Exam 8: Evaluating Variances From Standard Costs

Exam 1: Introduction to Managerial Accounting191 Questions

Exam 2: Job Order Costing178 Questions

Exam 3: Process Cost Systems182 Questions

Exam 4: Activity Based Costing110 Questions

Exam 5: Cost Volume Profit Analysis210 Questions

Exam 6: Variable Costing for Management Analysis153 Questions

Exam 7: Budgeting182 Questions

Exam 8: Evaluating Variances From Standard Costs166 Questions

Exam 9: Evaluating Decentralized Operations204 Questions

Exam 10: Differential Analysis and Product Pricing165 Questions

Exam 11: Capital Investment Analysis177 Questions

Exam 12: Lean Manufacturing and Activity Analysis123 Questions

Exam 13: Statement of Cash Flows171 Questions

Exam 14: Financial Statement Analysis183 Questions

Select questions type

The following data relate to direct labor costs for March:

Rate: standard, $12.00; actual, $12.25

Hours: standard, 18,500; actual, 17,955

Units of production: 9,450

Calculate the direct labor rate variance.

(Multiple Choice)

4.8/5  (31)

(31)

Aquatic Corp.'s standard material requirement to produce one Model 2000 is 15 pounds of material @ $110.00 per pound. Last month, Aquatic purchased 170,000 pounds of material at a total cost of $17,850,000. It used 162,000 pounds to produce 10,000 units of Model 2000.

Calculate the materials price variance and materials quantity variance, and indicate whether each variance is favorable or unfavorable.

(Short Answer)

4.8/5  (41)

(41)

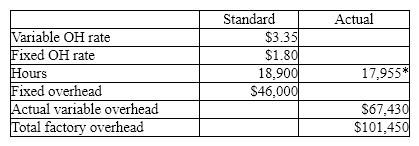

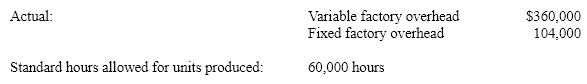

*Actual hours are equal to standard hours for units produced.

The total factory overhead cost variance is:

*Actual hours are equal to standard hours for units produced.

The total factory overhead cost variance is:

(Multiple Choice)

4.8/5  (34)

(34)

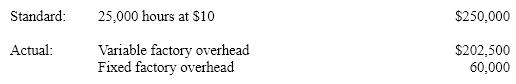

The standard factory overhead rate is $10 per direct labor hour ($8 for variable factory overhead and $2 for fixed factory overhead) based on 100% of normal capacity of 30,000 direct labor hours. The standard cost and the actual cost of factory overhead for the production of 5,000 units during May were as follows:  What is the amount of the variable factory overhead controllable variance?

What is the amount of the variable factory overhead controllable variance?

(Multiple Choice)

4.8/5  (33)

(33)

Japan Company produces lamps that require 2.25 standard hours per unit at an hourly rate of $15.00 per hour. Production of 7,700 units required 19,250 hours at an hourly rate of $14.90 per hour.

What is the direct labor?

(a) rate variance

(b) time variance

(c) total cost variance?

(Short Answer)

4.9/5  (29)

(29)

Standards are designed to evaluate price and quantity variances separately.

(True/False)

4.9/5  (34)

(34)

Which of the following is not a reason for a direct materials quantity variance?

(Multiple Choice)

4.9/5  (43)

(43)

Robin Company purchased and used 520 pounds of direct materials to produce a product with a 510 pound standard direct materials requirement. The standard materials price is $2.10 per pound. The actual materials price was $2.00 per pound.

Prepare the journal entries to record:

(1) the purchase of the materials

(2) the material entering production.

(Short Answer)

4.8/5  (47)

(47)

Assuming that the standard fixed overhead rate is based on full capacity, the cost of available but unused productive capacity is indicated by the

(Multiple Choice)

4.8/5  (22)

(22)

Which of the following is not a reason standard costs are separated into two components?

(Multiple Choice)

4.7/5  (37)

(37)

Normally, standard costs should be revised when labor rates change to incorporate new union contracts.

(True/False)

4.8/5  (42)

(42)

The following information is for the standard and actual costs for the Happy Corporation:

Standard Costs:

Budgeted units of production - 16,000 [80% (or normal) capacity]

Standard labor hours per unit - 4

Standard labor rate - $26 per hour

Standard material per unit - 8 lbs.

Standard material cost - $12 per pound

Standard variable overhead rate - $15 per labor hour

Budgeted fixed overhead - $640,000

Fixed overhead rate is based on budgeted labor hours at 80% (or normal) capacity.

Actual Cost:

Actual production - 16,500 units

Actual material purchased and used - 130,000 pounds

Actual total material cost - $1,600,000

Actual labor - 65,000 hours

Actual total labor costs - $1,700,000

Actual variable overhead - $1,000,000

Actual fixed overhead - $640,000

Determine:

(a) the direct materials quantity variance, price variance, and total cost variance

(b) the direct labor time variance, rate variance, and total cost variance

(c) the factory overhead volume variance, controllable variance, and total factory overhead cost variance. (Note: If following text formulas, do not round interim calculations.)

(Short Answer)

4.8/5  (35)

(35)

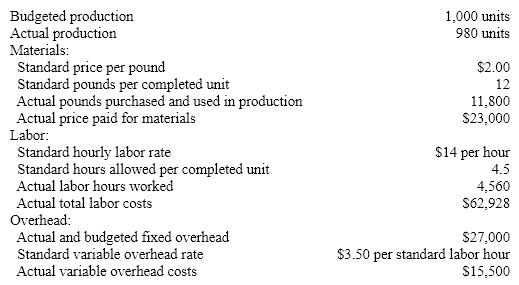

The following data is given for the Taylor Company:  Overhead is applied based on standard labor hours.

Compute the direct labor rate and time variances for Taylor Company.

Overhead is applied based on standard labor hours.

Compute the direct labor rate and time variances for Taylor Company.

(Short Answer)

4.9/5  (31)

(31)

The most effective means of presenting standard factory overhead cost variance data is through a factory overhead cost variance report.

(True/False)

4.8/5  (39)

(39)

Because accountants have financial expertise, they are the only ones that are able to set standard costs for the production area.

(True/False)

4.8/5  (43)

(43)

If a company records inventory purchases at standard cost and also records purchase price variances, prepare the journal entry for a purchase of widgets that were bought at $7.45 per unit and have a standard cost of $7.15. The total amount owed to the vendor for this purchase is $33,525.

(Short Answer)

4.9/5  (33)

(33)

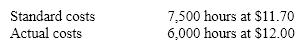

The following data relate to direct labor costs for the current period:  What is the direct labor time variance?

What is the direct labor time variance?

(Multiple Choice)

4.8/5  (38)

(38)

Changes in technology, machinery, or production methods may make past cost data irrelevant when setting standards.

(True/False)

4.9/5  (43)

(43)

The standard factory overhead rate is $7.50 per machine hour ($6.20 for variable factory overhead and $1.30 for fixed factory overhead) based on 100% of normal capacity of 80,000 machine hours. The standard cost and the actual cost of factory overhead for the production of 15,000 units during August were as follows:  What is the amount of the fixed factory overhead volume variance?

What is the amount of the fixed factory overhead volume variance?

(Multiple Choice)

4.8/5  (34)

(34)

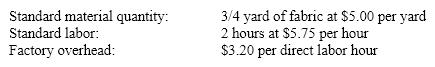

Compute the standard cost for one hat, based on the following standards for each hat:

(Short Answer)

4.8/5  (32)

(32)

Showing 61 - 80 of 166

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)