Exam 12: Overview of Fixed-Income Portfolio Management

Exam 1: Fixed-Income Securities: Defining Elements28 Questions

Exam 2: Fixed-Income Markets: Issuance, Trading, and Funding31 Questions

Exam 3: Introduction to Fixed-Income Valuation44 Questions

Exam 4: Introduction to Asset-Backed Securities42 Questions

Exam 5: Understanding Fixed Income Risk and Return27 Questions

Exam 6: Fundamentals of Credit Analysis45 Questions

Exam 7: The Term Structure and Interest Rate Dynamics56 Questions

Exam 8: The Arbitrage-Free Valuation Framework17 Questions

Exam 9: Valuation and Analysis of Bonds With Embedded Options36 Questions

Exam 10: Credit Analysis Models30 Questions

Exam 11: Credit Default Swaps15 Questions

Exam 12: Overview of Fixed-Income Portfolio Management12 Questions

Exam 13: Liability-Driven and Index-Based Strategies26 Questions

Exam 14: Yield Curve Strategies32 Questions

Exam 15: Fixed-Income Active Management: Credit Strategies15 Questions

Select questions type

The following information relates to Questions

Celia deveraux is chief investment officer for the topanga investors fund, which invests in equities and fixed income. The clients in the fund are all taxable investors. The fixed-income allocation includes a domestic (US) bond portfolio and an externally managed global bond portfolio.

The domestic bond portfolio has a total return mandate, which specifies a long-term re- turn objective of 25 basis points (bps) over the benchmark index. relative to the benchmark, small deviations in sector weightings are permitted, such risk factors as duration must closely match, and tracking error is expected to be less than 50 bps per year.

The objectives for the domestic bond portfolio include the ability to fund future liabili-ties, protect interest income from short-term inflation, and minimize the correlation with the fund's equity portfolio. The correlation between the fund's domestic bond portfolio and equity

portfolio is currently 0.14. deveraux plans to reduce the fund's equity allocation and increase

the allocation to the domestic bond portfolio. She reviews two possible investment strategies.

Strategy 1: Purchase aaa rated fixed-coupon corporate bonds with a modified duration

of two years and a correlation coefficient with the equity portfolio of −0.15.

Strategy 2: Purchase US government agency floating-coupon bonds with a modified du-

ration of one month and a correlation coefficient with the equity portfolioof −0.10.

deveraux realizes that the fund's return may decrease if the equity allocation of the fund is

reduced. deveraux decides to liquidate $20 million of US treasuries that are currently owned

and to invest the proceeds in the US corporate bond sector. to fulfill this strategy, deveraux

asks dan foster, a newly hired analyst for the fund, to recommend treasuries to sell and cor-porate bonds to purchase.

foster recommends treasuries from the existing portfolio that he believes are overvalued

and will generate capital gains. deveraux asks foster why he chose only overvalued bonds

with capital gains and did not include any bonds with capital losses. foster responds with two

statements.

Statement 1: taxable investors should prioritize selling overvalued bonds and always sell

them before selling bonds that are viewed as fairly valued or undervalued.

Statement 2: taxable investors should never intentionally realize capital losses.

regarding the purchase of corporate bonds, foster collects relevant data, which are pre-sented in exhibit 1. EXHIBIT 1 Selected Data on Three US Corporate Bonds Bond Characteristics Bond 1 Bond 2 Bond 3 Credit quality AA AA A Issue size (\ millions) 100 75 75 Maturity (years) 5 7 7 Total issuance outstanding (\ millions) 1,000 1,500 1,000 Months since issuance New issue 3 6

deveraux and foster review the total expected 12-month return (assuming no reinvest-ment income) for the global bond portfolio. Selected financial data are presented in exhibit 2.exhibit 2 Selected data on global bond Portfolio

deveraux contemplates adding a new manager to the global bond portfolio. She reviews three proposals and determines that each manager uses the same index as its benchmark but pursues a different total return approach, as presented in exhibit 3.

EXHIBIT 3 New Manager Proposals Fixed-Income Portfolio Characteristics Sector Weights (\%) Manager A Manager B Manager C Index Government 53.5 52.5 47.8 54.1 Agency/quasi-agency 16.2 16.4 13.4 16.0 Corporate 20.0 22.2 25.1 19.8 MBS 10.3 8.9 13.7 10.1 Risk and Return Characteristics Manager A Manager B Manager C Index Average maturity (years) 7.63 7.84 8.55 7.56 Modified duration (years) 5.23 5.25 6.16 5.22 Average yield (\%) 1.98 2.08 2.12 1.99 Turnover (\%) 207 220 290 205

-Strategy 2 is most likely preferred to Strategy 1 for meeting the objective of:

