Exam 11: Inventory

Exam 1: Welcome to Accounting158 Questions

Exam 2: The Accounting Equation and Transaction Analysis155 Questions

Exam 3: The Recording Process: Debits and Credits222 Questions

Exam 4: The Recording Process: the Journal, the Ledger, and the Trial Balance176 Questions

Exam 5: Adjusting the Accounts and Preparing an Adjusted Trial Balance180 Questions

Exam 6: Completing a Worksheet and Completing the Accounting Cycle186 Questions

Exam 7: Merchandising Companies: Purchases Perpetual153 Questions

Exam 8: Merchandising Companies: Sales Perpetual122 Questions

Exam 9: Merchandising Companies: Worksheets and Financial Statements Perpetual163 Questions

Exam 10: Special Journals153 Questions

Exam 11: Inventory205 Questions

Exam 12: Cash, Banking, and Internal Controls268 Questions

Exam 13: Payroll Accounting: Employee Taxes and Records101 Questions

Exam 14: Payroll Accounting: Employer Taxes and Records79 Questions

Select questions type

The accounting principle that requires that the cost flow method be consistent with the physical movement of goods is

(Multiple Choice)

4.8/5  (37)

(37)

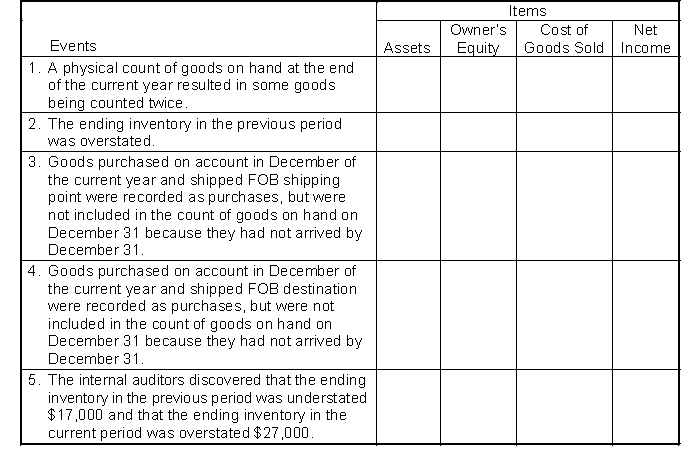

For each of the independent events listed below, analyze the impact on the indicated items at the end of the current year by placing the appropriate code letter in the box under each item.

Code: O = item is overstated

U = item is understated

NA = item is not affected

(Essay)

4.8/5  (38)

(38)

A survey of major U.S. companies revealed that 77% of those companies used either LIFO or FIFO cost flow methods, while 19% used average cost, and only 4% used other methods.

Required:

Provide brief, yet concise responses to the following questions.

a. Why are LIFO and FIFO so popular?

b. Since computers and inventory management software are readily available, why aren't more companies using specific identification?

(Essay)

4.8/5  (38)

(38)

Nolen Company is preparing the annual financial statements dated December 31, 2022. Information about inventory stocked for regular sale follows: Quantity Unit Cost Item on Hand When Acquired NRV at year end 50 \ 20 \ 19 100 45 45 20 59 62 40 40 36 Instructions

Compute the valuation for the December 31, 2022, inventory using the LCNRV basis.

(Essay)

4.8/5  (38)

(38)

Ortiz Department Store utilizes the retail inventory method to estimate its inventories. It calculated its cost to retail ratio during the period at 70%. Goods available for sale at retail amounted to $600,000 and net sales during the period for $440,000. The estimated cost of the ending inventory is

(Multiple Choice)

4.8/5  (31)

(31)

An error that overstates the ending inventory will also cause net income for the period to be overstated.

(True/False)

4.8/5  (39)

(39)

Of the following companies, which one would not likely employ the specific identification method for inventory costing?

(Multiple Choice)

4.8/5  (42)

(42)

At May 1, 2022, Mark Company had beginning inventory consisting of 200 units with a unit cost of $7. During May, the company purchased inventory as follows: 800 units at $7

500 units at $9

The company sold 500 units during the month for $12 per unit. Mark uses the average cost method. Mark's gross profit, to the nearest dollar, for the month of May is

(Multiple Choice)

4.9/5  (41)

(41)

Jill Tango is studying for the next accounting mid-term examination. What should Jill know about (a) departing from the cost basis of accounting for inventories and (b) the meaning of "NRV" in the LCNRV method?

(Essay)

4.9/5  (34)

(34)

A company just starting business made the following four inventory purchases in June: June 1 150 units \3 90 June 10 200 units 598 June 15 200 units 630 June 28 150 units 510 \2 ,128 A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand. Using a periodic inventory system and the FIFO inventory method, the amount allocated to cost of goods sold, to the nearest dollar, for June is

(Multiple Choice)

4.7/5  (38)

(38)

Accountants believe that the write-down from cost to LCNRV should not be made in the period in which the price decline occurs.

(True/False)

4.8/5  (33)

(33)

Pasquale has the following inventory information. July 1 Beginning Inventory 20 units at \ 19 \3 80 7 Purchases 70 units at \ 20 1,400 22 Purchases 10 units at \ 24 240 \2 ,020 A physical count of merchandise inventory on July 31 reveals that there are 30 units on hand. Using a periodic inventory system and the LIFO inventory method, the amount allocated to cost of goods sold for July is

(Multiple Choice)

4.8/5  (38)

(38)

A company may use more than one inventory costing method concurrently.

(True/False)

4.9/5  (35)

(35)

Shannon's Department Store prepares monthly financial statements but only takes a physical count of merchandise inventory at the end of the year. The following information has been compiled for the month of July: at cost at retail beginning inventory \3 6,000 \5 0,000 merchandise purchases 99,000 15,000 The net sales for july totaled $150,000.

Instructions

Use the retail inventory method to estimate the ending inventory at cost for July. Show all computations to support your answer.

(Essay)

4.8/5  (36)

(36)

Finished goods are a classification of inventory for a manufacturer that is the cost of goods which are completed and ready for sale.

(True/False)

4.8/5  (33)

(33)

In periods of rising prices, the inventory method that results in the inventory amount on the balance sheet that is closest to current cost is the

(Multiple Choice)

4.8/5  (36)

(36)

The accountant at Elvira Company is figuring out the difference in net income depending on the choice of either FIFO or LIFO as an inventory costing method. The FIFO method will result in gross profit of $8,290. The LIFO method will result in gross profit of $26,000 and an inventory valuation that is $275 less than the FIFO inventory valuation. What is the difference in gross profit between the two methods?

(Multiple Choice)

4.7/5  (39)

(39)

Berry, Inc. has 6 computers which have been part of the inventory for over two years. Each computer cost $600 and originally retailed for $900. At the statement date, each computer has a net realizable value of $450. What amount should Berry, Inc. report for the computers at the end of the year?

(Multiple Choice)

4.9/5  (45)

(45)

Shellhammer Company's inventory and purchases accounts show the following data for the month of September: Units Unit Cost Inventory, September 1 100 \ 3.34 Purchases: September 8 450 3.50 September 18 350 3.70 A physical inventory on September 30 shows 200 units on hand. Calculate the cost of ending inventory and cost of goods sold if the company uses the FIFO method and a periodic inventory system.

(Essay)

4.8/5  (36)

(36)

Showing 161 - 180 of 205

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)