk Analysis, Real Options, and Capital Budgeting35 Questions

Exam 10: Risk and Return: Lessons From Market History51 Questions

Exam 11: Risk and Return: the Capital Asset Pricing Model65 Questions

Exam 12: An Alternative View of Risk and Return: the Arbitrage Pricing Theory42 Questions

Exam 13: Risk, Return, and Capital Budgeting63 Questions

Exam 14: Corporate Financing Decisions and Efficient Capital Markets46 Questions

Exam 15: Long-Term Financing: an Introduction46 Questions

Exam 16: Capital Structure: Basic Concepts56 Questions

Exam 17: Capital Structure: Limits to the Use of Debt53 Questions

Exam 18: Valuation and Capital Budgeting for the Levered Firm54 Questions

Exam 19: Dividends and Other Payouts47 Questions

Exam 20: Issuing Equity Securities to the Public43 Questions

Exam 21: Long-Term Debt50 Questions

Exam 22: Leasing42 Questions

Exam 23: Options and Corporate Finance: Basic Concepts63 Questions

Exam 24: Options and Corporate Finance: Extensions and Applications24 Questions

Exam 25: Warrants and Convertibles47 Questions

Exam 26: Derivatives and Hedging Risk50 Questions

Exam 27: Short-Term Finance and Planning51 Questions

Exam 28: Cash Management35 Questions

Exam 29: Credit Management31 Questions

Exam 30: Mergers and Acquisitions55 Questions

Exam 31: Financial Distress22 Questions

Exam 32: International Corporate Finance54 Questions

Select questions type

A bond manager who wishes to hold the bond with the greatest potential volatility would wise to hold:

(Multiple Choice)

4.7/5  (30)

(30)

If the producer of a product has entered into a fixed price sale agreement for that output, the producer faces:

(Multiple Choice)

4.8/5  (33)

(33)

If a financial institution has equated the dollar effects of interest rate risk on the assets with the dollar effects on the liabilities, it has engaged in:

(Multiple Choice)

4.8/5  (34)

(34)

The main difference between a forward contract and a cash transaction is:

(Multiple Choice)

4.7/5  (31)

(31)

An inverse floater and a super-inverse floater are more valuable to a purchaser if:

(Multiple Choice)

4.9/5  (50)

(50)

Suppose you agree to purchase one ounce of gold for $984 any time over the next month. The current price of gold is $970. The spot price of gold then falls to $960 the next day. If the agreement is represented by a futures contract marking to market on a daily basis as the price changes, what is your cash flow at the end of the next business day?

(Multiple Choice)

4.8/5  (32)

(32)

To protect against interest rate risk, the mortgage banker should:

(Multiple Choice)

4.9/5  (37)

(37)

On March 1, you contract to take delivery of 1 ounce of gold for $495. The agreement is good for any day up to April 1. Throughout March, the price of gold hit a low of $425 and hit a high of $535. The price settled on March 31 at $505, and on April 1st you settle your futures agreement at that price. Your net cash flow is:

(Multiple Choice)

4.9/5  (31)

(31)

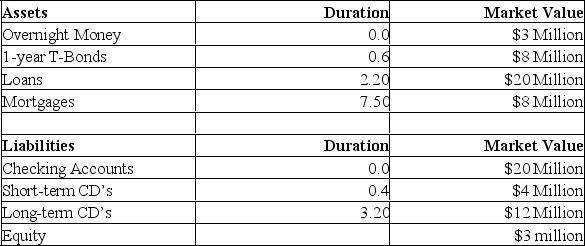

What new asset duration will immunize the statement of financial position if the duration of the liabilities are 1.111?

What new asset duration will immunize the statement of financial position if the duration of the liabilities are 1.111?

(Essay)

4.9/5  (41)

(41)

Showing 41 - 50 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)