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

A

The following information relates to Questions 1-6

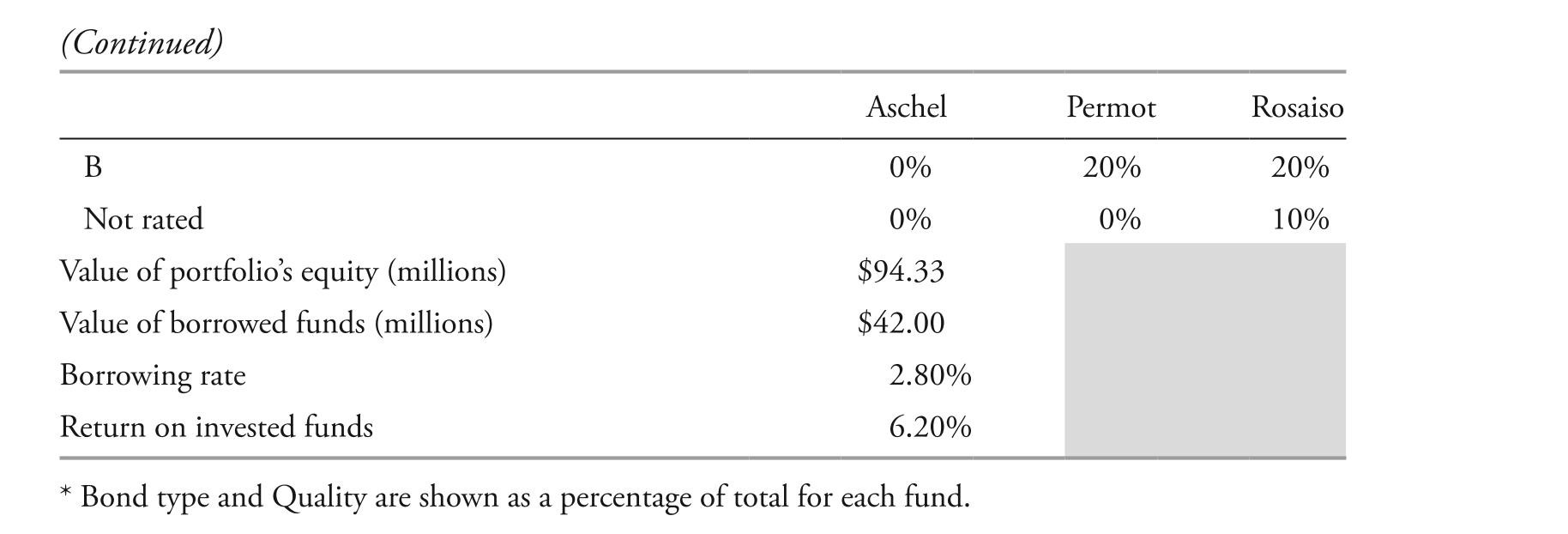

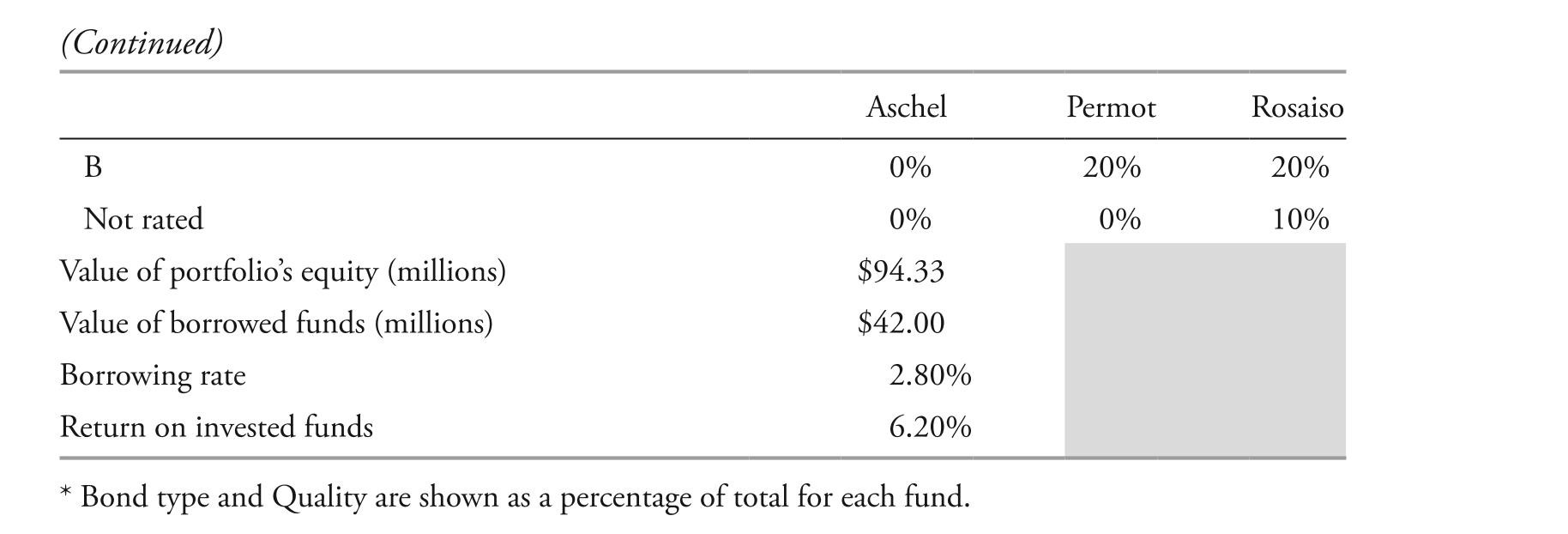

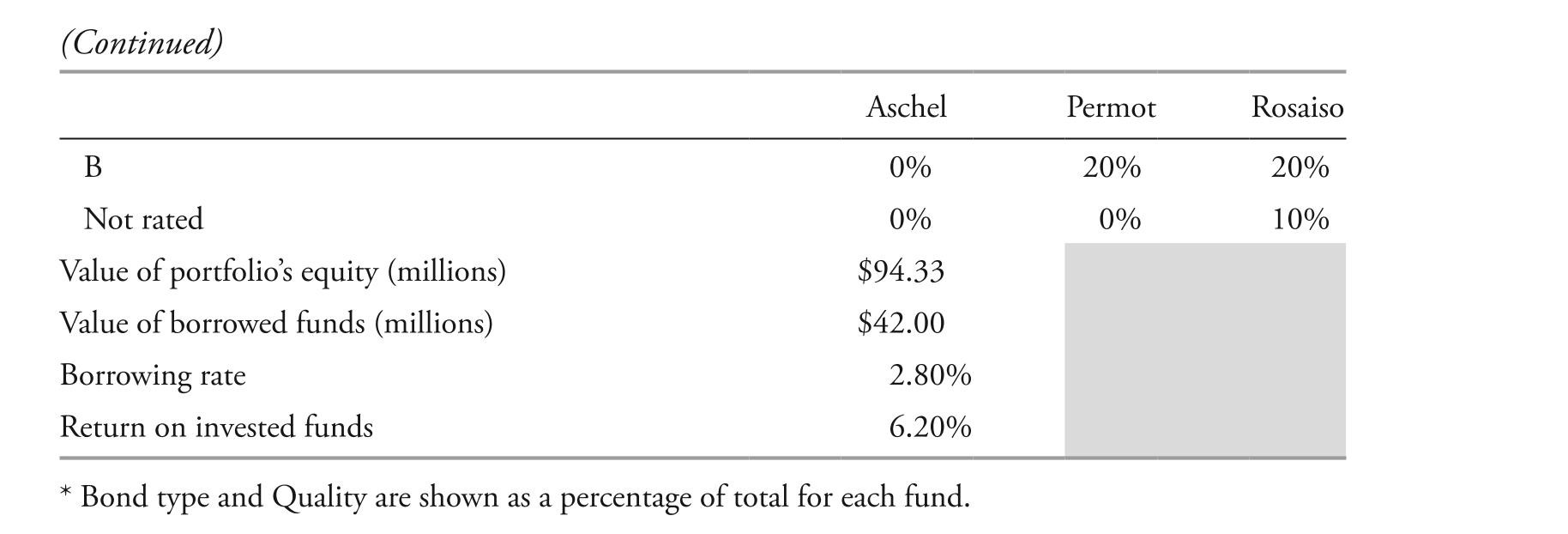

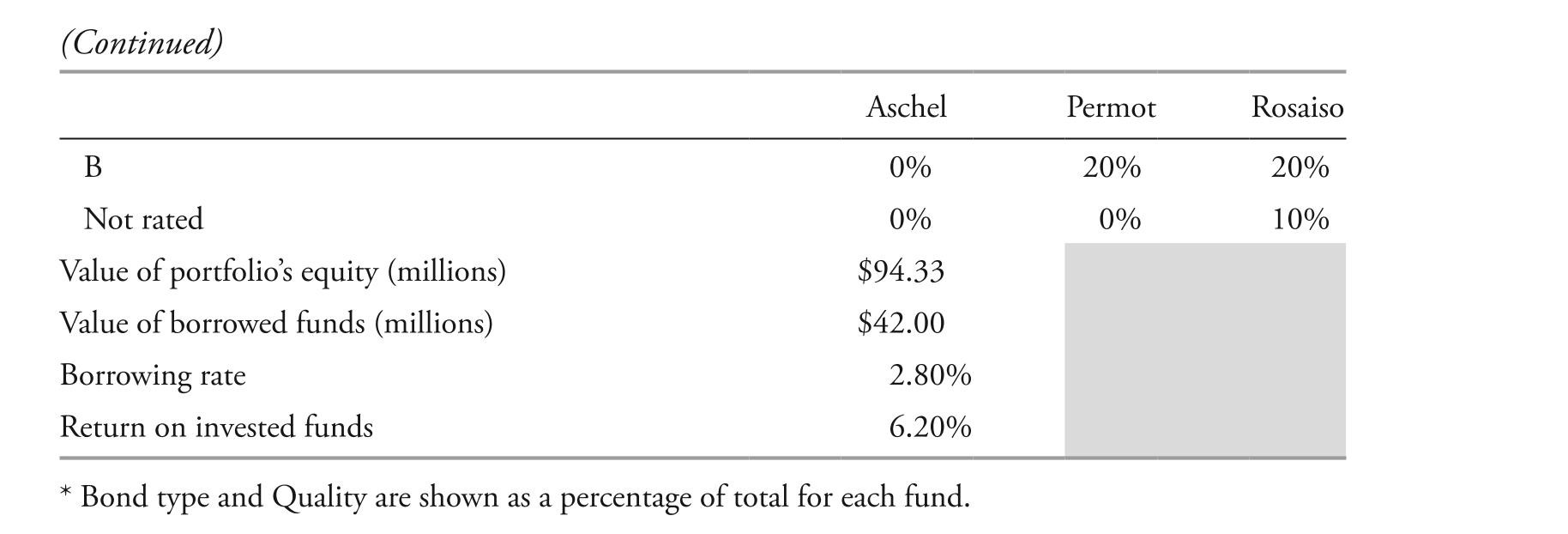

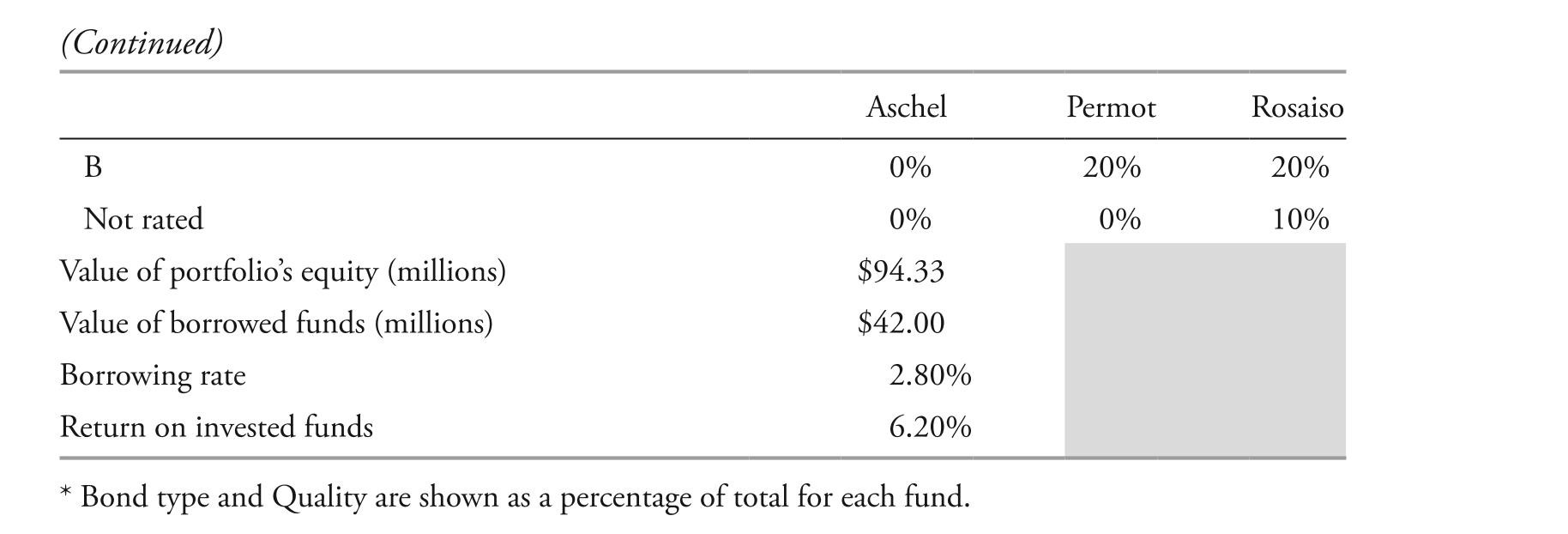

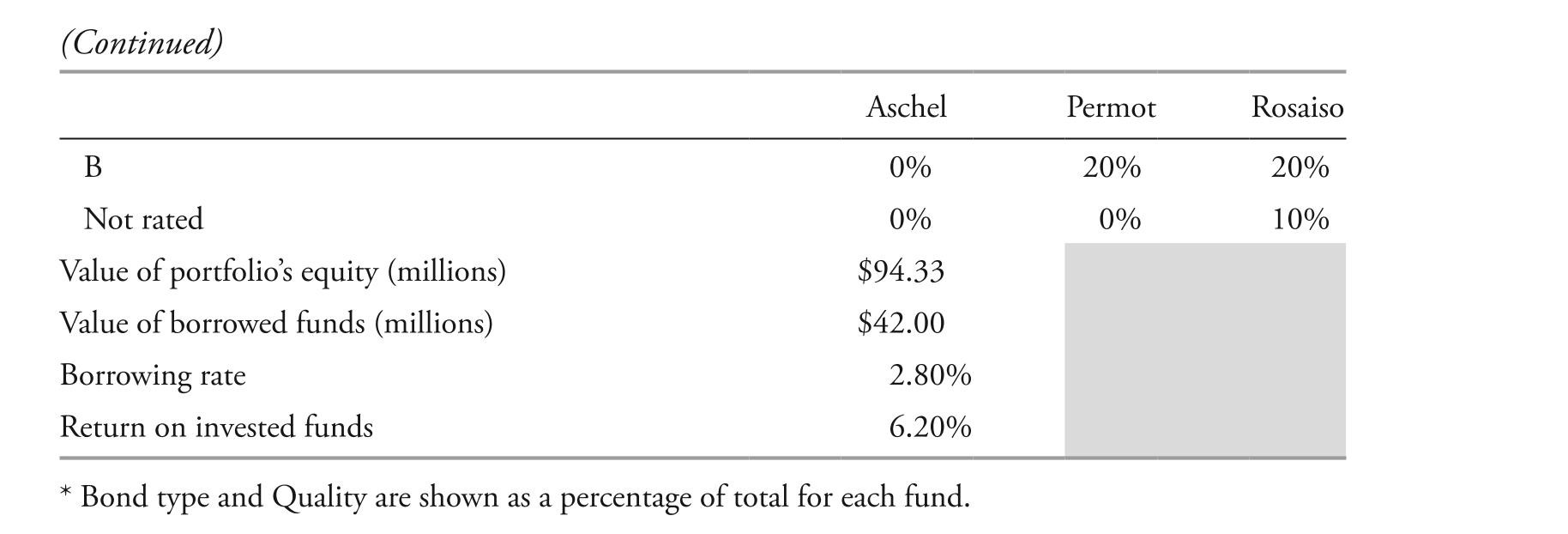

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

EXHIBIT 1 Selected Data on Fixed-Income Funds

Aschel Current average bond price \ 117.00 Expected average bond price in one year (end of Year 1) \ 114.00 Average modified duration 7.07 Average annual coupon payment \ 3.63 Present value of portfolio's assets (millions) \ 136.33 Bond type* Fixed-coupon bonds 95\% Floating-coupon bonds 2\% Inflation-linked bonds 3\% Quality* AAA 65\% BBB 35\% Permot Rosaiso \ 91.50 \ 94.60 \ 96.00 \ 97.00 7.38 6.99 \ 6.07 \ 6.36 \ 68.50 \ 74.38 38\% 62\% 34\% 17\% 28\% 21\% 15\% 20\% 65\% 50\% (continued)

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-based on note 2, rosaiso is the only fund for which the expected change in price based on the investor's views of yields and yield spreads should be calculated using:

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-based on note 2, rosaiso is the only fund for which the expected change in price based on the investor's views of yields and yield spreads should be calculated using:

Free

(Multiple Choice)

4.9/5  (27)

(27)

Correct Answer:

C

The following information relates to Questions

Celia deveraux is chief investment officer for the topanga investors fund, which invests in equities and fixed income. The clients in the fund are all taxable investors. The fixed-income allocation includes a domestic (US) bond portfolio and an externally managed global bond portfolio.

The domestic bond portfolio has a total return mandate, which specifies a long-term re- turn objective of 25 basis points (bps) over the benchmark index. relative to the benchmark, small deviations in sector weightings are permitted, such risk factors as duration must closely match, and tracking error is expected to be less than 50 bps per year.

The objectives for the domestic bond portfolio include the ability to fund future liabili-ties, protect interest income from short-term inflation, and minimize the correlation with the fund's equity portfolio. The correlation between the fund's domestic bond portfolio and equity

portfolio is currently 0.14. deveraux plans to reduce the fund's equity allocation and increase

the allocation to the domestic bond portfolio. She reviews two possible investment strategies.

