Exam 12: Monetary Policy in the Short Run

Exam 1: Introduction to Macroeconomics and the Great Recession68 Questions

Exam 2: Measuring the Macroeconomy78 Questions

Exam 3: The Canadian Financial System83 Questions

Exam 4: Money and Inflation80 Questions

Exam 5: The Global Financial System and Exchange Rates81 Questions

Exam 6: The Labour Market77 Questions

Exam 7: The Standard of Living Over Time and Across Countries74 Questions

Exam 8: Long-Run Economic Growth85 Questions

Exam 9: Business Cycles92 Questions

Exam 10: Explaining Aggregate Demand: the Is-Mp Model94 Questions

Exam 11: The Is-Mp Model: Adding Inflation and the Open Economy74 Questions

Exam 12: Monetary Policy in the Short Run83 Questions

Exam 13: Fiscal Policy in the Short Run77 Questions

Exam 14: Aggregate Demand, aggregate Supply, and Monetary Policy75 Questions

Exam 15: Fiscal Policy and the Government Budget in the Long Run55 Questions

Exam 16: Consumption and Investment74 Questions

Select questions type

A decrease in the policy rate ________ bank reserves and ________ the overnight rate.

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

B

Although initially a ________ institution,the Bank of Canada is now a ________ corporation.

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

B

By engaging in quantitative easing,the Bank of Canada is attempting to reduce the ________,causing the MP curve to ________.

(Multiple Choice)

4.8/5  (35)

(35)

Explain the dilemma that supply shocks pose when the Bank of Canada chooses to use monetary policy to achieve its goals.

(Essay)

4.7/5  (39)

(39)

The rate that financial institutions use to lend and borrow from each other at the end of the day is called the

(Multiple Choice)

4.8/5  (27)

(27)

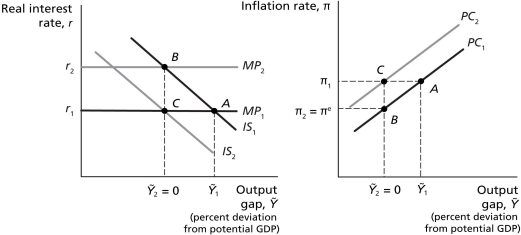

Figure 12.2

-Refer to Figure 12.2.Suppose the economy is initially above potential GDP,and the actual inflation rate is greater than the expected inflation rate.If the Bank of Canada wants to achieve the goal of price stability,this would be represented by a movement on the Phillips curve from

-Refer to Figure 12.2.Suppose the economy is initially above potential GDP,and the actual inflation rate is greater than the expected inflation rate.If the Bank of Canada wants to achieve the goal of price stability,this would be represented by a movement on the Phillips curve from

(Multiple Choice)

4.9/5  (41)

(41)

When the Bank of Canada makes an open market purchase,the money supply will ________,which will cause long-term real interest rates to ________.

(Multiple Choice)

4.8/5  (30)

(30)

Which of the goals pursued by policymakers in an open economy is desirable because it can help reduce the volatility of economic activity?

(Multiple Choice)

4.9/5  (29)

(29)

If exchange rates are floating,the Bank of Canada increasing its target inflation rate will cause the dollar to ________ relative to other currencies and cause net capital outflows to ________.

(Multiple Choice)

4.9/5  (33)

(33)

Suppose oil prices suddenly begin to rise and the Bank of Canada announces that the increase in oil prices is not expected to generate excessive inflation.If the Bank of Canada is incorrect in its assumption that rising oil prices will not generate excessive inflation and the inflation rate increases before the Bank of Canada takes corrective action,then other things equal,this would result in ________ and ________.

(Multiple Choice)

4.7/5  (42)

(42)

With a contractionary monetary policy,as the output gap increases,the response of the central bank will tend to cause net capital outflows to ________ and cause the nominal exchange rate to ________.

