Exam 2: Basic Managerial Accounting Concepts

Exam 1: Introduction to Managerial Accounting64 Questions

Exam 2: Basic Managerial Accounting Concepts238 Questions

Exam 3: Cost Behavior231 Questions

Exam 4: Cost-Volume-Profit Analysis: a Managerial Planning Tool185 Questions

Exam 5: Job-Order Costing196 Questions

Exam 6: Process Costing177 Questions

Exam 7: Activity-Based Costing and Management178 Questions

Exam 8: Absorption and Variable Costing, and Inventory Management125 Questions

Exam 9: Profit Planning186 Questions

Exam 10: Standard Costing: a Managerial Control Tool180 Questions

Exam 11: Flexible Budgets and Overhead Analysis173 Questions

Exam 12: Performance Evaluation and Decentralization167 Questions

Exam 13: Short-Run Decision Making: Relevant Costing170 Questions

Exam 14: Capital Investment Decisions172 Questions

Exam 15: Statement of Cash Flows185 Questions

Exam 16: Financial Statement Analysis190 Questions

Select questions type

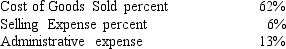

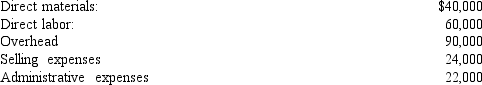

Rizzuto Company supplied the following information for the month of January.

Required: Reconstruct Rizzuto's income statement for January assuming that their total sales revenue for the month equaled $500,000.

Required: Reconstruct Rizzuto's income statement for January assuming that their total sales revenue for the month equaled $500,000.

(Essay)

4.7/5  (41)

(41)

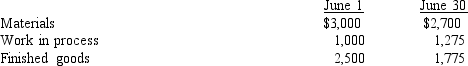

In June, Olympic Company purchased materials costing $38,000, and incurred direct labor cost of $42,000. Overhead totaled $27,000 for the month. Information on inventories was as follows.

Required:

Required:

(Essay)

4.9/5  (38)

(38)

Select the appropriate definition for each of the items listed below.

a.

Work in process inventory

b.

Finished goods inventory

c.

Cost of goods sold

d.

Cost of goods manufactured

e.

Total manufacturing costs

-Direct materials + direct labor + overhead

(Short Answer)

4.8/5  (39)

(39)

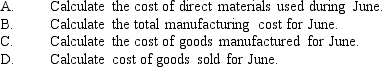

Figure 2-7.

Gateway Company produces a product with the following per-unit costs:

Last year, Gateway produced and sold 750 units at a sales price of $68 each. Total selling and administrative expense was $22,000.

-Refer to Figure 2-7. Prime cost per-unit was?

Last year, Gateway produced and sold 750 units at a sales price of $68 each. Total selling and administrative expense was $22,000.

-Refer to Figure 2-7. Prime cost per-unit was?

(Multiple Choice)

4.8/5  (42)

(42)

Allocation means that an indirect cost is assigned to a cost object using a reasonable and convenient method.

(True/False)

4.9/5  (39)

(39)

Select the appropriate definition for each of the items listed below.

a.

per-unit prime cost

b.

per-unit conversion cost

c.

per-unit cost of goods manufactured

-(direct labor + overhead)/units produced

(Short Answer)

4.7/5  (32)

(32)

Employees who convert direct materials into a product are classified as _____________.

(Short Answer)

4.9/5  (39)

(39)

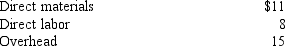

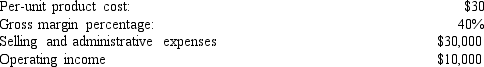

Figure 2-8.

Last year Quest Company incurred the following costs:

Quest produced and sold 2,000 units at a sales price of $125 each. Assume that beginning and ending inventories of materials, work in process, and finished goods were zero.

-Refer to Figure 2-8. Gross margin per-unit was?

Quest produced and sold 2,000 units at a sales price of $125 each. Assume that beginning and ending inventories of materials, work in process, and finished goods were zero.

-Refer to Figure 2-8. Gross margin per-unit was?

(Multiple Choice)

4.8/5  (29)

(29)

A(n)_________________ is the benefit given up or sacrificed when one alternative is chosen over another.

(Short Answer)

4.8/5  (43)

(43)

Select the appropriate definition for each of the items listed below.

a.

period cost

b.

direct cost

c.

opportunity cost

d.

variable cost

e.

indirect cost

f.

fixed cost

g.

product cost

-A cost that is not inventoried

(Short Answer)

4.9/5  (31)

(31)

Figure 2-6.

Seaview Company took the following data from their income statement at the end of the current year.

-Refer to Figure 2-6. What was gross margin for the year?

-Refer to Figure 2-6. What was gross margin for the year?

(Multiple Choice)

4.8/5  (31)

(31)

Select the appropriate definition for each of the items listed below.

a.

Work in process inventory

b.

Finished goods inventory

c.

Cost of goods sold

d.

Cost of goods manufactured

e.

Total manufacturing costs

-(direct materials + direct labor + overhead) +/-the change in work in process inventory from the beginning to the end of the current period

(Short Answer)

4.8/5  (35)

(35)

Accumulating costs is the way that costs are measured and recorded.

(True/False)

4.8/5  (44)

(44)

______________________ is the sum of direct labor cost and manufacturing overhead cost.

(Short Answer)

4.9/5  (28)

(28)

Figure 2-1.

Concam Inc. manufactures television sets. Last month direct materials (electronic components, etc.) costing $500,000 were put into production. Direct labor of $800,000 was incurred, overhead equaled $450,000, and selling and administrative costs totaled $360,000. The company manufactured 8,000 television sets during the month. Assume that there were no beginning or ending work in process balances.

-Refer to Figure 2-1. The per-unit conversion cost was:

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is an example of an intangible product?

(Multiple Choice)

4.7/5  (42)

(42)

Period costs are all costs that are not product costs, such as office supplies.

(True/False)

4.8/5  (34)

(34)

Assigning costs involves the way that a cost is linked to some cost object.

(True/False)

4.9/5  (34)

(34)

Showing 121 - 140 of 238

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)