Strategy 1: Purchase aaa rated fixed-coupon corporate bonds with a modified duration

of two years and a correlation coefficient with the equity portfolio of −0.15.

Strategy 2: Purchase US government agency floating-coupon bonds with a modified du-

ration of one month and a correlation coefficient with the equity portfolioof −0.10.

deveraux realizes that the fund's return may decrease if the equity allocation of the fund is

reduced. deveraux decides to liquidate $20 million of US treasuries that are currently owned

and to invest the proceeds in the US corporate bond sector. to fulfill this strategy, deveraux

asks dan foster, a newly hired analyst for the fund, to recommend treasuries to sell and cor-porate bonds to purchase.

foster recommends treasuries from the existing portfolio that he believes are overvalued

and will generate capital gains. deveraux asks foster why he chose only overvalued bonds

with capital gains and did not include any bonds with capital losses. foster responds with two

statements.

Statement 1: taxable investors should prioritize selling overvalued bonds and always sell

them before selling bonds that are viewed as fairly valued or undervalued.

Statement 2: taxable investors should never intentionally realize capital losses.

regarding the purchase of corporate bonds, foster collects relevant data, which are pre-sented in exhibit 1. EXHIBIT 1 Selected Data on Three US Corporate Bonds Bond Characteristics Bond 1 Bond 2 Bond 3 Credit quality AA AA A Issue size (\ millions) 100 75 75 Maturity (years) 5 7 7 Total issuance outstanding (\ millions) 1,000 1,500 1,000 Months since issuance New issue 3 6

deveraux and foster review the total expected 12-month return (assuming no reinvest-ment income) for the global bond portfolio. Selected financial data are presented in exhibit 2.exhibit 2 Selected data on global bond Portfolio

deveraux contemplates adding a new manager to the global bond portfolio. She reviews three proposals and determines that each manager uses the same index as its benchmark but pursues a different total return approach, as presented in exhibit 3.

EXHIBIT 3 New Manager Proposals Fixed-Income Portfolio Characteristics Sector Weights (\%) Manager A Manager B Manager C Index Government 53.5 52.5 47.8 54.1 Agency/quasi-agency 16.2 16.4 13.4 16.0 Corporate 20.0 22.2 25.1 19.8 MBS 10.3 8.9 13.7 10.1 Risk and Return Characteristics Manager A Manager B Manager C Index Average maturity (years) 7.63 7.84 8.55 7.56 Modified duration (years) 5.23 5.25 6.16 5.22 Average yield (\%) 1.98 2.08 2.12 1.99 Turnover (\%) 207 220 290 205

-which approach to its total return mandate is the fund's domestic bond portfolio most likely to use?

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

B

The following information relates to Questions 1-6

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

EXHIBIT 1 Selected Data on Fixed-Income Funds

Aschel Current average bond price \ 117.00 Expected average bond price in one year (end of Year 1) \ 114.00 Average modified duration 7.07 Average annual coupon payment \ 3.63 Present value of portfolio's assets (millions) \ 136.33 Bond type* Fixed-coupon bonds 95\% Floating-coupon bonds 2\% Inflation-linked bonds 3\% Quality* AAA 65\% BBB 35\% Permot Rosaiso \ 91.50 \ 94.60 \ 96.00 \ 97.00 7.38 6.99 \ 6.07 \ 6.36 \ 68.50 \ 74.38 38\% 62\% 34\% 17\% 28\% 21\% 15\% 20\% 65\% 50\% (continued)

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-The levered portfolio return for aschel is closest to:

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-The levered portfolio return for aschel is closest to:

(Multiple Choice)

4.7/5  (34)

(34)

The following information relates to Questions 1-6

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

EXHIBIT 1 Selected Data on Fixed-Income Funds

Aschel Current average bond price \ 117.00 Expected average bond price in one year (end of Year 1) \ 114.00 Average modified duration 7.07 Average annual coupon payment \ 3.63 Present value of portfolio's assets (millions) \ 136.33 Bond type* Fixed-coupon bonds 95\% Floating-coupon bonds 2\% Inflation-linked bonds 3\% Quality* AAA 65\% BBB 35\% Permot Rosaiso \ 91.50 \ 94.60 \ 96.00 \ 97.00 7.38 6.99 \ 6.07 \ 6.36 \ 68.50 \ 74.38 38\% 62\% 34\% 17\% 28\% 21\% 15\% 20\% 65\% 50\% (continued)

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-is Perreaux correct with respect to key features of cash flow matching?

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-is Perreaux correct with respect to key features of cash flow matching?

(Multiple Choice)

4.7/5  (39)

(39)

The following information relates to Questions

Celia deveraux is chief investment officer for the topanga investors fund, which invests in equities and fixed income. The clients in the fund are all taxable investors. The fixed-income allocation includes a domestic (US) bond portfolio and an externally managed global bond portfolio.

The domestic bond portfolio has a total return mandate, which specifies a long-term re- turn objective of 25 basis points (bps) over the benchmark index. relative to the benchmark, small deviations in sector weightings are permitted, such risk factors as duration must closely match, and tracking error is expected to be less than 50 bps per year.

The objectives for the domestic bond portfolio include the ability to fund future liabili-ties, protect interest income from short-term inflation, and minimize the correlation with the fund's equity portfolio. The correlation between the fund's domestic bond portfolio and equity

portfolio is currently 0.14. deveraux plans to reduce the fund's equity allocation and increase

the allocation to the domestic bond portfolio. She reviews two possible investment strategies.

Strategy 1: Purchase aaa rated fixed-coupon corporate bonds with a modified duration

of two years and a correlation coefficient with the equity portfolio of −0.15.

