Exam 2: Introduction to Financial Statement Analysis

Exam 1: Corporate Finance and the Financial Manager91 Questions

Exam 2: Introduction to Financial Statement Analysis122 Questions

Exam 3: The Valuation Principle: the Foundation of Financial Decision Making120 Questions

Exam 4: The Time Value of Money101 Questions

Exam 5: Interest Rates118 Questions

Exam 6: Bonds122 Questions

Exam 7: Valuing Stocks122 Questions

Exam 8: Investment Decision Rules137 Questions

Exam 9: Fundamentals of Capital Budgeting107 Questions

Exam 10: Risk and Return in Capital Markets101 Questions

Exam 11: Systematic Risk and the Equity Risk Premium102 Questions

Exam 12: Determining the Cost of Capital106 Questions

Exam 13: Risk and the Pricing of Options112 Questions

Exam 14: Raising Equity Capital104 Questions

Exam 15: Debt Financing109 Questions

Exam 16: Capital Structure113 Questions

Exam 17: Payout Policy101 Questions

Exam 18: Financial Modelling and Pro Forma Analysis124 Questions

Exam 19: Working Capital Management122 Questions

Exam 20: Short Term Financial Planning105 Questions

Exam 21: Risk Management108 Questions

Exam 22: International Corporate Finance108 Questions

Exam 23: Leasing86 Questions

Exam 24: Mergers and Acquisitions81 Questions

Exam 25: Corporate Governance52 Questions

Select questions type

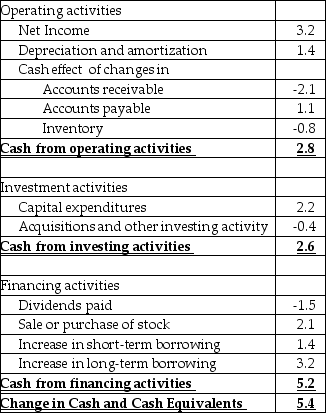

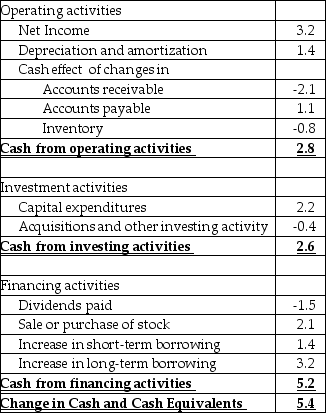

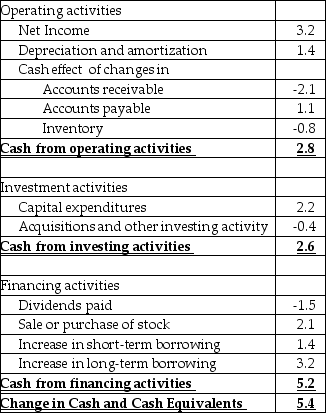

Use the table for the question(s) below.

AOS Industries Statement of Cash Flows for 2015

-Consider the above statement of cash flows.Which of the following is true of AOS Industries' operating cash flows?

-Consider the above statement of cash flows.Which of the following is true of AOS Industries' operating cash flows?

(Multiple Choice)

4.8/5  (34)

(34)

Solid State Software has retained earnings of $42 million,after paying dividends of $10 million.What was the firm's payout ratio?

(Multiple Choice)

4.9/5  (28)

(28)

A firm has EBIT of $24 million and has a corporate tax rate of 25%.The firm has total debt of $40 million,and excess cash of $8 million.If the firm's book value of equity is $72 million,what is the firm's return on invested capital (ROIC)?

(Multiple Choice)

4.8/5  (41)

(41)

Use the table for the question(s) below.

Income Statement for CharmCorp:

-Consider the above Income Statement for CharmCorp.All values are in millions of dollars.If CharmCorp has 6 million shares outstanding,and its managers and employees have stock options for 1 million shares,what is its diluted EPS in 2015?

-Consider the above Income Statement for CharmCorp.All values are in millions of dollars.If CharmCorp has 6 million shares outstanding,and its managers and employees have stock options for 1 million shares,what is its diluted EPS in 2015?

(Multiple Choice)

4.8/5  (38)

(38)

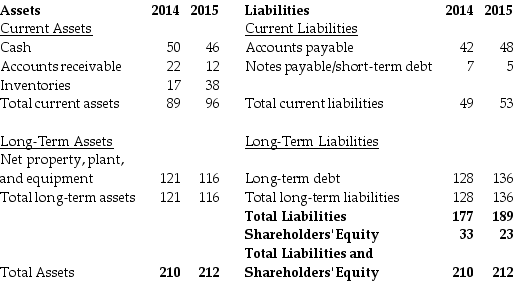

Use the table for the question(s) below.

