Exam 7: Valuing Stocks

Exam 1: Corporate Finance and the Financial Manager91 Questions

Exam 2: Introduction to Financial Statement Analysis122 Questions

Exam 3: The Valuation Principle: the Foundation of Financial Decision Making120 Questions

Exam 4: The Time Value of Money101 Questions

Exam 5: Interest Rates118 Questions

Exam 6: Bonds122 Questions

Exam 7: Valuing Stocks122 Questions

Exam 8: Investment Decision Rules137 Questions

Exam 9: Fundamentals of Capital Budgeting107 Questions

Exam 10: Risk and Return in Capital Markets101 Questions

Exam 11: Systematic Risk and the Equity Risk Premium102 Questions

Exam 12: Determining the Cost of Capital106 Questions

Exam 13: Risk and the Pricing of Options112 Questions

Exam 14: Raising Equity Capital104 Questions

Exam 15: Debt Financing109 Questions

Exam 16: Capital Structure113 Questions

Exam 17: Payout Policy101 Questions

Exam 18: Financial Modelling and Pro Forma Analysis124 Questions

Exam 19: Working Capital Management122 Questions

Exam 20: Short Term Financial Planning105 Questions

Exam 21: Risk Management108 Questions

Exam 22: International Corporate Finance108 Questions

Exam 23: Leasing86 Questions

Exam 24: Mergers and Acquisitions81 Questions

Exam 25: Corporate Governance52 Questions

Select questions type

Aaron Inc.has 316 million shares outstanding.It expects earnings at the end of the year to be $602 million.The firm's equity cost of capital is 11.5%.Aaron pays out 50% of its earnings in total: 30% paid out as dividends and 20% used to repurchase shares.If Aaron's earnings are expected to grow at a constant 6% per year,what is Aaron's share price?

(Multiple Choice)

4.8/5  (37)

(37)

Avril Synchronistics will pay a dividend of $1.30 per share this year.It is expected that this dividend will grow by 5% each year in the future.What will be the current value of a single share of Avril's stock if the firm's equity cost of capital is 14%?

(Multiple Choice)

4.9/5  (45)

(45)

Individual investors' tendency to trade too much based on the mistaken belief that they can pick winners and losers better than investment professionals is known as

(Multiple Choice)

4.9/5  (42)

(42)

Danforth Corp has a current stock price of $117.15 and is expected to pay a dividend of $4.50 in one year.If Danforth's equity cost of capital is 10%,what price would Danforth's stock be expected to sell for immediately after it pays the dividend?

(Multiple Choice)

4.9/5  (37)

(37)

If a firm has leverage,it is best to use the total payout model to determine the firm's value.

(True/False)

4.7/5  (39)

(39)

The ownership in a corporation is divided into shares of stock,which carry rights to share in the profits of the firm through future dividend payments.

(True/False)

4.9/5  (33)

(33)

Advanced Chemical Industries is awaiting the verdict from a court case over whether it is liable for the clean-up of wastes on a disused factory site.If it is liable,this will result in a reduction of its free cash flow by $12 million per year for ten years.If it is not liable,there will be no effect.On the close of trading the day before the announcement of the verdict,Advanced Chemicals was trading at $20 per share.Most investors calculate that there is a 100% chance that Advanced Chemicals will have a verdict returned against them.One investor,Jo,has performed extensive research into the outcome of the trial and estimates that there is no chance Advanced Chemicals will have a verdict returned against them.Given that Advanced Chemicals has 60 million shares outstanding and an equity cost of capital of 8% with no debt,Jo's estimate of the value of a share of Advanced Chemicals would be how much more than the market price?

(Multiple Choice)

4.7/5  (46)

(46)

Carbondale Oil announces that a wildcat well that it has sunk in a new oil province has shown the existence of substantial oil reserves.The exploitation of these reserves is expected to increase Carbondale's free cash flow by $100 million per year for eight years.If investors had not been expecting this news,what is the most likely effect on Carbondale's stock price upon the announcement,given that Carbondale has 80 million shares outstanding,no debt,and an equity cost of capital of 10%?

