Exam 11: Managing Aggregate Demand: Fiscal Policy

Exam 1: What Is Economics?227 Questions

Exam 2: The Economy: Myth and Reality150 Questions

Exam 3: The Fundamental Economic Problem: Scarcity and Choice250 Questions

Exam 4: Supply and Demand: An Initial Look308 Questions

Exam 5: An Introduction to Macroeconomics211 Questions

Exam 6: The Goals of Macroeconomic Policy207 Questions

Exam 7: Economic Growth: Theory and Policy223 Questions

Exam 8: Aggregate Demand and the Powerful Consumer214 Questions

Exam 9: Demand-Side Equilibrium: Unemployment or Inflation?211 Questions

Exam 10: Bringing in the Supply Side: Unemployment and Inflation?223 Questions

Exam 11: Managing Aggregate Demand: Fiscal Policy205 Questions

Exam 12: Money and the Banking System219 Questions

Exam 13: Monetary Policy: Conventional and Unconventional205 Questions

Exam 14: The Financial Crisis and the Great Recession61 Questions

Exam 15: The Debate over Monetary and Fiscal Policy214 Questions

Exam 16: Budget Deficits in the Short and Long Run210 Questions

Exam 17: The Trade Off between Inflation and Unemployment214 Questions

Exam 18: International Trade and Comparative Advantage226 Questions

Exam 19: The International Monetary System: Order or Disorder?213 Questions

Exam 20: Exchange Rates and the Macroeconomy214 Questions

Select questions type

Conservatives usually favor increasing government spending to increase aggregate demand.

(True/False)

4.8/5  (38)

(38)

How does an increase in taxes affect the expenditure schedule?

(Multiple Choice)

4.9/5  (36)

(36)

One of the practical issues in the choice of government spending or taxes to change aggregate demand is how large a

(Multiple Choice)

4.9/5  (37)

(37)

If personal income tax rates are decreased in an attempt to stimulate spending,we should expect to see

(Multiple Choice)

4.9/5  (43)

(43)

If all variable taxes in the United States were removed and only fixed taxes remained,what would be the effect on the expenditures schedule?

(Multiple Choice)

4.9/5  (38)

(38)

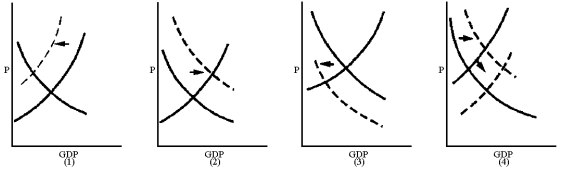

Figure 11-2

-Which graph in Figure 11-2 best reflects a Keynesian's view of the impact of raising taxes on saving?

-Which graph in Figure 11-2 best reflects a Keynesian's view of the impact of raising taxes on saving?

(Multiple Choice)

4.9/5  (34)

(34)

If income tax rates are increased in an attempt to balance the federal budget,we should expect to see

(Multiple Choice)

4.8/5  (31)

(31)

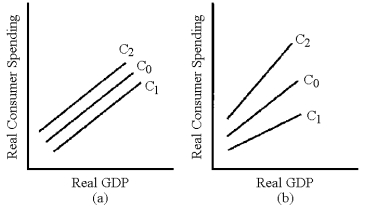

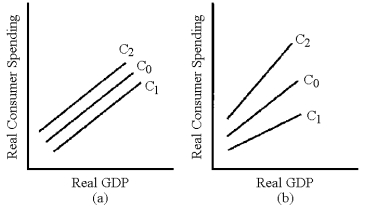

Figure 11-3

-In Figure 11-3,which line represents the change in the consumption schedule caused by an increase in the residential property tax?

-In Figure 11-3,which line represents the change in the consumption schedule caused by an increase in the residential property tax?

(Multiple Choice)

5.0/5  (43)

(43)

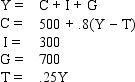

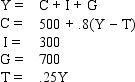

Table 11-1

-Refer to Table 11-1.What is the equilibrium level of income in this model?

-Refer to Table 11-1.What is the equilibrium level of income in this model?

(Multiple Choice)

4.9/5  (33)

(33)

In the determination of disposable income,transfer payments are treated as if they

(Multiple Choice)

4.8/5  (46)

(46)

Contractionary fiscal policy may have some undesirable consequences.Among these is

(Multiple Choice)

4.9/5  (37)

(37)

Income taxes and transfer payments help prevent extreme macroeconomic fluctuations.

(True/False)

4.7/5  (45)

(45)

____ is the income actually available to the consumers that determines aggregate demand.

(Multiple Choice)

4.8/5  (34)

(34)

During the debate on the stimulus package in 2009 and 2010,Republicans argued in favor of increased government spending as opposed to tax cuts based in part on the impact government spending would have on aggregate supply.

(True/False)

4.8/5  (34)

(34)

Figure 11-3

-In Figure 11-3,which line represents the change in the consumption schedule caused by an increase in the personal income tax?

-In Figure 11-3,which line represents the change in the consumption schedule caused by an increase in the personal income tax?

(Multiple Choice)

4.7/5  (41)

(41)

Table 11-1

-Refer to Table 11-1.What is the level of consumption in this model?

-Refer to Table 11-1.What is the level of consumption in this model?

(Multiple Choice)

4.7/5  (45)

(45)

If the Bush tax cuts were allowed to expire in 2010,the maximum personal income tax rate in the United States would have moved above 50 percent.

(True/False)

4.9/5  (42)

(42)

If the demand-side effects of supply-side tax cuts are greater than the supply-side effects,then we can expect the result to be a(n)

(Multiple Choice)

4.9/5  (38)

(38)

Showing 21 - 40 of 205

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)