Statement of Financial Position

-If the above statement of financial position is for a retail company,what indications about this company would best be drawn from the changes in leverage between 2014 and 2015?

-If the above statement of financial position is for a retail company,what indications about this company would best be drawn from the changes in leverage between 2014 and 2015?

(Multiple Choice)

4.8/5  (31)

(31)

Use the table for the question(s) below.

-Refer to the statement of financial position above.If in 2015 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then what is Luther's enterprise value?

-Refer to the statement of financial position above.If in 2015 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then what is Luther's enterprise value?

(Multiple Choice)

4.8/5  (46)

(46)

Use the table for the question(s) below.

AOS Industries Statement of Cash Flows for 2015

-Consider the above statement of cash flows.If all amounts shown above are in millions of dollars,what was AOS Industries' change in retained earnings for 2015?

-Consider the above statement of cash flows.If all amounts shown above are in millions of dollars,what was AOS Industries' change in retained earnings for 2015?

(Multiple Choice)

4.8/5  (33)

(33)

A small company has current assets of $112,000 and current liabilities of $117,000.Which of the following statements about that company is most likely to be true?

(Multiple Choice)

4.9/5  (32)

(32)

Use the table for the question(s) below.

AOS Industries Statement of Cash Flows for 2015

-Consider the above statement of cash flows.In 2015,AOS Industries had contemplated buying a new warehouse for $2 million,the cost of which would be depreciated over 10 years.If AOS Industries has a tax rate of 25%,what would be the impact on the amount of cash held by AOS at the the end of the 2015?

-Consider the above statement of cash flows.In 2015,AOS Industries had contemplated buying a new warehouse for $2 million,the cost of which would be depreciated over 10 years.If AOS Industries has a tax rate of 25%,what would be the impact on the amount of cash held by AOS at the the end of the 2015?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following statement of financial position equations is correct?

(Multiple Choice)

4.9/5  (32)

(32)

A firm's net profit margin increased from 8.1% to 8.3% from 2014 to 2015.If net income increased from $4.5 million to $5.6 million,what was the change in the firm's sales?

(Multiple Choice)

4.9/5  (32)

(32)

Company A has current assets of $42 billion and current liabilities of $31 billion.Company B has current assets of $2.7 billion and current liabilities of $1.8 billion.Which of the following statements is correct,based on this information?

(Multiple Choice)

4.8/5  (33)

(33)

How does a firm select the dates for preparation of its income statement?

(Essay)

4.9/5  (29)

(29)

A firm's current assets increase from 1.4 million in 2014 to 1.7 million in 2015.If the firm's current liabilities are unchanged at $1.1 million,and inventory remains unchanged,what is the change in the firm's quick ratio?

(Multiple Choice)

4.8/5  (34)

(34)

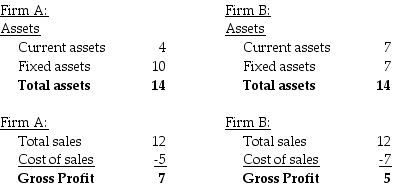

Above are portions of the balance sheet and income statement for two companies in 2015.Based upon this information,which of the following statements is most likely to be true?

Above are portions of the balance sheet and income statement for two companies in 2015.Based upon this information,which of the following statements is most likely to be true?

(Multiple Choice)

4.7/5  (37)

(37)

A firm has $10 million in cash,$4.5 million in accounts receivable,and inventory of $8 million.The firm's accounts payable is $6.2 million and the firm has no short-term debt.What is the firm's current ratio?

(Multiple Choice)

4.8/5  (34)

(34)

The income statement reports the firm's revenues and expenses,and it computes the firm's bottom line of net income,or earnings.

(True/False)

4.7/5  (27)

(27)

What will be the effect on the income statement if a firm buys a new processing plant through a new loan?

(Essay)

4.9/5  (31)

(31)

A firm has $6 million in cash,$1.5 million in accounts receivable,and inventory of $4.2 million.The firm's accounts payable is $7.4 million and the firm has no short-term debt.What is the firm's quick ratio?

(Multiple Choice)

4.8/5  (47)

(47)

Showing 41 - 60 of 122

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)