Exam 7: Activity-Based Costing and Management

Exam 1: Introduction to Managerial Accounting64 Questions

Exam 2: Basic Managerial Accounting Concepts238 Questions

Exam 3: Cost Behavior231 Questions

Exam 4: Cost-Volume-Profit Analysis: a Managerial Planning Tool185 Questions

Exam 5: Job-Order Costing196 Questions

Exam 6: Process Costing177 Questions

Exam 7: Activity-Based Costing and Management178 Questions

Exam 8: Absorption and Variable Costing, and Inventory Management125 Questions

Exam 9: Profit Planning186 Questions

Exam 10: Standard Costing: a Managerial Control Tool180 Questions

Exam 11: Flexible Budgets and Overhead Analysis173 Questions

Exam 12: Performance Evaluation and Decentralization167 Questions

Exam 13: Short-Run Decision Making: Relevant Costing170 Questions

Exam 14: Capital Investment Decisions172 Questions

Exam 15: Statement of Cash Flows185 Questions

Exam 16: Financial Statement Analysis190 Questions

Select questions type

Costs incurred when products and services fail to conform to requirements or satisfy customer needs after being delivered to customers are

(Multiple Choice)

4.9/5  (39)

(39)

Last year, Stevita Inc. shipped 3,000,000 kilograms of goods to customers at a cost of $2,400,000. If an individual customer orders 20,000 kilograms and produces $400,000 of revenue (total revenue is $40 million), the amount of shipping cost assigned to the customer using activity-based costing would be

(Multiple Choice)

4.9/5  (36)

(36)

Activities necessary to remain in business are called valuable activities.

(True/False)

4.7/5  (28)

(28)

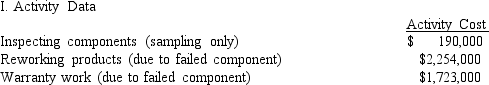

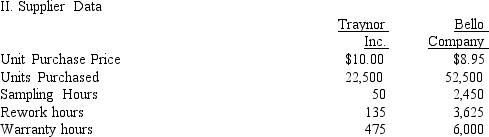

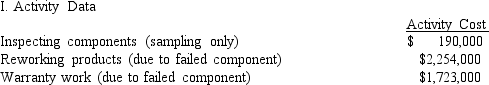

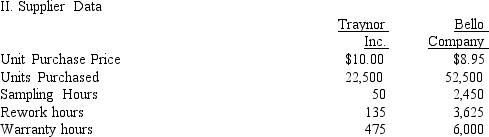

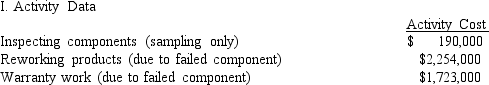

Figure 7-3.

Hamilton Company manufactures engines. Hamilton produces all the parts necessary for its engines except for one electronic component, which is purchased from two local suppliers: Traynor Inc. and Bello Company. Both suppliers are reliable and rarely deliver late; however, Traynor sells the component for $10.00 per unit and Bello sells the same component for $8.95. Hamilton purchases 70% of its components from Bello, because of the lower price. The total annual demand is 75,000 units.

-Refer to Figure 7-3. Calculate the activity rate for inspecting components based on sampling hours.

-Refer to Figure 7-3. Calculate the activity rate for inspecting components based on sampling hours.

(Multiple Choice)

4.9/5  (35)

(35)

Activity attributes are financial and nonfinancial information items that describe individual activities.

(True/False)

4.8/5  (33)

(33)

Figure 7-3.

Hamilton Company manufactures engines. Hamilton produces all the parts necessary for its engines except for one electronic component, which is purchased from two local suppliers: Traynor Inc. and Bello Company. Both suppliers are reliable and rarely deliver late; however, Traynor sells the component for $10.00 per unit and Bello sells the same component for $8.95. Hamilton purchases 70% of its components from Bello, because of the lower price. The total annual demand is 75,000 units.

-Refer to Figure 7-3. Suppose that Hamilton loses $2,500,000 in sales per year because of its reputation for defective units attributable to failed components. Using warranty hours, assign the proportional cost of lost sales to Bello Company. Then determine what effect this would have on the cost per component.

-Refer to Figure 7-3. Suppose that Hamilton loses $2,500,000 in sales per year because of its reputation for defective units attributable to failed components. Using warranty hours, assign the proportional cost of lost sales to Bello Company. Then determine what effect this would have on the cost per component.

(Multiple Choice)

4.8/5  (36)

(36)

Charlotte Company produces folding chairs. It takes the company 18,000 hours to produce 90,000 chairs.

Required:

A. What is the velocity in hours?

B. What is the cycle time in hours?

(Essay)

4.8/5  (34)

(34)

Figure 7-3.

Hamilton Company manufactures engines. Hamilton produces all the parts necessary for its engines except for one electronic component, which is purchased from two local suppliers: Traynor Inc. and Bello Company. Both suppliers are reliable and rarely deliver late; however, Traynor sells the component for $10.00 per unit and Bello sells the same component for $8.95. Hamilton purchases 70% of its components from Bello, because of the lower price. The total annual demand is 75,000 units.

-Refer to Figure 7-3. Calculate the activity rate for warranty work based on warranty hours. Round to the nearest whole dollar.