Strategy 2: Purchase US government agency floating-coupon bonds with a modified du-

ration of one month and a correlation coefficient with the equity portfolioof −0.10.

deveraux realizes that the fund's return may decrease if the equity allocation of the fund is

reduced. deveraux decides to liquidate $20 million of US treasuries that are currently owned

and to invest the proceeds in the US corporate bond sector. to fulfill this strategy, deveraux

asks dan foster, a newly hired analyst for the fund, to recommend treasuries to sell and cor-porate bonds to purchase.

foster recommends treasuries from the existing portfolio that he believes are overvalued

and will generate capital gains. deveraux asks foster why he chose only overvalued bonds

with capital gains and did not include any bonds with capital losses. foster responds with two

statements.

Statement 1: taxable investors should prioritize selling overvalued bonds and always sell

them before selling bonds that are viewed as fairly valued or undervalued.

Statement 2: taxable investors should never intentionally realize capital losses.

regarding the purchase of corporate bonds, foster collects relevant data, which are pre-sented in exhibit 1. EXHIBIT 1 Selected Data on Three US Corporate Bonds Bond Characteristics Bond 1 Bond 2 Bond 3 Credit quality AA AA A Issue size (\ millions) 100 75 75 Maturity (years) 5 7 7 Total issuance outstanding (\ millions) 1,000 1,500 1,000 Months since issuance New issue 3 6

deveraux and foster review the total expected 12-month return (assuming no reinvest-ment income) for the global bond portfolio. Selected financial data are presented in exhibit 2.exhibit 2 Selected data on global bond Portfolio

deveraux contemplates adding a new manager to the global bond portfolio. She reviews three proposals and determines that each manager uses the same index as its benchmark but pursues a different total return approach, as presented in exhibit 3.

EXHIBIT 3 New Manager Proposals Fixed-Income Portfolio Characteristics Sector Weights (\%) Manager A Manager B Manager C Index Government 53.5 52.5 47.8 54.1 Agency/quasi-agency 16.2 16.4 13.4 16.0 Corporate 20.0 22.2 25.1 19.8 MBS 10.3 8.9 13.7 10.1 Risk and Return Characteristics Manager A Manager B Manager C Index Average maturity (years) 7.63 7.84 8.55 7.56 Modified duration (years) 5.23 5.25 6.16 5.22 Average yield (\%) 1.98 2.08 2.12 1.99 Turnover (\%) 207 220 290 205

-based on exhibit 1, which bond most likely has the highest liquidity premium?

(Multiple Choice)

4.9/5  (41)

(41)

The following information relates to Questions 1-6

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

EXHIBIT 1 Selected Data on Fixed-Income Funds

Aschel Current average bond price \ 117.00 Expected average bond price in one year (end of Year 1) \ 114.00 Average modified duration 7.07 Average annual coupon payment \ 3.63 Present value of portfolio's assets (millions) \ 136.33 Bond type* Fixed-coupon bonds 95\% Floating-coupon bonds 2\% Inflation-linked bonds 3\% Quality* AAA 65\% BBB 35\% Permot Rosaiso \ 91.50 \ 94.60 \ 96.00 \ 97.00 7.38 6.99 \ 6.07 \ 6.36 \ 68.50 \ 74.38 38\% 62\% 34\% 17\% 28\% 21\% 15\% 20\% 65\% 50\% (continued)

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-based on exhibit 1, the rolling yield of aschel over a one-year investment horizon is closest to:

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-based on exhibit 1, the rolling yield of aschel over a one-year investment horizon is closest to:

(Multiple Choice)

4.9/5  (30)

(30)

The following information relates to Questions

Celia deveraux is chief investment officer for the topanga investors fund, which invests in equities and fixed income. The clients in the fund are all taxable investors. The fixed-income allocation includes a domestic (US) bond portfolio and an externally managed global bond portfolio.

The domestic bond portfolio has a total return mandate, which specifies a long-term re- turn objective of 25 basis points (bps) over the benchmark index. relative to the benchmark, small deviations in sector weightings are permitted, such risk factors as duration must closely match, and tracking error is expected to be less than 50 bps per year.

The objectives for the domestic bond portfolio include the ability to fund future liabili-ties, protect interest income from short-term inflation, and minimize the correlation with the fund's equity portfolio. The correlation between the fund's domestic bond portfolio and equity

portfolio is currently 0.14. deveraux plans to reduce the fund's equity allocation and increase

the allocation to the domestic bond portfolio. She reviews two possible investment strategies.

Strategy 1: Purchase aaa rated fixed-coupon corporate bonds with a modified duration

of two years and a correlation coefficient with the equity portfolio of −0.15.

Strategy 2: Purchase US government agency floating-coupon bonds with a modified du-

ration of one month and a correlation coefficient with the equity portfolioof −0.10.

deveraux realizes that the fund's return may decrease if the equity allocation of the fund is

reduced. deveraux decides to liquidate $20 million of US treasuries that are currently owned

and to invest the proceeds in the US corporate bond sector. to fulfill this strategy, deveraux

asks dan foster, a newly hired analyst for the fund, to recommend treasuries to sell and cor-porate bonds to purchase.

foster recommends treasuries from the existing portfolio that he believes are overvalued

and will generate capital gains. deveraux asks foster why he chose only overvalued bonds

with capital gains and did not include any bonds with capital losses. foster responds with two

statements.

Statement 1: taxable investors should prioritize selling overvalued bonds and always sell

them before selling bonds that are viewed as fairly valued or undervalued.

Statement 2: taxable investors should never intentionally realize capital losses.

regarding the purchase of corporate bonds, foster collects relevant data, which are pre-sented in exhibit 1. EXHIBIT 1 Selected Data on Three US Corporate Bonds Bond Characteristics Bond 1 Bond 2 Bond 3 Credit quality AA AA A Issue size (\ millions) 100 75 75 Maturity (years) 5 7 7 Total issuance outstanding (\ millions) 1,000 1,500 1,000 Months since issuance New issue 3 6

deveraux and foster review the total expected 12-month return (assuming no reinvest-ment income) for the global bond portfolio. Selected financial data are presented in exhibit 2.exhibit 2 Selected data on global bond Portfolio

deveraux contemplates adding a new manager to the global bond portfolio. She reviews three proposals and determines that each manager uses the same index as its benchmark but pursues a different total return approach, as presented in exhibit 3.

