Exam 10: Risk and Return: Lessons From Market History

Exam 1: Introduction to Corporate Finance38 Questions

Exam 2: Accounting Statements and Cash Flow59 Questions

Exam 3: Financial Planning and Growth39 Questions

Exam 4: Financial Markets and Net Present Value: First Principles of Finance36 Questions

Exam 5: The Time Value of Money73 Questions

Exam 6: How to Value Bonds and Stocks81 Questions

Exam 7: Net Present Value and Other Investment Rules57 Questions

Exam 8: Net Present Value and Capital Budgeting48 Questions

Exam 9: Risk Analysis, Real Options, and Capital Budgeting35 Questions

Exam 10: Risk and Return: Lessons From Market History51 Questions

Exam 11: Risk and Return: the Capital Asset Pricing Model65 Questions

Exam 12: An Alternative View of Risk and Return: the Arbitrage Pricing Theory42 Questions

Exam 13: Risk, Return, and Capital Budgeting63 Questions

Exam 14: Corporate Financing Decisions and Efficient Capital Markets46 Questions

Exam 15: Long-Term Financing: an Introduction46 Questions

Exam 16: Capital Structure: Basic Concepts56 Questions

Exam 17: Capital Structure: Limits to the Use of Debt53 Questions

Exam 18: Valuation and Capital Budgeting for the Levered Firm54 Questions

Exam 19: Dividends and Other Payouts47 Questions

Exam 20: Issuing Equity Securities to the Public43 Questions

Exam 21: Long-Term Debt50 Questions

Exam 22: Leasing42 Questions

Exam 23: Options and Corporate Finance: Basic Concepts63 Questions

Exam 24: Options and Corporate Finance: Extensions and Applications24 Questions

Exam 25: Warrants and Convertibles47 Questions

Exam 26: Derivatives and Hedging Risk50 Questions

Exam 27: Short-Term Finance and Planning51 Questions

Exam 28: Cash Management35 Questions

Exam 29: Credit Management31 Questions

Exam 30: Mergers and Acquisitions55 Questions

Exam 31: Financial Distress22 Questions

Exam 32: International Corporate Finance54 Questions

Select questions type

The Zolo Co. just declared that it is increasing its annual dividend from $1.00 per share to $1.25 per share. If the stock price remains constant, then:

(Multiple Choice)

4.8/5  (41)

(41)

The returns on your portfolio over the last 5 years were -5%, 20%, 0%, 10% and 5%. What is the arithmetic average return?

(Multiple Choice)

4.9/5  (31)

(31)

Which one of the following statements concerning the standard deviation is correct?

(Multiple Choice)

4.9/5  (39)

(39)

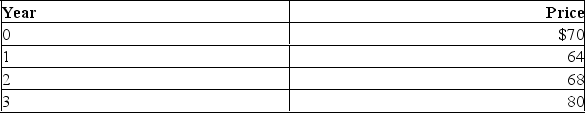

The prices for IMB over the last 3 years are given below. Assuming no dividends were paid, what was the 3-year holding period return?

(Multiple Choice)

4.9/5  (40)

(40)

Suppose you own a risky asset with an expected return of 12% and a standard deviation of 20%. If the returns are normally distributed, the approximate probability of receiving a return greater than 72%, or less than -48% is:

(Multiple Choice)

4.8/5  (39)

(39)

Kids Toy Co. has had total returns over the past five years of 0%, 7%, -2%, 10%, and 12%. What is the percentage change in wealth over the five years

(Multiple Choice)

4.9/5  (37)

(37)

You bought 100 shares of stock at $20 each. At the end of the year, you received a total of $400 in dividends, and your stock was worth $2,500 total. What was your percentage rate of return?

(Multiple Choice)

4.7/5  (38)

(38)

The market portfolio of common stocks earned 20.4% last year. Treasury bills earned 5.3% on average last year. The average inflation rate was 2.5%. What was the equity risk premium?

(Multiple Choice)

4.9/5  (37)

(37)

Suppose you are the risk manager of a bank with a trading portfolio of $1 billion. You have just received the latest information about the portfolio allocations made by the trading branch of your bank, who tell you that the portfolio will earn a premium return of 23% over the risk free rate in one year. You have carried out an independent analysis, and find that the return on your portfolio over the next ten days is normally distributed with a mean of 0.77% and a standard deviation of 5%. Find the ten day 1% value at risk for this portfolio.

(Essay)

4.8/5  (37)

(37)

A stock had returns of 8%, 14%, and 2% for the past three years. Based on these returns, what is the probability that this stock will earn at least 20% in any one given year?

(Multiple Choice)

4.9/5  (38)

(38)

You just sold 200 shares of XYZ Inc. stock at a price of $38.75 a share. Last year you paid $41.50 a share to buy this stock. Over the course of the year, you received dividends totaling $1.64 per share. What is your capital gain on this investment?

(Multiple Choice)

4.8/5  (45)

(45)

Showing 41 - 51 of 51

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)