Exam 12: Cost-Volume-Profit Analysis

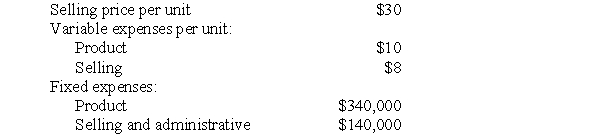

Mulvey Corporation manufactures hand painted vases. The company currently sells 50,000 units per year. The company's revenues and costs follow:

Required:

a. Calculate Mulvey's before-tax break-even point in units and sales dollars.

b. Calculate Mulvey's contribution margin ratio.

c. Calculate Mulvey's variable cost ratio.

d. Calculate Mulvey's margin of safety in units and sales dollars.

e. Calculate Mulvey's degree of operating leverage.

f. Using your answer from (e), determine what impact a 30% increase in sales volume would have on pretax profits. Use an income statement to prove your answer by calculating the pretax profits at the new sales volume level.

Required:

a. Calculate Mulvey's before-tax break-even point in units and sales dollars.

b. Calculate Mulvey's contribution margin ratio.

c. Calculate Mulvey's variable cost ratio.

d. Calculate Mulvey's margin of safety in units and sales dollars.

e. Calculate Mulvey's degree of operating leverage.

f. Using your answer from (e), determine what impact a 30% increase in sales volume would have on pretax profits. Use an income statement to prove your answer by calculating the pretax profits at the new sales volume level.

a. ($30 - $10 - $8)X - ($340,000 + $140,000) = $0

$12X - $480,000 = $0

$12X = $480,000

X = 40,000 units

40,000 units x $30 = $1,200,000

b. Contribution margin per unit = $30 - $10 - $8 = $12

Contribution margin ratio = $12 ÷ $30 = 40%

c. Total variable cost per unit = $10 + $8 = $18 per unit

Variable cost ratio = $18 ÷ $30 = 60%

or

Variable cost ratio = 100% - CM% = 100% - 40% = 60%

d. Margin of safety in units = 50,000 - 40,000 = 10,000 units

Margin of safety in dollars = 10,000 units x $30 = $300,000

e. Total contribution margin = $12 x 50,000 units = $600,000

Pretax profit = $600,000 - ($340,000 + $140,000) = $600,000 - $480,000 = $120,000

Degree of operating leverage = $600,000 ÷ $120,000 = 5

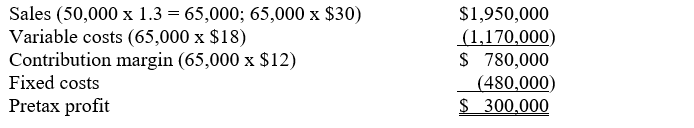

f. Impact on profit = DOL x % increase in sales = 5 x 0.30 = 1.5%

Proof:

Increase in pretax profit = $300,000 - $120,000 = $180,000

Increase in profits = $180,000 ÷ $120,000 = 1.5 times

If a company's contribution margin increases and its fixed costs remain constant, break-even point will decrease.

True

Use the following information to answer questions

Wild Bear Corp. sells tents for $250. The company produced and sold 5,000 tents in 2010 and incurred the following costs:

Variable production cost per tent $125

Fixed production cost $195,000

Variable selling expense per tent $25

Fixed selling and administrative cost $135,000

The company had expected to sell 3,900 units in 2010. Wild Boar's tax rate is 30%.

-What was Wild Bear's margin of safety in dollars for 2010?

D

The contribution margin ratio is always computed on a per-unit basis.

A company could determine the effect that a 10% variable cost increase would have on total production costs by using

Use the following information to answer questions

Reliable Furniture manufactures recliners selling for $500 each. Variable costs per unit are $175 for direct material, $125 for direct labor, $35 for variable production overhead, and $15 for variable selling and administrative costs. Annual fixed costs are $200,000 for production overhead and $100,000 for selling and administrative costs. The company applies fixed production overhead to recliners based on a capacity of 20,000 units per year.

-Reliable Furniture's contribution margin ratio is

A graph that shows profit and loss amounts at specific volume levels is a

The contribution margin ratio is equal to (selling price - variable costs) divided by selling price.

If a company's sales revenue is $500,000 and its break-even sales are $300,000, then its margin of safety is 1.67.

On a break-even graph, total fixed cost is plotted as a line horizontal to the x-axis.

The break-even point is shown on a BEP graph as the point at which the

If a company's contribution margin remains constant and its fixed costs decrease, then break-even point will increase.

Managers of businesses are primarily interested in the break-even point because it provides

Break-even point and cost-volume-profit analysis are both based on the income statement formula.

In 2010, Brown Dog sold 20,000 units of its product at $50 per unit. The following information is also available:

What was Brown Dog's degree of operating leverage in 2010?

What was Brown Dog's degree of operating leverage in 2010?

Use the following information to answer questions 32 - 34:

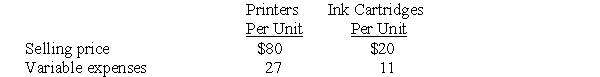

In 2010, Printext estimates that for every two printers sold, the company will sell six ink cartridges. The products have a 2:6 ratio. Fixed production costs are $150,000 and fixed selling costs are $50,000. Printext's selling prices and variable expenses information are as follows:

-If the sales mix changed to 3:5 and Printext sold 2.700 printers, the company will incur a

-If the sales mix changed to 3:5 and Printext sold 2.700 printers, the company will incur a

The measure that reflects an organization's variable and fixed cost relationship and indicates how a percentage change in sale from the current level will impact impact profits is called the

Decisions about pricing a special order at less than "normal" selling price per unit should be made solely on the basis of the net profit or loss that might be generated from the special order.

Use the following information to answer questions

Boca Inc.'s current product selling price is $70, variable cost per unit is $35, total fixed costs are $1,430,000, and sales volume is 150,000 units.

-The company estimates that a $10 reduction in selling price and an $80,000 increase in advertising will cause sales volume to increase by 20,000 units. What is the incremental profit or loss?

Use the following information to answer questions

Reliable Furniture manufactures recliners selling for $500 each. Variable costs per unit are $175 for direct material, $125 for direct labor, $35 for variable production overhead, and $15 for variable selling and administrative costs. Annual fixed costs are $200,000 for production overhead and $100,000 for selling and administrative costs. The company applies fixed production overhead to recliners based on a capacity of 20,000 units per year.

-If the company wants to earn a before-tax profit of $600,000, how many recliners must be sold?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)