EXHIBIT 3 New Manager Proposals Fixed-Income Portfolio Characteristics Sector Weights (\%) Manager A Manager B Manager C Index Government 53.5 52.5 47.8 54.1 Agency/quasi-agency 16.2 16.4 13.4 16.0 Corporate 20.0 22.2 25.1 19.8 MBS 10.3 8.9 13.7 10.1 Risk and Return Characteristics Manager A Manager B Manager C Index Average maturity (years) 7.63 7.84 8.55 7.56 Modified duration (years) 5.23 5.25 6.16 5.22 Average yield (\%) 1.98 2.08 2.12 1.99 Turnover (\%) 207 220 290 205

-based on exhibit 2, the total expected return of the fund's global bond portfolio is closest to:

(Multiple Choice)

4.9/5  (26)

(26)

The following information relates to Questions

Celia deveraux is chief investment officer for the topanga investors fund, which invests in equities and fixed income. The clients in the fund are all taxable investors. The fixed-income allocation includes a domestic (US) bond portfolio and an externally managed global bond portfolio.

The domestic bond portfolio has a total return mandate, which specifies a long-term re- turn objective of 25 basis points (bps) over the benchmark index. relative to the benchmark, small deviations in sector weightings are permitted, such risk factors as duration must closely match, and tracking error is expected to be less than 50 bps per year.

The objectives for the domestic bond portfolio include the ability to fund future liabili-ties, protect interest income from short-term inflation, and minimize the correlation with the fund's equity portfolio. The correlation between the fund's domestic bond portfolio and equity

portfolio is currently 0.14. deveraux plans to reduce the fund's equity allocation and increase

the allocation to the domestic bond portfolio. She reviews two possible investment strategies.

Strategy 1: Purchase aaa rated fixed-coupon corporate bonds with a modified duration

of two years and a correlation coefficient with the equity portfolio of −0.15.

Strategy 2: Purchase US government agency floating-coupon bonds with a modified du-

ration of one month and a correlation coefficient with the equity portfolioof −0.10.

deveraux realizes that the fund's return may decrease if the equity allocation of the fund is

reduced. deveraux decides to liquidate $20 million of US treasuries that are currently owned

and to invest the proceeds in the US corporate bond sector. to fulfill this strategy, deveraux

asks dan foster, a newly hired analyst for the fund, to recommend treasuries to sell and cor-porate bonds to purchase.

foster recommends treasuries from the existing portfolio that he believes are overvalued

and will generate capital gains. deveraux asks foster why he chose only overvalued bonds

with capital gains and did not include any bonds with capital losses. foster responds with two

statements.

Statement 1: taxable investors should prioritize selling overvalued bonds and always sell

them before selling bonds that are viewed as fairly valued or undervalued.

Statement 2: taxable investors should never intentionally realize capital losses.

regarding the purchase of corporate bonds, foster collects relevant data, which are pre-sented in exhibit 1. EXHIBIT 1 Selected Data on Three US Corporate Bonds Bond Characteristics Bond 1 Bond 2 Bond 3 Credit quality AA AA A Issue size (\ millions) 100 75 75 Maturity (years) 5 7 7 Total issuance outstanding (\ millions) 1,000 1,500 1,000 Months since issuance New issue 3 6

deveraux and foster review the total expected 12-month return (assuming no reinvest-ment income) for the global bond portfolio. Selected financial data are presented in exhibit 2.exhibit 2 Selected data on global bond Portfolio

deveraux contemplates adding a new manager to the global bond portfolio. She reviews three proposals and determines that each manager uses the same index as its benchmark but pursues a different total return approach, as presented in exhibit 3.

EXHIBIT 3 New Manager Proposals Fixed-Income Portfolio Characteristics Sector Weights (\%) Manager A Manager B Manager C Index Government 53.5 52.5 47.8 54.1 Agency/quasi-agency 16.2 16.4 13.4 16.0 Corporate 20.0 22.2 25.1 19.8 MBS 10.3 8.9 13.7 10.1 Risk and Return Characteristics Manager A Manager B Manager C Index Average maturity (years) 7.63 7.84 8.55 7.56 Modified duration (years) 5.23 5.25 6.16 5.22 Average yield (\%) 1.98 2.08 2.12 1.99 Turnover (\%) 207 220 290 205

-are foster's statements to deveraux supporting foster's choice of bonds to sell correct?

(Multiple Choice)

4.9/5  (34)

(34)

The following information relates to Questions

Celia deveraux is chief investment officer for the topanga investors fund, which invests in equities and fixed income. The clients in the fund are all taxable investors. The fixed-income allocation includes a domestic (US) bond portfolio and an externally managed global bond portfolio.

The domestic bond portfolio has a total return mandate, which specifies a long-term re- turn objective of 25 basis points (bps) over the benchmark index. relative to the benchmark, small deviations in sector weightings are permitted, such risk factors as duration must closely match, and tracking error is expected to be less than 50 bps per year.

The objectives for the domestic bond portfolio include the ability to fund future liabili-ties, protect interest income from short-term inflation, and minimize the correlation with the fund's equity portfolio. The correlation between the fund's domestic bond portfolio and equity

portfolio is currently 0.14. deveraux plans to reduce the fund's equity allocation and increase

the allocation to the domestic bond portfolio. She reviews two possible investment strategies.

Strategy 1: Purchase aaa rated fixed-coupon corporate bonds with a modified duration

of two years and a correlation coefficient with the equity portfolio of −0.15.