(Multiple Choice)

4.8/5  (40)

(40)

Use the information for the question(s) below.

Gonzales Corporation generated free cash flow of $88 million this year. For the next two years, the company's free cash flow is expected to grow at a rate of 8%. After that time, the company's free cash flow is expected to level off to the industry long-term growth rate of 4% per year. Suppose the weighted average cost of capital is 10% and Gonzales Corporation has cash of $100 million, debt of $300 million, and 100 million shares outstanding.

-What is Gonzales Corporation's expected current share price?

(Multiple Choice)

4.7/5  (42)

(42)

If you want to value a firm that has consistent earnings growth,but varies how it pays out these earnings to shareholders between dividends and repurchases,the simplest model for you to use is the

(Multiple Choice)

4.8/5  (30)

(30)

Suppose CP Rail has a current share price of $194.83 and an EPS of 9.01.Its competitor,CN Rail,has an EPS of 4.27.Using the method of comparables,what is the expected price of CN Rail stock?

(Multiple Choice)

4.8/5  (41)

(41)

Tarmac Airlines has 115 million shares outstanding and expects earnings at the end of this year of $370 million.Tarmac plans to pay out 40% of its earnings as a dividend and 20% of its earnings through share repurchases.The firm has an equity cost of capital of 8%.If Tarmac' earnings are expected to grow by 3% per year and these payout rates remain constant,what is Tarmac's share price?

(Multiple Choice)

4.9/5  (46)

(46)

What is a major assumption about growth rate in the dividend-discount model?

(Essay)

4.8/5  (47)

(47)

Bondi Company is expected to pay a quarterly dividend of $0.45 for the next five years.If the current price of Bondi stock is $17.62,and Bondi's equity cost of capital is 12% per year,what price would you expect Bondi's stock to sell for at the end of the five years?

(Multiple Choice)

4.8/5  (29)

(29)

JRN Enterprises just announced that it plans to cut its dividend from $2.50 to $1.50 per share and use the extra funds to expand its operations.Prior to this announcement,JRN's dividends were expected to grow at 4% per year and JRN's stock was trading at $25.00 per share.With the new expansion,JRN's dividends are expected to grow at 8% per year indefinitely.Assuming that JRN's risk is unchanged by the expansion,the value of a share of JRN after the announcement is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

A stock is bought for $22.00 and sold for $26.00 one year later,immediately after it has paid a dividend of $1.50.What is the capital gain rate for this transaction?

(Multiple Choice)

4.9/5  (42)

(42)

Von Bora Corporation (VBC)is expected to pay a $2.00 dividend at the end of this year.If you expect VBC's dividend to grow by 5% per year forever and VBC's equity cost of capital is 13%,then the value of a share of VBS stock is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

Garville Corporation has a current stock price of $7.43 and is expected to sell for $8.14 in one year's time,immediately after it pays a dividend of $0.35.Which of the following is closest to Garville's equity cost of capital?

(Multiple Choice)

4.8/5  (39)

(39)

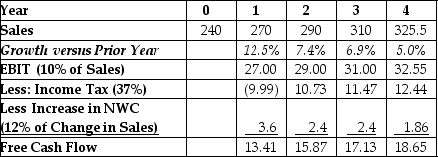

Use the table for the question(s) below.

-Banco Industries expects sales to grow at a rapid rate over the next three years,but settle to an industry growth rate of 5% in year 4.The spreadsheet above shows a simplified pro forma for Banco Industries.If Banco Industries has a weighted average cost of capital of 12%,$50 million in cash,$60 million in debt,and 18 million shares outstanding,which of the following is the best estimate of Banco's stock price at the start of year 1?

-Banco Industries expects sales to grow at a rapid rate over the next three years,but settle to an industry growth rate of 5% in year 4.The spreadsheet above shows a simplified pro forma for Banco Industries.If Banco Industries has a weighted average cost of capital of 12%,$50 million in cash,$60 million in debt,and 18 million shares outstanding,which of the following is the best estimate of Banco's stock price at the start of year 1?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 61 - 80 of 122

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)