Exam 3: Analysis of Financial Statements

Exam 1: An Overview of Financial Management and the Financial Environment46 Questions

Exam 2: Financial Statements, cash Flow, and Taxes77 Questions

Exam 3: Analysis of Financial Statements104 Questions

Exam 4: Time Value of Money168 Questions

Exam 5: Bonds, bond Valuation, and Interest Rates100 Questions

Exam 6: Risk and Return146 Questions

Exam 7: Valuation of Stocks and Corporations80 Questions

Exam 8: Financial Options and Applications in Corporate Finance28 Questions

Exam 9: The Cost of Capital92 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows108 Questions

Exam 11: Cash Flow Estimation and Risk Analysis78 Questions

Exam 12: Corporate Valuation and Financial Planning41 Questions

Exam 13: Agency Conflicts and Corporate Governance6 Questions

Exam 15: Capital Structure Decisions59 Questions

Exam 16: Supply Chains and Working Capital Management135 Questions

Exam 17: Multinational Financial Management49 Questions

Exam 18: Public and Private Financing: Initial Offerings, seasoned Offerings, and Investment Banks22 Questions

Exam 18: Extension 18 A: Rights Offerings4 Questions

Exam 19: Lease Financing23 Questions

Exam 20: Hybrid Financing: Preferred Stock, warrants, and Convertibles26 Questions

Exam 21: Dynamic Capital Structures22 Questions

Exam 22: Mergers and Corporate Control46 Questions

Exam 23: Enterprise Risk Management14 Questions

Exam 24: Bankruptcy, reorganization, and Liquidation12 Questions

Exam 25: Portfolio Theory and Asset Pricing Models35 Questions

Exam 26: Real Options11 Questions

Exam 27: Providing and Obtaining Credit29 Questions

Exam 28: Advanced Issues in Cash Management and Inventory Control17 Questions

Exam 29: Pension Plan Management10 Questions

Exam 30: Financial Management in Not For Profit Businesses10 Questions

Select questions type

Northwest Lumber had a profit margin of 5.25%,a total assets turnover of 1.5,and an equity multiplier of 1.8.What was the firm's ROE?

Free

(Multiple Choice)

4.8/5  (44)

(44)

Correct Answer:

C

Which of the following would indicate an improvement in a company's financial position,holding other things constant?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

A

Chambliss Corp.'s total assets at the end of last year were $305,000 and its EBIT was 62,500.What was its basic earning power (BEP)?

Free

(Multiple Choice)

5.0/5  (28)

(28)

Correct Answer:

C

It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all the firms being compared have the same proportion of fixed assets to total assets.

(True/False)

4.9/5  (37)

(37)

Suppose a firm wants to maintain a specific TIE ratio.It knows the amount of its debt,the interest rate on that debt,the applicable tax rate,and its operating costs.With this information,the firm can calculate the amount of sales required to achieve its target TIE ratio.

(True/False)

4.7/5  (29)

(29)

Companies Heidee and Leaudy have the same tax rate,sales,total assets,and basic earning power.Both companies have positive net incomes.Company Heidee has a higher debt ratio and,therefore,a higher interest expense.Which of the following statements is CORRECT?

(Multiple Choice)

4.7/5  (24)

(24)

