Exam 11: Inventory

Exam 1: Welcome to Accounting158 Questions

Exam 2: The Accounting Equation and Transaction Analysis155 Questions

Exam 3: The Recording Process: Debits and Credits222 Questions

Exam 4: The Recording Process: the Journal, the Ledger, and the Trial Balance176 Questions

Exam 5: Adjusting the Accounts and Preparing an Adjusted Trial Balance180 Questions

Exam 6: Completing a Worksheet and Completing the Accounting Cycle186 Questions

Exam 7: Merchandising Companies: Purchases Perpetual153 Questions

Exam 8: Merchandising Companies: Sales Perpetual122 Questions

Exam 9: Merchandising Companies: Worksheets and Financial Statements Perpetual163 Questions

Exam 10: Special Journals153 Questions

Exam 11: Inventory205 Questions

Exam 12: Cash, Banking, and Internal Controls268 Questions

Exam 13: Payroll Accounting: Employee Taxes and Records101 Questions

Exam 14: Payroll Accounting: Employer Taxes and Records79 Questions

Select questions type

Purchased goods that have been shipped FOB destination but which are in transit at the end of the period should be excluded from the buyer's physical count of ending inventory.

(True/False)

4.8/5  (38)

(38)

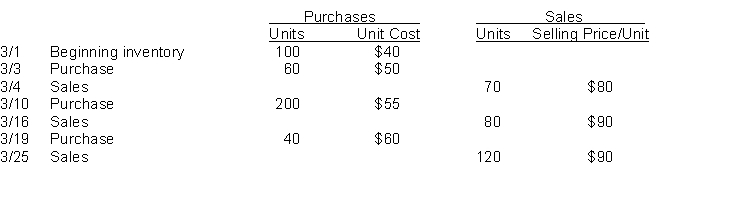

Norris Company uses the perpetual inventory system and had the following purchases and sales during March.  Instructions

Using the inventory and sales data above, calculate the cost assigned to cost of goods sold in March and to the ending inventory at March 31 using (a) FIFO and (b) LIFO.

Instructions

Using the inventory and sales data above, calculate the cost assigned to cost of goods sold in March and to the ending inventory at March 31 using (a) FIFO and (b) LIFO.

(Essay)

4.9/5  (40)

(40)

The widely used method (methods) of estimating inventories is (are)

(Multiple Choice)

4.9/5  (42)

(42)

Which of the following is not a common cost flow method used in costing inventory?

(Multiple Choice)

4.7/5  (39)

(39)

Elly Company uses a periodic inventory system. Details for the inventory and purchases accounts for the month of January, 2022 are as follows: Units Per unit price Total Balance, 1/1/22 200 \ 5.00 \ 1,000 Purchase, 1/15/22 100 5.30 530 Purchase, 1/28/22 100 5.50 550 An end of the month (1/31/20) inventory showed that 150 units were on hand. If the company uses LIFO, what is the cost of the ending inventory?

(Multiple Choice)

4.8/5  (33)

(33)

Winters Company identifies the following items for possible inclusion in the physical inventory. Indicate whether each item should 1. Goods shipped on consignment by Winters to another company.

2. Goods in transit from a supplier shipped FOB destination.

3. Goods shipped via common carrier to a customer with terms FOB shipping point.

4. Goods held on consignment from another company.

(Essay)

4.9/5  (40)

(40)

Which of the following statements is true regarding inventory cost flow methods?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following should be included in the ending inventory of a company?

(Multiple Choice)

4.9/5  (32)

(32)

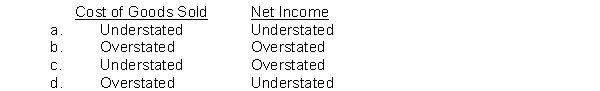

If beginning inventory is understated by $15,000, the effect of this error in the current period is

(Short Answer)

4.9/5  (36)

(36)

The cost flow method that often parallels the actual physical flow of merchandise is the

(Multiple Choice)

5.0/5  (26)

(26)

Errors occasionally occur when physically counting inventory items on hand. Identify the financial statement effects of an overstatement of the ending inventory in the current period. If the error is not corrected, how does it affect the financial statements for the following year?

(Essay)

4.9/5  (45)

(45)

Under the LIFO method and a perpetual inventory system, companies charge to cost of goods sold the cost of the

(Multiple Choice)

4.9/5  (44)

(44)

If a company has no beginning inventory and the unit cost of inventory items does not change during the year, the value assigned to the ending inventory will be the same under LIFO and average cost flow assumptions.

(True/False)

4.8/5  (35)

(35)

Henri Company's inventory and purchases accounts show the following data: Units Unit Cost Inventory, January 1 10,000 \ 9.20 Purchases: June 18 9,000 8.00 Novermber 8 6,000 7.25 A physical inventory on December 31 shows 3,000 units on hand. Henri sells the units for $12 each. Henri uses the periodic inventory method. What is the difference in net income if LIFO rather than FIFO is used?

(Multiple Choice)

4.9/5  (41)

(41)

Pasquale has the following inventory information. July 1 Beginning Inventory 20 units at \ 19 \3 80 7 Purchases 70 units at \ 20 1,400 22 Purchases 10 units at \ 24 240 \2 ,020 A physical count of merchandise inventory on July 31 reveals that there are 30 units on hand. Using a periodic inventory system and the average-cost method, the cost of ending inventory is

(Multiple Choice)

4.8/5  (40)

(40)

An auto manufacturer would classify vehicles in various stages of production as

(Multiple Choice)

5.0/5  (44)

(44)

In a period of rising prices, the costs allocated to ending inventory may be understated in the

(Multiple Choice)

4.8/5  (40)

(40)

Inventories are reported in the current assets section of the balance sheet immediately below receivables.

(True/False)

4.8/5  (23)

(23)

Showing 21 - 40 of 205

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)