Exam 9: Forecasting Exchange Rates

Exam 1: Multinational Financial Management: An Overview79 Questions

Exam 2: International Flow of Funds74 Questions

Exam 3: International Financial Markets101 Questions

Exam 4: Exchange Rate Determination69 Questions

Exam 5: Currency Derivatives161 Questions

Exam 6: Government Influence on Exchange Rates116 Questions

Exam 7: International Arbitrage and Interest Rate Parity92 Questions

Exam 8: Relationships among Inflation, Interest Rates, and Exchange Rates59 Questions

Exam 9: Forecasting Exchange Rates84 Questions

Exam 10: Measuring Exposure to Exchange Rate Fluctuations82 Questions

Exam 11: Managing Transaction Exposure81 Questions

Exam 12: Managing Economic Exposure and Translation Exposure58 Questions

Exam 13: Direct Foreign Investment53 Questions

Exam 14: Multinational Capital Budgeting60 Questions

Exam 15: International Corporate Governance and Control72 Questions

Exam 16: Country Risk Analysis57 Questions

Exam 17: Multinational Cost of Capital and Capital Structure68 Questions

Exam 18: Long-Term Debt Financing53 Questions

Exam 19: Financing International Trade66 Questions

Exam 20: Short-Term Financing49 Questions

Exam 21: International Cash Management50 Questions

Select questions type

If a particular currency is consistently declining substantially over time, then a market-based forecast of a currency in a developed country will usually have:

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following forecasting techniques would be most likely to use today's forward exchange rate to forecast the future exchange rate?

(Multiple Choice)

5.0/5  (38)

(38)

When measuring forecast performance of different currencies, it is oFten useful to adjust for their relative sizes. Thus, percentages, rather than nominal amounts, are oFten used to compute forecast errors.

(True/False)

4.9/5  (38)

(38)

Which of the following forecasting techniques would be most likely to use the historical exchange rate data for the euro to predict the euro's future exchange rate?

(Multiple Choice)

4.9/5  (36)

(36)

If graphical points lie above the perfect forecast line, then the forecast overestimated the future value.

(Multiple Choice)

4.9/5  (35)

(35)

If the forward rate is used as an indicator of the future spot rate, the spot rate is expected to appreciate or depreciate by the same amount as the forward premium or discount, respectively.

(True/False)

4.7/5  (34)

(34)

Since the forward rate does not capture the nominal interest rate between two countries, it should provide a less accurate forecast for currencies in high-inflation countries than the spot rate.

(True/False)

4.8/5  (38)

(38)

Assume that interest rate parity holds. The U.S. five-year interest rate is 5 percent annualized, and the Mexican five-year interest rate is 8 percent annualized. Today's spot rate of the Mexican peso is $.20. What is the approximate five-year forecast of the peso's spot rate if the five-year forward rate is used as a forecast?

(Multiple Choice)

4.8/5  (49)

(49)

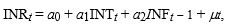

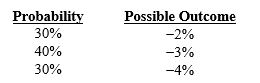

The following regression model was estimated to forecast the value of the Indian rupee (INR):

Where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the United States and India, and INF is the inflation rate differential between the United States and India in the previous period. Regression results indicate coefficients of a₀ = .003; a₁ = -.5; and a₂ = .8. Assume that INFt - 1 = 2 percent. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

Where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the United States and India, and INF is the inflation rate differential between the United States and India in the previous period. Regression results indicate coefficients of a₀ = .003; a₁ = -.5; and a₂ = .8. Assume that INFt - 1 = 2 percent. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

The expected change in the Indian rupee in period t is:

The expected change in the Indian rupee in period t is:

(Multiple Choice)

4.8/5  (39)

(39)

Exchange rates one year in advance are typically forecasted with almost perfect accuracy for the major currencies, but not for currencies of smaller countries.

(True/False)

4.8/5  (44)

(44)

Which of the following is not one of the major reasons for MNCs to forecast exchange rates?

(Multiple Choice)

4.9/5  (41)

(41)

Factors such as economic growth, inflation, and interest rates are an integral part of ____ forecasting.

(Multiple Choice)

4.8/5  (34)

(34)

If a foreign country's interest rate is similar to the U.S. rate, the forward rate premium or discount will be close to zero, meaning that the forward rate and the spot rate will provide similar forecasts.

(True/False)

4.9/5  (32)

(32)

A motivation for forecasting exchange rate volatility is to obtain a range surrounding the forecast.

(True/False)

4.9/5  (38)

(38)

Which of the following is not a limitation of fundamental forecasting?

(Multiple Choice)

4.9/5  (33)

(33)

If speculators expect the spot rate of the Canadian dollar in 30 days to be ____ than the 30-day forward rate on Canadian dollars, they will ____ Canadian dollars forward and put ____ pressure on the Canadian dollar forward rate.

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following forecasting techniques would be most likely to use today's spot exchange rate of the euro to forecast the euro's future exchange rate?

(Multiple Choice)

4.8/5  (28)

(28)

Market-based forecasting is based on fundamental relationships between economic variables and exchange rates.

(True/False)

4.8/5  (46)

(46)

Assume that U.S. interest rates for the next three years are 5 percent, 6 percent, and 7 percent, respectively. Also assume that Canadian interest rates for the next three years are 3 percent, 6 percent, and 9 percent. The current Canadian spot rate is $.840. What is the approximate three-year forecast of the Canadian dollar's spot rate if the three-year forward rate is used as a forecast?

(Multiple Choice)

4.8/5  (30)

(30)

Showing 61 - 80 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)