Strategy 2: Purchase US government agency floating-coupon bonds with a modified du-

ration of one month and a correlation coefficient with the equity portfolioof −0.10.

deveraux realizes that the fund's return may decrease if the equity allocation of the fund is

reduced. deveraux decides to liquidate $20 million of US treasuries that are currently owned

and to invest the proceeds in the US corporate bond sector. to fulfill this strategy, deveraux

asks dan foster, a newly hired analyst for the fund, to recommend treasuries to sell and cor-porate bonds to purchase.

foster recommends treasuries from the existing portfolio that he believes are overvalued

and will generate capital gains. deveraux asks foster why he chose only overvalued bonds

with capital gains and did not include any bonds with capital losses. foster responds with two

statements.

Statement 1: taxable investors should prioritize selling overvalued bonds and always sell

them before selling bonds that are viewed as fairly valued or undervalued.

Statement 2: taxable investors should never intentionally realize capital losses.

regarding the purchase of corporate bonds, foster collects relevant data, which are pre-sented in exhibit 1. EXHIBIT 1 Selected Data on Three US Corporate Bonds Bond Characteristics Bond 1 Bond 2 Bond 3 Credit quality AA AA A Issue size (\ millions) 100 75 75 Maturity (years) 5 7 7 Total issuance outstanding (\ millions) 1,000 1,500 1,000 Months since issuance New issue 3 6

deveraux and foster review the total expected 12-month return (assuming no reinvest-ment income) for the global bond portfolio. Selected financial data are presented in exhibit 2.exhibit 2 Selected data on global bond Portfolio

deveraux contemplates adding a new manager to the global bond portfolio. She reviews three proposals and determines that each manager uses the same index as its benchmark but pursues a different total return approach, as presented in exhibit 3.

EXHIBIT 3 New Manager Proposals Fixed-Income Portfolio Characteristics Sector Weights (\%) Manager A Manager B Manager C Index Government 53.5 52.5 47.8 54.1 Agency/quasi-agency 16.2 16.4 13.4 16.0 Corporate 20.0 22.2 25.1 19.8 MBS 10.3 8.9 13.7 10.1 Risk and Return Characteristics Manager A Manager B Manager C Index Average maturity (years) 7.63 7.84 8.55 7.56 Modified duration (years) 5.23 5.25 6.16 5.22 Average yield (\%) 1.98 2.08 2.12 1.99 Turnover (\%) 207 220 290 205

-based on exhibit 3, which manager is most likely to have an active management total return mandate?

(Multiple Choice)

4.9/5  (24)

(24)

The following information relates to Questions 1-6

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

EXHIBIT 1 Selected Data on Fixed-Income Funds

Aschel Current average bond price \ 117.00 Expected average bond price in one year (end of Year 1) \ 114.00 Average modified duration 7.07 Average annual coupon payment \ 3.63 Present value of portfolio's assets (millions) \ 136.33 Bond type* Fixed-coupon bonds 95\% Floating-coupon bonds 2\% Inflation-linked bonds 3\% Quality* AAA 65\% BBB 35\% Permot Rosaiso \ 91.50 \ 94.60 \ 96.00 \ 97.00 7.38 6.99 \ 6.07 \ 6.36 \ 68.50 \ 74.38 38\% 62\% 34\% 17\% 28\% 21\% 15\% 20\% 65\% 50\% (continued)

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-based on exhibit 2, the optimal strategy to meet villash foundation's cash needs is the sale of:

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-based on exhibit 2, the optimal strategy to meet villash foundation's cash needs is the sale of:

(Multiple Choice)

4.8/5  (33)

(33)

The following information relates to Questions 1-6

Cécile Perreaux is a junior analyst for an international wealth management firm. her supervi-sor, Margit daasvand, asks Perreaux to evaluate three fixed-income funds as part of the firm's global fixed-income offerings. Selected financial data for the funds aschel, Permot, and rosaiso are presented in exhibit 1. in Perreaux's initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

EXHIBIT 1 Selected Data on Fixed-Income Funds

Aschel Current average bond price \ 117.00 Expected average bond price in one year (end of Year 1) \ 114.00 Average modified duration 7.07 Average annual coupon payment \ 3.63 Present value of portfolio's assets (millions) \ 136.33 Bond type* Fixed-coupon bonds 95\% Floating-coupon bonds 2\% Inflation-linked bonds 3\% Quality* AAA 65\% BBB 35\% Permot Rosaiso \ 91.50 \ 94.60 \ 96.00 \ 97.00 7.38 6.99 \ 6.07 \ 6.36 \ 68.50 \ 74.38 38\% 62\% 34\% 17\% 28\% 21\% 15\% 20\% 65\% 50\% (continued)

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-based on exhibit 1, which fund provides the highest level of protection against inflation for coupon payments?

after further review of the composition of each of the funds, Perreaux notes the following.

note 1: aschel is the only fund of the three that uses leverage.note 2: rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.daasvand asks Perreaux to analyze immunization approaches to liability-based mandates for a meeting with villash foundation. villash foundation is a tax-exempt client. Prior to the meeting, Perreaux identifies what she considers to be two key features of a cash flow-matching approach.

feature 1: it requires no yield curve assumptions.

feature 2: Cash flows come from coupons and liquidating bond portfolio positions.two years later, daasvand learns that villash foundation needs $5,000,000 in cash to meet liabilities. She asks Perreaux to analyze two bonds for possible liquidation. Selected data

on the two bonds are presented in exhibit 2.

Bond 1 Current market value \ 5,000,000 Capital gain/loss 400,000 Coupon rate 2.05\% Remaining maturity 8 years Investment view Overvalued Income tax rate Capital gains tax rate Bond 2 \ 5,000,000 -400,000 2.05\% 8 years Undervalued 39\% 30\%

-based on exhibit 1, which fund provides the highest level of protection against inflation for coupon payments?

(Multiple Choice)

4.8/5  (31)

(31)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)