Exam 8: Stockholders Equity

Exam 1: An Introduction to the Role of Accounting in the Business World73 Questions

Exam 2: Concepts and Elements Underlying Accounting109 Questions

Exam 3: The Mechanics of Double-Entry Bookkeeping86 Questions

Exam 4: Cash, Short-Term Investments and Accounts Receivable64 Questions

Exam 5: Inventory86 Questions

Exam 6: Long-Term Assets: Property, Plant Equipment and Intangibles93 Questions

Exam 7: Liabilities119 Questions

Exam 8: Stockholders Equity106 Questions

Exam 9: The Corporate Income Statement and Financial Analysis113 Questions

Exam 10: Statement of Cash Flows85 Questions

Exam 11: Managerial Accounting116 Questions

Exam 12: Cost-Volume-Profit Analysis77 Questions

Exam 13: The Master Budget96 Questions

Exam 14: Activity-Based Management and Performance Measurementreward114 Questions

Select questions type

Use the following information to answer questions

Grambling Corporation issued 500 shares of common stock for $22 per share.

-If the common stock has a $5 par value, how should Grambling record this transaction?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

C

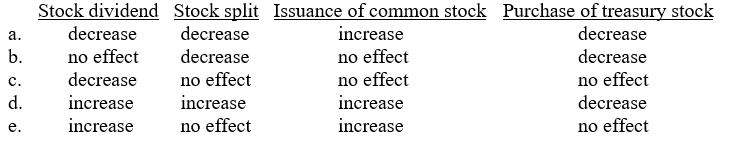

How will the Retained Earnings account be affected by each of the following?

Free

(Short Answer)

4.8/5  (30)

(30)

Correct Answer:

C

The issuance of which of the following types of stock could never affect an additional paid-in capital account?

Free

(Multiple Choice)

4.7/5  (38)

(38)

Correct Answer:

C

After the death of a partner, new partnerships may be formed immediately without interrupting business operations.

(True/False)

4.8/5  (28)

(28)

McCallister Corp. acquired a machine in exchange for 100 shares of $2 par-value common stock. The fair market value of McCallister's stock at the time of the exchange was $53 per share. The company selling the machine to McCallister showed a book value of that machine of $4,000. Because of this transaction, McCallister's

(Multiple Choice)

4.9/5  (48)

(48)

A corporate CEO can also be the chairman of the board of the same company.

(True/False)

4.9/5  (37)

(37)

Stock splits typically increase the number of shares authorized, issued, and outstanding.

(True/False)

4.8/5  (34)

(34)

Use the following information to answer questions

Marco Co. has 10,000 shares of $50 par value, cumulative preferred stock. The annual dividend on the preferred stock is $3 per share. By the end of 2010, Marco had not declared any dividends for 4 years.

-On its 2010 year-end financial statements, Marco Co.

(Multiple Choice)

4.8/5  (37)

(37)

Sleepy Times Corp.'s common stock has a $1 par value. On January 1, 2010, Sleepy Time's had 750,000 authorized shares, of which 450,000 were issued and outstanding. The following treasury stock transactions were incurred by Sleepy Time during 2010.

April 2 Bought 13,000 shares of its own common stock for $32 per share.

May 7 Sold 5,000 shares of treasury stock for $37 per share.

June 15 Sold 4,000 shares of treasury stock to employees for $27 per share.

Aug. 17 Sold 2,000 shares of treasury stock for $29 per share.

Sept. 24 Sold 500 shares of treasury stock for $34 per share.

Required:

a. Prepare journal entries for the treasury stock transactions.

b. How many shares of common stock were outstanding at December 31, 2010?

(Essay)

4.8/5  (25)

(25)

Under the preemptive right, the owner of 10,000 of the 1,000,000 outstanding shares of Country Bay common stock can purchase an additional 500 shares if Country Bay decides to issue an additional 500,000 shares.

(True/False)

4.8/5  (34)

(34)

The stock of all corporations is traded on a stock exchange, although the size of the exchange may vary.

(True/False)

4.9/5  (45)

(45)

Anderson Corp. declared a 5% stock dividend on its 20,000 outstanding shares of $1 par value common stock, which had a fair value of $5 per share on the declaration date. The accounting entry on the declaration date would include a

(Multiple Choice)

4.9/5  (27)

(27)

On January 1, 2010, Brian Brezina owned 25% of Wilder Corporation's 5,000,000 issued and outstanding shares of common stock. If Wilder issues another 1,000,000 shares and Brezina exercises his full preemptive right, how many shares will Brezina own?

(Multiple Choice)

4.9/5  (39)

(39)

Vicky Corp. had 500,000 shares of common stock authorized and 410,000 shares outstanding at December 31, 2009. The following events occurred during 2010:

April 1 Declared 5% stock dividend

June 1 Purchased 75,000 shares

Sept. 1 Reissued 25,000 shares

Nov) 1 Declared 2-for-1 stock split

How many shares of common stock did Vicky have outstanding at December 31, 2010?

(Multiple Choice)

4.8/5  (34)

(34)

Prior period adjustments are made for all errors made in the financial statements.

(True/False)

4.8/5  (38)

(38)

The process of reincorporating in a tax haven is called conversion.

(True/False)

4.9/5  (32)

(32)

It is possible for the sale of treasury stock to increase Retained Earnings.

(True/False)

4.9/5  (35)

(35)

Use the following information to answer questions

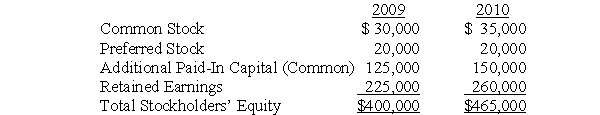

On December 31, 2009 and 2010, the equity sections of Deveraux Corporation's balance sheet were as follows:

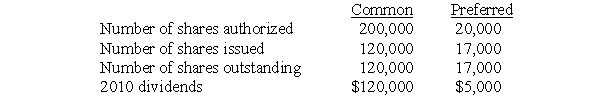

Total shares authorized, issued, and outstanding on December 31, 2010 are listed below. 2010 common and preferred dividends are also listed below.

Total shares authorized, issued, and outstanding on December 31, 2010 are listed below. 2010 common and preferred dividends are also listed below.

Deveraux's 2010 net income is $200,000. The market price of the common stock in 2010 was $25 per share.

-What is Deveraux's return on equity for 2010?

Deveraux's 2010 net income is $200,000. The market price of the common stock in 2010 was $25 per share.

-What is Deveraux's return on equity for 2010?

(Multiple Choice)

4.9/5  (41)

(41)

A contract between a corporation and the state in which it was created and identifies the corporation's principal rights and obligations is called

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)