(Multiple Choice)

4.7/5  (29)

(29)

Quantitative easing is a central bank policy that attempts to stimulate the economy by possibly

(Multiple Choice)

4.8/5  (37)

(37)

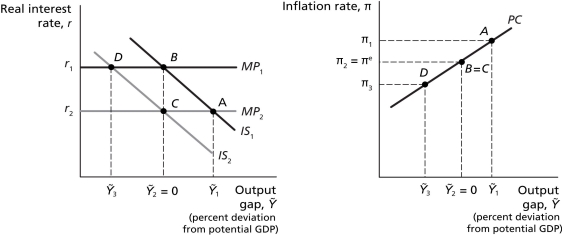

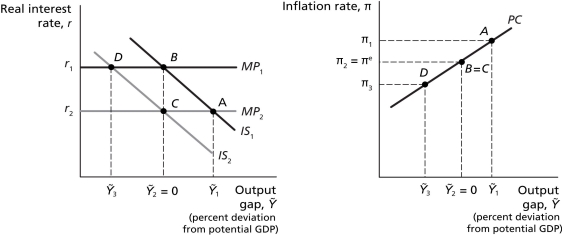

Figure 12.4

Scenario: The above figures represent the economy of Mondolvia, where points A, B, C, and D in the first figure reflect the corresponding points in the second figure. The economy of Mondolvia is initially at equilibrium with real GDP equal to potential GDP. In April 2012, Mondolvia reached the peak of a rapid housing bubble that dramatically increased consumer wealth. The central bank of Mondolvia recognized this housing bubble peak existed in June, 2012 and implemented corrective policy in August 2012. The corrective policy actually changed output in the economy 12 months after it was implemented. In the meantime, the housing bubble burst in December 2012, returning the economy back to its initial, pre-bubble equilibrium level.

-Refer to Figure 12.4.As a result of the monetary policy taking effect after the housing bubble had already burst,real GDP will be ________ potential GDP and the rate of inflation will be ________ the rate of inflation when the economy was initially in equilibrium.

Scenario: The above figures represent the economy of Mondolvia, where points A, B, C, and D in the first figure reflect the corresponding points in the second figure. The economy of Mondolvia is initially at equilibrium with real GDP equal to potential GDP. In April 2012, Mondolvia reached the peak of a rapid housing bubble that dramatically increased consumer wealth. The central bank of Mondolvia recognized this housing bubble peak existed in June, 2012 and implemented corrective policy in August 2012. The corrective policy actually changed output in the economy 12 months after it was implemented. In the meantime, the housing bubble burst in December 2012, returning the economy back to its initial, pre-bubble equilibrium level.

-Refer to Figure 12.4.As a result of the monetary policy taking effect after the housing bubble had already burst,real GDP will be ________ potential GDP and the rate of inflation will be ________ the rate of inflation when the economy was initially in equilibrium.

(Multiple Choice)

4.9/5  (31)

(31)

Assume that the Bank of Canada knows a demand shock has occurred in the economy.It takes the Bank of Canada two months to adjust policy to the shock,and it takes the economy 14 months for the policy change to affect the economy.The two-month time period refers to the ________,and the following 14-month time period refers to the ________.

(Multiple Choice)

4.8/5  (29)

(29)

Assume it takes the Bank of Canada four months to understand that a demand shock has occurred in the economy,and another one month to adjust policy to the shock.The initial four-month time period refers to the ________,and the following one-month time period refers to the ________.

(Multiple Choice)

4.8/5  (30)

(30)

Figure 12.4

Scenario: The above figures represent the economy of Mondolvia, where points A, B, C, and D in the first figure reflect the corresponding points in the second figure. The economy of Mondolvia is initially at equilibrium with real GDP equal to potential GDP. In April 2012, Mondolvia reached the peak of a rapid housing bubble that dramatically increased consumer wealth. The central bank of Mondolvia recognized this housing bubble peak existed in June, 2012 and implemented corrective policy in August 2012. The corrective policy actually changed output in the economy 12 months after it was implemented. In the meantime, the housing bubble burst in December 2012, returning the economy back to its initial, pre-bubble equilibrium level.

-Refer to Figure 12.4.The implementation of corrective policy by the central bank is designed to move the economy from

Scenario: The above figures represent the economy of Mondolvia, where points A, B, C, and D in the first figure reflect the corresponding points in the second figure. The economy of Mondolvia is initially at equilibrium with real GDP equal to potential GDP. In April 2012, Mondolvia reached the peak of a rapid housing bubble that dramatically increased consumer wealth. The central bank of Mondolvia recognized this housing bubble peak existed in June, 2012 and implemented corrective policy in August 2012. The corrective policy actually changed output in the economy 12 months after it was implemented. In the meantime, the housing bubble burst in December 2012, returning the economy back to its initial, pre-bubble equilibrium level.

-Refer to Figure 12.4.The implementation of corrective policy by the central bank is designed to move the economy from

(Multiple Choice)

4.9/5  (31)

(31)

Showing 1 - 20 of 83

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)