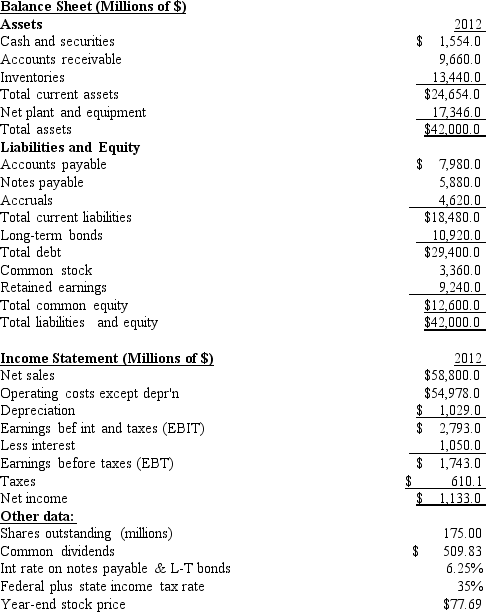

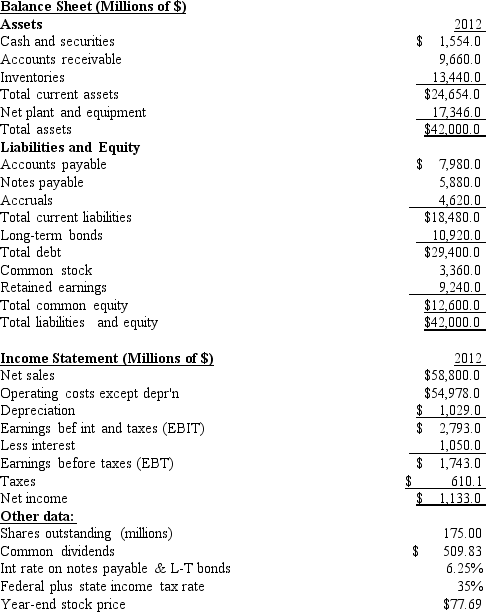

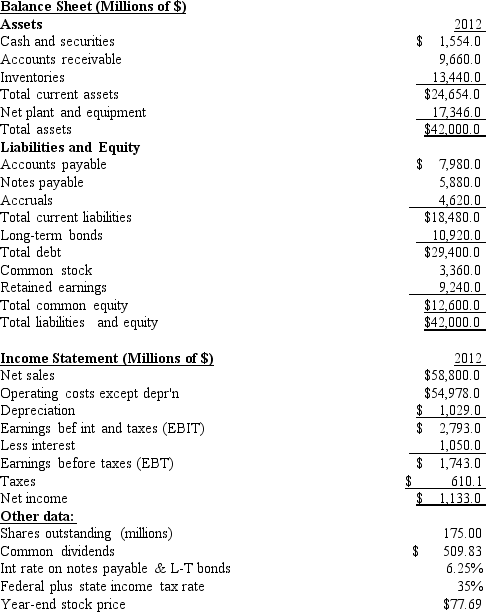

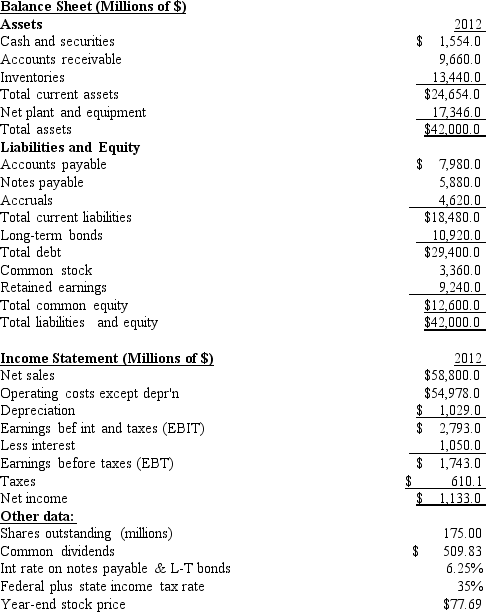

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's book value per share?

-Refer to Exhibit 3.1.What is the firm's book value per share?

(Multiple Choice)

4.8/5  (35)

(35)

A firm wants to strengthen its financial position.Which of the following actions would increase its quick ratio?

(Multiple Choice)

4.8/5  (32)

(32)

The inventory turnover ratio and days sales outstanding (DSO)are two ratios that are used to assess how effectively a firm is managing its assets.

(True/False)

4.7/5  (34)

(34)

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's inventory turnover ratio?

-Refer to Exhibit 3.1.What is the firm's inventory turnover ratio?

(Multiple Choice)

4.8/5  (24)

(24)

Lincoln Industries' current ratio is 0.5.Considered alone,which of the following actions would increase the company's current ratio?

(Multiple Choice)

4.9/5  (35)

(35)

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's EPS?

-Refer to Exhibit 3.1.What is the firm's EPS?

(Multiple Choice)

4.8/5  (30)

(30)

Arshadi Corp.'s sales last year were $52,000,and its total assets were $22,000.What was its total assets turnover ratio (TATO)?

(Multiple Choice)

4.9/5  (37)

(37)

Ratio analysis involves analyzing financial statements in order to appraise a firm's financial position and strength.

(True/False)

4.8/5  (27)

(27)

Companies Heidee and Leaudy have the same total assets,sales,operating costs,and tax rates,and they pay the same interest rate on their debt.However,company Heidee has a higher debt ratio.Which of the following statements is CORRECT?

(Multiple Choice)

4.8/5  (34)

(34)

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's market-to-book ratio?

-Refer to Exhibit 3.1.What is the firm's market-to-book ratio?

(Multiple Choice)

4.8/5  (33)

(33)

Bonner Corp.'s sales last year were $415,000,and its year-end total assets were $355,000.The average firm in the industry has a total assets turnover ratio (TATO)of 2.4.Bonner's new CFO believes the firm has excess assets that can be sold so as to bring the TATO down to the industry average without affecting sales.By how much must the assets be reduced to bring the TATO to the industry average,holding sales constant?

(Multiple Choice)

4.8/5  (32)

(32)

If the CEO of a large,diversified,firm were filling out a fitness report on a division manager (i.e.,"grading" the manager),which of the following situations would be likely to cause the manager to receive a better grade? In all cases,assume that other things are held constant.

(Multiple Choice)

4.9/5  (31)

(31)

Suppose Firms A and B have the same amount of assets,pay the same interest rate on their debt,have the same basic earning power (BEP),and have the same tax rate.However,Firm A has a higher debt ratio.If BEP is greater than the interest rate on debt,Firm A will have a higher ROE as a result of its higher debt ratio.

(True/False)

4.8/5  (38)

(38)

Showing 1 - 20 of 104

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)