-Refer to Figure 7-3. Calculate the activity rate for warranty work based on warranty hours. Round to the nearest whole dollar.

(Multiple Choice)

4.9/5  (43)

(43)

Using the original design, a machine requires 12 hours of setup time. By redesigning the machine, the setup time is reduced by 25%. The cost per setup hour is $225. Calculate the reduction in nonvalue-added cost per setup.

(Multiple Choice)

4.8/5  (35)

(35)

A factory produces 124,000 televisions per quarter. A total of 8,000 production hours are used within the factory per quarter. Compute the velocity in units per hour.

(Multiple Choice)

4.7/5  (32)

(32)

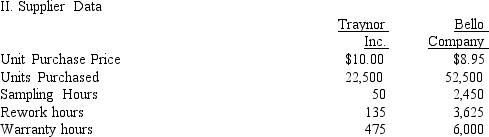

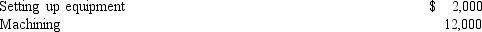

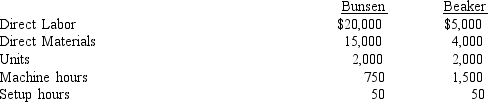

Figure 7-4.

Honeydew Company produces two products, a high end laptop computer under the label Bunsen Laptops, and an inexpensive desktop computer under the label Beaker Computers. The two products use two overhead activities, with the following costs:

The controller has collected the expected annual prime costs for each product, the machine hours, the setup hours, and the expected production.

The controller has collected the expected annual prime costs for each product, the machine hours, the setup hours, and the expected production.

-Refer to Figure 7-4. Calculate Beaker's consumption ratio for setup hours.

-Refer to Figure 7-4. Calculate Beaker's consumption ratio for setup hours.

(Multiple Choice)

4.8/5  (28)

(28)

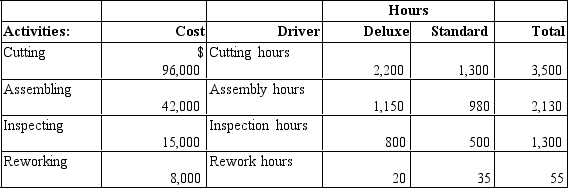

Taylor Corporation produces two models of their leather brief cases: deluxe and standard. The four activities and four drivers are as follows:

Required:

A. Calculate the consumption ratios for the four drivers.

B. Calculate the activity rates that would be used to assign costs to each product. Round your answer to two decimal places.

C. Calculate the unit cost assuming that 500 deluxe models were produced and 700 standard models were produced.

Required:

A. Calculate the consumption ratios for the four drivers.

B. Calculate the activity rates that would be used to assign costs to each product. Round your answer to two decimal places.

C. Calculate the unit cost assuming that 500 deluxe models were produced and 700 standard models were produced.

(Essay)

4.8/5  (39)

(39)

____________________ are financial and nonfinancial information items that describe individual activities.

(Short Answer)

4.8/5  (37)

(37)

A costing system that first assigns costs to activities and then to products is

(Multiple Choice)

4.7/5  (41)

(41)

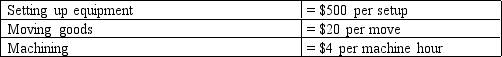

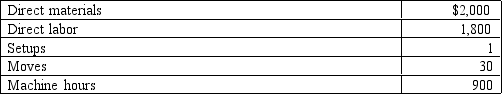

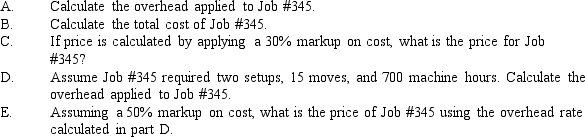

The Thompson Company uses activity-based costing to determine product cost. Three activities and their rates have been calculated as shown below.

Thompson provided the following data from the job order cost sheet for Job #345

Thompson provided the following data from the job order cost sheet for Job #345

(Essay)

4.9/5  (32)

(32)

Figure 7-7.

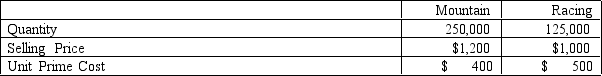

Armstrong Company produces a variety of bicycles. One of its plants produces two bicycles: a mountain model and a racing model. At the beginning of the year, the following data were prepared for this plant:

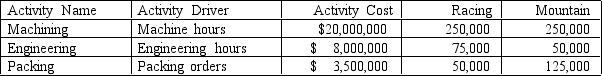

In addition, the following information was provided so that overhead costs could be assigned to each product:

In addition, the following information was provided so that overhead costs could be assigned to each product:

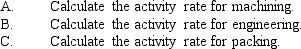

-Refer to Figure 7-7.

-Refer to Figure 7-7.

(Essay)

4.8/5  (39)

(39)

A list of activities accompanied by information that describes each activity is an activity ____.

(Multiple Choice)

4.7/5  (46)

(46)

In an activity dictionary, types of resources consumed is an example of a(n)

(Multiple Choice)

4.9/5  (36)

(36)

Setups, material handling, and inspection are all possible examples of

(Multiple Choice)

4.7/5  (31)

(31)

Showing 61 - 80 of 178

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)