Exam 18: Public Choice, Taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models240 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System258 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply242 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes208 Questions

Exam 5: Externalities, Environmental Policy, and Public Goods262 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply293 Questions

Exam 7: The Economics of Health Care171 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance261 Questions

Exam 9: Comparative Advantage and the Gains From International Trade188 Questions

Exam 10: Consumer Choice and Behavioral Economics304 Questions

Exam 11: Technology, Production, and Costs327 Questions

Exam 12: Firms in Perfectly Competitive Markets297 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a272 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets257 Questions

Exam 15: Monopoly and Antitrust Policy279 Questions

Exam 16: Pricing Strategy258 Questions

Exam 17: The Markets for Labor and Other Factors of Production279 Questions

Exam 18: Public Choice, Taxes, and the Distribution of Income258 Questions

Select questions type

A tax is efficient if it imposes a small excess burden relative to the tax revenue it raises.

(True/False)

4.9/5  (40)

(40)

For a given supply curve, how does the elasticity of demand affect the excess burden of a tax imposed on a product?

(Multiple Choice)

4.9/5  (37)

(37)

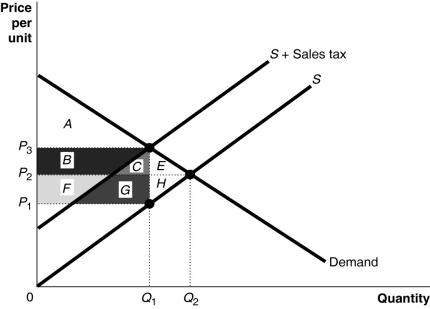

Figure 18-1

-Refer to Figure 18-1.Of the tax revenue collected by the government, the portion borne by consumers is represented by the area

-Refer to Figure 18-1.Of the tax revenue collected by the government, the portion borne by consumers is represented by the area

(Multiple Choice)

4.9/5  (46)

(46)

A common belief among political analysts is that someone running for his or her party's nomination for president of the United States must choose a different strategy once the nomination is secured.To be nominated, the candidate must appeal to voters from one party-Democrat or Republican-but in a general election a party's nominee must appeal to voters from both parties as well as independent voters.Which of the following offers the best explanation for this change in strategy?

(Multiple Choice)

4.8/5  (27)

(27)

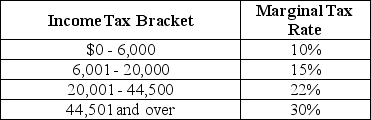

Table 18-9

Table 18-9 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

-Refer to Table 18-9.How much income tax does Sylvia pay if she is a single taxpayer with an income of $70,000?

Table 18-9 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

-Refer to Table 18-9.How much income tax does Sylvia pay if she is a single taxpayer with an income of $70,000?

(Multiple Choice)

4.8/5  (35)

(35)

The voting paradox suggests that the "voting market," as represented by elections

(Multiple Choice)

4.8/5  (24)

(24)

If you pay $2,000 in taxes on an income of $20,000, and a tax of $3,500 on an income of $30,000, then over this range of income the tax is

(Multiple Choice)

4.7/5  (34)

(34)

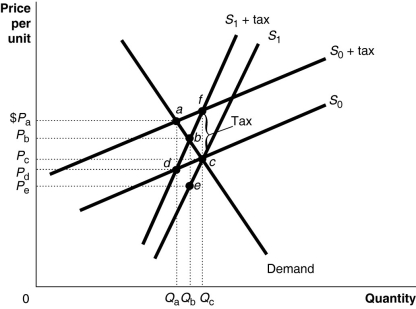

Figure 18-2

Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold, the government's revenue from the tax is represented by the area

Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold, the government's revenue from the tax is represented by the area

(Multiple Choice)

4.9/5  (36)

(36)

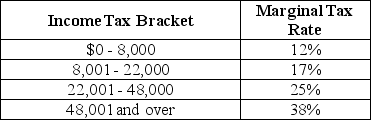

Table 18-6

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6.How much income tax does Sasha pay if he is a single taxpayer with an income of $60,000?

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6.How much income tax does Sasha pay if he is a single taxpayer with an income of $60,000?

(Multiple Choice)

4.9/5  (37)

(37)

Economists caution that conventional statistics used to estimate the extent of poverty in the United States fail to account for benefits people receive that, if considered, would reduce the amount of poverty.Which of the following is an example of these benefits?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following is not an example of rent-seeking behavior?

(Multiple Choice)

4.7/5  (35)

(35)

Many economists believe that when the federal government establishes an agency to regulate a particular industry, the regulated firms try to influence the agency even if these actions do not benefit the public.Economists refer to this result of government regulation by which of the following terms?

(Multiple Choice)

4.9/5  (27)

(27)

Which of the following is a consequence of the voting paradox?

(Multiple Choice)

4.9/5  (43)

(43)

Figure 18-5

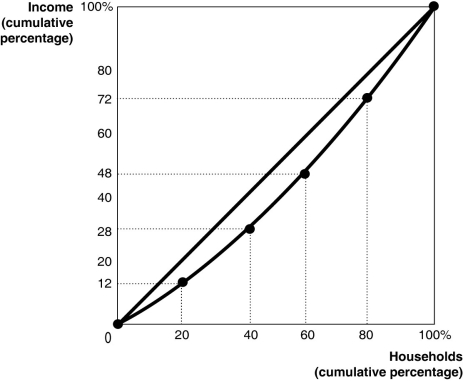

Figure 18-5 shows the Lorenz curve for a hypothetical country.

-Refer to Figure 18-5.The highest 20 percent of households

Figure 18-5 shows the Lorenz curve for a hypothetical country.

-Refer to Figure 18-5.The highest 20 percent of households

(Multiple Choice)

4.7/5  (44)

(44)

Congressman Gallstone seeks support from his colleagues for a bill he sponsors that will establish a new national park in his district.He offers to support Congresswoman Disrail's proposal to build a new library in her district in exchange for her vote for his national park bill.This is an example of

(Multiple Choice)

4.7/5  (45)

(45)

The federal government does not tax employees on on the amount that employers spend providing them with health insurance.When comparing employees who receive employee-provided health insurance and consumers who must pay for their own health insurance, the non-taxed amount spent on employer-provided health insurance is an example of

(Multiple Choice)

4.7/5  (37)

(37)

Horizontal equity is achieved when taxes are collected from those who benefit from the government expenditure of the tax revenue.

(True/False)

4.8/5  (40)

(40)

Showing 121 - 140 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)