Exam 27: Managing Aggregate Demand: Fiscal Policy

Exam 1: What Is Economics254 Questions

Exam 2: The Economony: Myth and Reality184 Questions

Exam 3: The Fundamental Economic Problem: Scarcity and Choice278 Questions

Exam 4: Supply and Demand: an Initial Look297 Questions

Exam 5: Consumer Choice: Individual and Market Demand213 Questions

Exam 6: Demand and Elasticity247 Questions

Exam 7: Production, Inputs, and Cost: Building Blocks for Supply Analysis246 Questions

Exam 8: Output, Price, and Profit: the Importance of Marginal Analysis232 Questions

Exam 9: The Financial Markets and the Economy: the Tail That Wags the Dog225 Questions

Exam 10: The Firm and the Industry Under Perfect Competition219 Questions

Exam 11: The Case for Free Markets: the Price System251 Questions

Exam 12: Monopoly236 Questions

Exam 13: Between Competition and Monopoly248 Questions

Exam 14: Limiting Market Power: Antitrust and Regulation152 Questions

Exam 15: The Shortcomings of Free Markets210 Questions

Exam 16: The Economics of the Environment, and Natural Resources218 Questions

Exam 17: Taxation and Resource Allocation218 Questions

Exam 18: Pricing the Factors of Production230 Questions

Exam 19: Labor and Entrepreneurship: the Human Inputs267 Questions

Exam 20: Poverty, Inequality, and Discrimination167 Questions

Exam 21: An Introduction to Macroeconomics212 Questions

Exam 22: The Goals of Macroeconomic Policy212 Questions

Exam 23: Economic Growth: Theory and Policy226 Questions

Exam 24: Aggregate Demand and the Powerful Consumer216 Questions

Exam 25: Demand-Side Equilibrium: Unemployment or Inflation215 Questions

Exam 26: Bringing in the Supply Side: Unemployment and Inflation228 Questions

Exam 27: Managing Aggregate Demand: Fiscal Policy207 Questions

Exam 28: Money and the Banking System222 Questions

Exam 29: Monetary Policy: Conventional and Unconventional208 Questions

Exam 30: The Financial Crisis and the Great Recession64 Questions

Exam 31: The Debate Over Monetary and Fiscal Policy216 Questions

Exam 32: Budget Deficits in the Short and Long Run214 Questions

Exam 33: The Trade-Off Between Inflation and Unemployment218 Questions

Exam 34: International Trade and Comparative Advantage215 Questions

Exam 35: The International Monetary System: Order or Disorder216 Questions

Exam 36: Exchange Rates and the Macroeconomy215 Questions

Exam 37: Contemporary Issues in the Useconomy23 Questions

Select questions type

The use of spending and taxes by the government to influence aggregate demand is known as

(Multiple Choice)

4.9/5  (29)

(29)

In 2009, President Obama and Congress stimulated aggregate demand by

(Multiple Choice)

4.8/5  (39)

(39)

Reductions in the personal income tax, often advocated by supply-siders to increase labor supply and effort, can be expected to also

(Multiple Choice)

5.0/5  (36)

(36)

Inflationary gaps can be cured by either cutting government expenditures or raising taxes.

(True/False)

4.9/5  (36)

(36)

Critics of supply-side economics argue that tax cuts favored by supply-siders will have the greatest effect on

(Multiple Choice)

4.9/5  (37)

(37)

With regard to GDP, residential property taxes are an example of ____ taxes.

(Multiple Choice)

4.8/5  (40)

(40)

When the economy has an income tax that is variable, the multiplier is

(Multiple Choice)

4.9/5  (30)

(30)

If all variable taxes in the United States were removed and only fixed taxes remained, what would be the effect on the expenditures schedule?

(Multiple Choice)

4.9/5  (37)

(37)

When government increases a fixed tax, consumption schedule

(Multiple Choice)

4.9/5  (42)

(42)

Federal budget deficits are often increased by supply-side policies because of their reliance on

(Multiple Choice)

4.8/5  (35)

(35)

Do policy makers know the exact value of the fiscal multiplier?

(Multiple Choice)

4.9/5  (40)

(40)

The oversimplified formula for the multiplier is misleading because it ignores the effects of

(Multiple Choice)

4.8/5  (34)

(34)

As a general rule, when an income tax is added to the basic macroeconomic model, what happens to the consumption schedule?

(Multiple Choice)

4.7/5  (39)

(39)

If President Obama wanted to decrease aggregate demand, which of the following would he tend to favor?

(Multiple Choice)

4.9/5  (40)

(40)

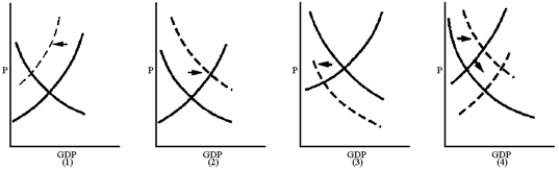

Figure 11-2

-Which graph in Figure 11-2 best reflects a Keynesian's view of the impact of raising taxes on saving?

-Which graph in Figure 11-2 best reflects a Keynesian's view of the impact of raising taxes on saving?

(Multiple Choice)

4.9/5  (44)

(44)

Recessionary gaps can be cured by raising government expenditures.

(True/False)

4.8/5  (41)

(41)

Showing 81 - 100 of 207

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)