Exam 11: Inventory

Exam 1: Welcome to Accounting158 Questions

Exam 2: The Accounting Equation and Transaction Analysis155 Questions

Exam 3: The Recording Process: Debits and Credits222 Questions

Exam 4: The Recording Process: the Journal, the Ledger, and the Trial Balance176 Questions

Exam 5: Adjusting the Accounts and Preparing an Adjusted Trial Balance180 Questions

Exam 6: Completing a Worksheet and Completing the Accounting Cycle186 Questions

Exam 7: Merchandising Companies: Purchases Perpetual153 Questions

Exam 8: Merchandising Companies: Sales Perpetual122 Questions

Exam 9: Merchandising Companies: Worksheets and Financial Statements Perpetual163 Questions

Exam 10: Special Journals153 Questions

Exam 11: Inventory205 Questions

Exam 12: Cash, Banking, and Internal Controls268 Questions

Exam 13: Payroll Accounting: Employee Taxes and Records101 Questions

Exam 14: Payroll Accounting: Employer Taxes and Records79 Questions

Select questions type

Overstating ending inventory will overstate all of the following except

(Multiple Choice)

4.8/5  (29)

(29)

Henri Company's inventory and purchases accounts show the following data: Units Unit Cost Inventory, January 1 10,000 \ 9.20 Purchases: June 18 9,000 8.00 Novermber 8 6,000 7.25 A physical inventory on December 31 shows 3,000 units on hand. Henri sells the units for $12 each. Henri uses the periodic inventory method. What is the cost of goods available for sale?

(Multiple Choice)

4.7/5  (41)

(41)

Which costing method cannot be used to determine the cost of inventory items before LCNRV is applied?

(Multiple Choice)

4.9/5  (36)

(36)

Nicholas Industries had the following inventory transactions occur during 2022: Units Cost/unit 2/1/22 Purchase 54 \ 45 3/14/22 Purchase 93 \ 47 5/1/22 Purchase 66 \ 49 The company sold 140 units at $65 each. Assume that a periodic inventory system is used, what is the company's gross profit using LIFO?

(Multiple Choice)

4.9/5  (34)

(34)

Henri Company's inventory and purchases accounts show the following data: Units Unit Cost Inventory, January 1 10,000 \ 9.20 Purchases: June 18 9,000 8.00 Novermber 8 6,000 7.25 A physical inventory on December 31 shows 3,000 units on hand. Henri sells the units for $12 each. Henri uses the periodic inventory method. If the company uses FIFO, what is the gross profit for the period?

(Multiple Choice)

4.9/5  (35)

(35)

Goods in transit should be included in the inventory of the buyer when the

(Multiple Choice)

5.0/5  (41)

(41)

Which of the following statements is correct with respect to inventories?

(Multiple Choice)

4.9/5  (27)

(27)

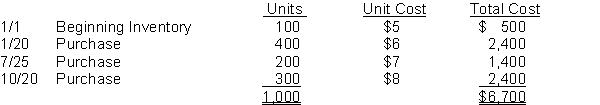

Instructions

1. Show computations to cost the ending inventory using the FIFO method if 600 units remain on hand at October 31.

2. Show computations to cost the ending inventory using the weighted-average cost method if 600 units remain on hand at October 31.

3. Show computations to cost the ending inventory using the LIFO method if 600 units remain on hand at October 31.

(Essay)

4.9/5  (37)

(37)

Henri Company's inventory and purchases accounts show the following data: Units Unit Cost Inventory, January 1 10,000 \ 9.20 Purchases: June 18 9,000 8.00 Novermber 8 6,000 7.25 A physical inventory on December 31 shows 3,000 units on hand. Henri sells the units for $12 each. Henri uses the periodic inventory method. The weighted-average cost per unit is

(Multiple Choice)

4.8/5  (43)

(43)

When costing ending inventory under a perpetual inventory system, the

(Multiple Choice)

4.7/5  (37)

(37)

Pancho Steinberg's uses the retail inventory method. A formula not used by the company is:

(Multiple Choice)

4.8/5  (34)

(34)

Storme Shutters has the following inventory information. Nov. 1 Inventory 30 units @\ 8.00 8 Purchase 120 units \ 8.30 17 Purchase 60 units \ 8.40 25 Purchase 90 units \ 8.80 A physical count of merchandise inventory on November 30 reveals that there are 80 units on hand. Assuming that the specific identification method is used and that ending inventory consists of 20 units from each of the three purchases and 20 units from the November 1 inventory, cost of goods sold is

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following often parallels the actual physical flow of merchandise?

(Multiple Choice)

4.8/5  (39)

(39)

The accountant at Peacock Company has determined that gross profit amounted to $6,500 using the FIFO costing method. If the grossprofit is $1,060 greater than if the LIFO costing method were used, what would be the amount of gross profit under the LIFO method?

(Multiple Choice)

4.8/5  (38)

(38)

The Vogelson Company accumulates the following cost and net realizable value data at December 31. Inventory Categories Cost Data NRV Camera \ 11,000 \ 9,900 Camcorders 7,800 8,500 DVDs 14,000 12,000 What is the lower-of-cost-or-NRV amount for the inventory?

(Essay)

4.7/5  (49)

(49)

The following amounts are reported for Bainbridge Company:

Advertising expense

Freight-in

Cost of inventory purchased

Delivery expense

Salaries expense

Sales revenue

Which of the amounts would be included in calculating the cost of inventory?

(Short Answer)

4.9/5  (38)

(38)

Irish Company uses the periodic inventory system and had the following inventory information available:  A physical count of inventory on December 31 revealed that there were 480 units on hand.

Instructions

1. Assume that the company uses the FIFO method. The cost of the ending inventory at December 31 is $__________.

2. Assume that the company uses the Average-Cost method. The cost of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The cost of the ending inventory on December 31 is $__________.

4. Determine the difference in the amount of gross profit that the company would have reported if it had used the FIFO method instead of the LIFO method. Would gross profit have been greater or less?

A physical count of inventory on December 31 revealed that there were 480 units on hand.

Instructions

1. Assume that the company uses the FIFO method. The cost of the ending inventory at December 31 is $__________.

2. Assume that the company uses the Average-Cost method. The cost of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The cost of the ending inventory on December 31 is $__________.

4. Determine the difference in the amount of gross profit that the company would have reported if it had used the FIFO method instead of the LIFO method. Would gross profit have been greater or less?

(Essay)

4.7/5  (34)

(34)

A company purchased inventory as follows: 150 units at

350 units at The average unit cost for inventory is

(Multiple Choice)

4.9/5  (41)

(41)

FIFO and LIFO are the two most common cost flow assumptions made in costing inventories. The amounts assigned to the same inventory items on hand may be different under each cost flow assumption. If a company has no beginning inventory, explain the difference in ending inventory values under the FIFO and LIFO cost bases when the cost of inventory items purchased during the period have been (1) increasing, (2) decreasing, and (3) remained constant.

(Essay)

4.8/5  (29)

(29)

Showing 41 - 60 of 205

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)