Exam 6: Long-Term Assets: Property, Plant Equipment and Intangibles

Exam 1: An Introduction to the Role of Accounting in the Business World73 Questions

Exam 2: Concepts and Elements Underlying Accounting109 Questions

Exam 3: The Mechanics of Double-Entry Bookkeeping86 Questions

Exam 4: Cash, Short-Term Investments and Accounts Receivable64 Questions

Exam 5: Inventory86 Questions

Exam 6: Long-Term Assets: Property, Plant Equipment and Intangibles93 Questions

Exam 7: Liabilities119 Questions

Exam 8: Stockholders Equity106 Questions

Exam 9: The Corporate Income Statement and Financial Analysis113 Questions

Exam 10: Statement of Cash Flows85 Questions

Exam 11: Managerial Accounting116 Questions

Exam 12: Cost-Volume-Profit Analysis77 Questions

Exam 13: The Master Budget96 Questions

Exam 14: Activity-Based Management and Performance Measurementreward114 Questions

Select questions type

Use the following information to answer questions

On June 30, 2010, Jumbo Corp. purchased a mine for $2,700,000 with an estimated 1,500,000 tons of extractable ore. The mine has an estimated value of $300,000 after the ore has been extracted. During the first year, 150,000 tons of ore were extracted and 100,000 tons were sold.

-What amount of ore cost is included in Cost of Goods Sold for 2010?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

B

Use the following information to answer questions

On January 1, 2010, Run & Go Pizza purchased a delivery truck for $50,000. The truck has a $5,000 salvage value and a four-year (or 56,250 miles) useful life. During 2010, the company put 15,750 miles on the delivery truck.

-If Run & Go uses the units-of-production method, how much depreciation expense should Run & Go recognize in 2010?

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

E

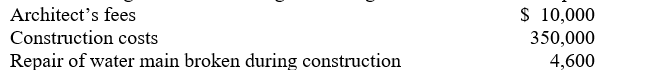

On September 1, 2010, Pablo Co. purchased a parcel of land for $150,000. Pablo paid $5,000 in legal costs to research the title for the land. The following additional costs were incurred during 2010 as Pablo began building construction on the  Pablo should record which of the following amounts as the cost for the land and the cost for the building:

Pablo should record which of the following amounts as the cost for the land and the cost for the building:

Free

(Short Answer)

4.8/5  (34)

(34)

Correct Answer:

C

The choice of a depreciation method can significantly influence a company's apparent financial condition and reported profits.

(True/False)

4.7/5  (36)

(36)

A patent grants the holder an exclusive right to manufacture a specific product or to use a specific process for 40 years.

(True/False)

4.9/5  (38)

(38)

The decision of whether to capitalize or expense an amount spent on a PP&E item after its original purchase is based on the cost of the item.

(True/False)

4.8/5  (30)

(30)

On June 1, 2010, Pacific Landscaping bought a lawnmower for $29,000. The lawnmower has an estimated life of four years and a $5,000 salvage value. Pacific Landscaping uses the straight-line method of depreciation. Total depreciation expense for the year ended December 31, 2010, is

(Multiple Choice)

4.8/5  (37)

(37)

Use the following information to answer questions

On September 1, 2010, Faster than R&G purchased a delivery truck for $42,000. The truck has a $3,000 salvage value and a five-year (or 60,000 miles) useful life. During 2010, the company put 8,700 miles on the delivery truck; the company put 16,100 miles on the truck in 2011. (Round all answers to the nearest dollar.)

-If Faster than R&G uses the double-declining balance method, how much depreciation expense should Faster than R&G recognize in 2011?

