Exam 11: Inventory

Exam 1: Welcome to Accounting158 Questions

Exam 2: The Accounting Equation and Transaction Analysis155 Questions

Exam 3: The Recording Process: Debits and Credits222 Questions

Exam 4: The Recording Process: the Journal, the Ledger, and the Trial Balance176 Questions

Exam 5: Adjusting the Accounts and Preparing an Adjusted Trial Balance180 Questions

Exam 6: Completing a Worksheet and Completing the Accounting Cycle186 Questions

Exam 7: Merchandising Companies: Purchases Perpetual153 Questions

Exam 8: Merchandising Companies: Sales Perpetual122 Questions

Exam 9: Merchandising Companies: Worksheets and Financial Statements Perpetual163 Questions

Exam 10: Special Journals153 Questions

Exam 11: Inventory205 Questions

Exam 12: Cash, Banking, and Internal Controls268 Questions

Exam 13: Payroll Accounting: Employee Taxes and Records101 Questions

Exam 14: Payroll Accounting: Employer Taxes and Records79 Questions

Select questions type

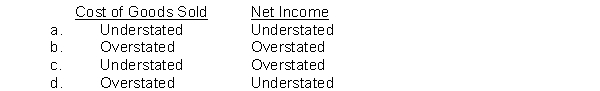

An error in the physical count of goods on hand at the end of a period resulted in an $18,000 overstatement of the ending inventory. The effect of this error in the current period is

(Short Answer)

4.9/5  (36)

(36)

The factor that determines whether goods should be included in a physical count of inventory is

(Multiple Choice)

4.8/5  (36)

(36)

In a manufacturing company, goods that are ready to be sold to customers are referred to as ________________, whereas in a merchandising company they are generally referred to as _______________.

(Essay)

4.8/5  (23)

(23)

Beginning inventory plus the cost of goods purchased equals

(Multiple Choice)

4.8/5  (34)

(34)

Selection of an inventory costing method by management does not usually depend on

(Multiple Choice)

4.8/5  (34)

(34)

Cost of goods available for sale consists of which two elements?

(Multiple Choice)

4.8/5  (37)

(37)

Disclosures about inventory should include each of the following except the

(Multiple Choice)

5.0/5  (36)

(36)

Jeff Franklin, a new employee of Bail Company, recorded $1,800 in consigned goods received as part of the firm's inventory. The goods were received one day after the end of the fiscal period, but Jeff reasoned that the goods should Required:

You are Jeff's supervisor. Write a memo to Jeff explaining why the error should have been corrected.

(Essay)

4.9/5  (35)

(35)

Harpo's Used Cars uses the specific identification method of costing inventory. During March, Harpo purchased three cars for $12,000, $14,400, and $19,200, respectively. During March, two cars are sold for a total of $36,400. Harpo determines that at March 31, the $14,400 car is still on hand. What is Harpo's gross profit for March?

(Multiple Choice)

4.9/5  (38)

(38)

Cesar Company understated its inventory by $20,000 at December 31, 2022. It did not correct the error in 2022 or 2023. As a result, Cesar's owner's equity was:

(Multiple Choice)

4.8/5  (38)

(38)

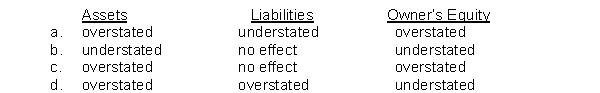

Penny Company made an inventory count on December 31, 2022. During the count, one of the clerks made the error of counting an inventory item twice. For the balance sheet at December 31, 2022, the effects of this error are

(Short Answer)

4.8/5  (41)

(41)

The LCNRV basis is an example of the accounting concept of conservatism.

(True/False)

5.0/5  (34)

(34)

Storme Shutters has the following inventory information. Nov. 1 Inventory 30 units @\ 8.00 8 Purchase 120 units \ 8.30 17 Purchase 60 units \ 8.70 25 Purchase 90 units \ 8.80 A physical count of merchandise inventory on November 30 reveals that there are 80 units on hand. Assume a periodic inventory system is used. Ending inventory under LIFO is

(Multiple Choice)

4.7/5  (40)

(40)

P. Didee has the following inventory information.

July 1 Beginning Inventory 20 units at \ 90 5 Purchases 120 units at \ 92 14 Sale 90 units 21 Purchases 60 units at \ 95 30 Sale 58 units

Assuming that a perpetual inventory system is used, what is the ending inventory on a LIFO basis?

(Multiple Choice)

4.8/5  (37)

(37)

In a period of rising prices, the inventory reported in Sinatra Company's balance sheet is close to the current cost of the inventory. Crosby Company's inventory is considerably below its current cost. Identify the inventory cost flow method being used by each company. Which company has probably been reporting the higher gross profit?

(Essay)

4.9/5  (43)

(43)

Management has the choice of physically counting inventory on hand at the end of the year or using the gross profit method to estimate the ending inventory.

(True/False)

4.8/5  (38)

(38)

As a result of a thorough physical inventory, Greeley Company determined that it had inventory costing $325,000 at December 31, 2022. This count did not take into consideration the following facts: Walker Consignment currently has goods costing $47,000 on its sales floor that belong to Greeley but are being sold on consignment by Walker. The selling price of these goods is $75,000. Greeley purchased $22,000 of goods that were shipped on December 27, FOB destination, that will be received by Greeley on January 3. Determine the correct amount of inventory that Greeley should report.

(Multiple Choice)

4.8/5  (37)

(37)

Mesa Company's inventory and purchases accounts show the following data for the month of September: Units Unit Cost Inventory, September 1 100 \ 3.35 Purchases: September 8 450 3.50 September 18 350 3.70 A physical inventory on September 30 shows 250 units on hand. Calculate the cost of ending inventory and cost of goods sold if the company uses the LIFO method and a periodic inventory system.

(Essay)

4.8/5  (34)

(34)

Management may choose any inventory costing method it desires as long as the cost flow assumption chosen is consistent with the physical movement of goods in the company.

(True/False)

4.8/5  (39)

(39)

Showing 121 - 140 of 205

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)