(Multiple Choice)

4.7/5  (41)

(41)

Use the following information to answer questions

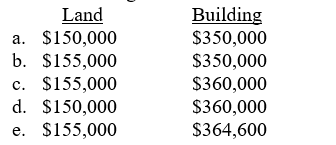

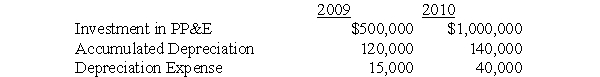

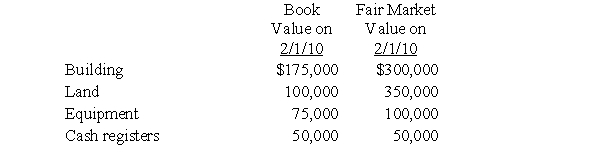

On February 1, 2010, Consolidated Department Stores purchased the assets of Jackson Department Store for $750,000. Following are the book and fair market values of those assets at the time of acquisition:

-Consolidated should recognize the cost of the building as

-Consolidated should recognize the cost of the building as

(Multiple Choice)

4.9/5  (34)

(34)

The Deep Hole Company recently paid $2,400,000 for a mine capable of producing 6,000 tons of ore. In the first year, Deep Hole extracted 600 tons of ore from the mine and immediately sold it at $500 per ton.

(Multiple Choice)

4.9/5  (31)

(31)

On January 1, 2010, Green Pharmaceuticals received a patent for a new arthritis medication. Research and development costs of $1,000,000 had been incurred by Green during 2007-2009 in developing this patent. The patent has a legal life of 20 years and has an estimated useful life of 5 years. What adjusting journal entry should Green prepare on December 31, 2010 relative to this patent?

(Multiple Choice)

4.9/5  (32)

(32)

If a depreciable asset is disposed of at any point other than year-end, an adjusting entry must be made to recognize depreciation expense on that asset before the disposal is recorded.

(True/False)

4.8/5  (37)

(37)

Use the following information to answer questions

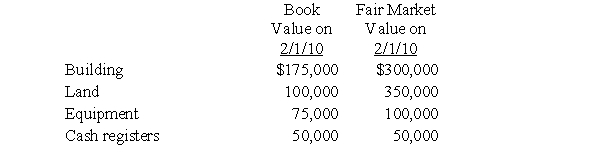

The following information is from Sargent's 2009 and 2010 financial statements.  -What is the average asset age of Sargent's assets in 2010?

-What is the average asset age of Sargent's assets in 2010?

(Multiple Choice)

4.9/5  (27)

(27)

On January 1, 2010, Green Pharmaceuticals purchased a patent for a new arthritis medication from Winwood Research Labs for $1,000,000. The patent has a remaining legal life of 10 years and an estimated useful life of 5 years. What adjusting journal entry should Green prepare on December 31, 2010 relative to this patent?

(Multiple Choice)

4.9/5  (32)

(32)

Depreciable cost is used to calculate annual depreciation expense using the double-declining-balance method.

(True/False)

4.8/5  (39)

(39)

Use the following information to answer questions

On February 1, 2010, Consolidated Department Stores purchased the assets of Jackson Department Store for $750,000. Following are the book and fair market values of those assets at the time of acquisition:

-Consolidated should recognize the cost of the equipment as

-Consolidated should recognize the cost of the equipment as

(Multiple Choice)

4.9/5  (41)

(41)

Loli Ice Cream Services purchased an ice-cream machine on January 1, 2005, for $44,000. At the time of purchase, the machine was estimated to have a useful life of 10 years and a salvage value of $2,000. The company records depreciation on a straight-line basis. On April 1, 2010, the machine was sold for $20,000. What gain or loss should be recognized from the sale of the machine?

(Multiple Choice)

4.8/5  (32)

(32)

On January 1, 2007, Holloway Enterprises purchased an air compressor for $50,000. The compressor has an estimated salvage value of $5,000 and an estimated useful life of 5 years. Holloway uses the straight-line method to depreciate its assets.

Required:

1. Assume that Holloway sells the air compressor for $30,000 cash on March 31, 2010. Prepare all journal entries related to this asset's disposition.

2. Assume that Holloway sells the air compressor for $10,000 cash on March 31, 2010. Prepare all journal entries related to this asset's disposition.

(Essay)

4.9/5  (38)

(38)

Average asset age is not affected by the use of different depreciation methods.

(True/False)

4.9/5  (39)

(39)

Showing 1 - 20 of 93

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)