Exam 10: Capital-Budgeting Techniques and Practice

Exam 1: An Introduction to the Foundations of Financial Management144 Questions

Exam 2: The Financial Markets and Interest Rates160 Questions

Exam 3: Understanding Financial Statements and Cash Flows127 Questions

Exam 4: Evaluating a Firms Financial Performance151 Questions

Exam 5: The Time Value of Money164 Questions

Exam 6: The Meaning and Measurement of Risk and Return151 Questions

Exam 7: The Valuation and Characteristics of Bonds151 Questions

Exam 8: The Valuation and Characteristics of Stock130 Questions

Exam 9: The Cost of Capital134 Questions

Exam 10: Capital-Budgeting Techniques and Practice158 Questions

Exam 11: Cash Flows and Other Topics in Capital Budgeting160 Questions

Exam 12: Determining the Financing Mix156 Questions

Exam 13: Dividend Policy and Internal Financing171 Questions

Exam 14: Short-Term Financial Planning144 Questions

Exam 15: Working-Capital Management168 Questions

Exam 16: International Business Finance114 Questions

Exam 17: Cash,receivables,and Inventory Management187 Questions

Select questions type

All of the following are criticisms of the payback period criterion EXCEPT

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

C

The capital budgeting manager for XYZ Corporation,a very profitable high technology company,completed her analysis of Project A assuming 5-year depreciation.Her accountant reviews the analysis and changes the depreciation method to 3-year depreciation.This change will

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

A

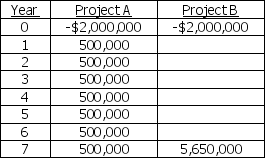

Company K is considering two mutually exclusive projects.The cash flows of the projects are as follows:

a.Compute the NPV and IRR for the above two projects,assuming a 13% required rate of return.

b.Discuss the ranking conflict.

c.What decision should be made regarding these two projects?

a.Compute the NPV and IRR for the above two projects,assuming a 13% required rate of return.

b.Discuss the ranking conflict.

c.What decision should be made regarding these two projects?

Free

(Essay)

4.9/5  (40)

(40)

Correct Answer:

a.NPV of A = $211,305 NPV of B = $401,592.64

IRR of A = 16.33% IRR of B = 15.99%

b. The later cash flow of B causes its lower IRR even though it has the higher NPV.

c.B should be accepted because it is the mutually exclusive project with the highest positive NPV.

DYI Construction Co.is considering a new inventory system that will cost $750,000.The system is expected to generate positive cash flows over the next four years in the amounts of $350,000 in year one,$325,000 in year two,$150,000 in year three,and $180,000 in year four.DYI's required rate of return is 8%.What is the modified internal rate of return of this project?

(Multiple Choice)

4.9/5  (38)

(38)

A project with a payback period of four years is acceptable as long as the company's target payback period is greater than or equal to four years.

(True/False)

4.8/5  (34)

(34)

Raindrip Corp.can purchase a new machine for $1,875,000 that will provide an annual net cash flow of $650,000 per year for five years.The machine will be sold for $120,000 after taxes at the end of year five.What is the net present value of the machine if the required rate of return is 13.5%.

(Multiple Choice)

4.8/5  (35)

(35)

Many financial managers believe the payback period is of limited usefulness because it ignores the time value of money; hence,it is referred to as the discounted payback period.

(True/False)

4.9/5  (37)

(37)

The discounted payback period takes the time value of money into account in that it uses discounted free cash flows rather than actual undiscounted free cash flows in calculating the payback period.

(True/False)

4.8/5  (38)

(38)

Capital rationing generally leads to higher stock prices as management is doing the best job it can in selecting only the best capital budgeting projects.

(True/False)

4.8/5  (38)

(38)

The modified internal rate of return represents the project's internal rate of return assuming that intermediate cash flows from the project can be reinvested at the project's required return.

(True/False)

4.8/5  (32)

(32)

We compute the profitability index of a capital budgeting proposal by

(Multiple Choice)

4.9/5  (41)

(41)

A project's IRR is analogous to the concept of the yield to maturity for bonds.

(True/False)

4.8/5  (36)

(36)

The required rate of return reflects the costs of funds needed to finance a project.

(True/False)

4.9/5  (34)

(34)

Lithium,Inc.is considering two mutually exclusive projects,A and B.Project A costs $95,000 and is expected to generate $65,000 in year one and $75,000 in year two.Project B costs $120,000 and is expected to generate $64,000 in year one,$67,000 in year two,$56,000 in year three,and $45,000 in year four.Lithium,Inc.'s required rate of return for these projects is 10%.The modified internal rate of return for Project B is

(Multiple Choice)

4.9/5  (37)

(37)

Any project deemed acceptable using the discounted payback period will also be acceptable if using the traditional payback period.

(True/False)

4.7/5  (37)

(37)

The capital budgeting decision-making process involves measuring the incremental cash flows of an investment proposal and evaluating the attractiveness of these cash flows relative to the project's cost.

(True/False)

4.8/5  (28)

(28)

Lithium,Inc.is considering two mutually exclusive projects,A and B.Project A costs $95,000 and is expected to generate $65,000 in year one and $75,000 in year two.Project B costs $120,000 and is expected to generate $64,000 in year one,$67,000 in year two,$56,000 in year three,and $45,000 in year four.Lithium,Inc.'s required rate of return for these projects is 10%.The profitability index for Project B is

(Multiple Choice)

4.8/5  (37)

(37)

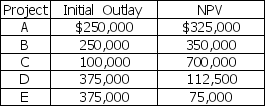

I301 Motors has several investment projects under consideration,all with positive net present values.However,due to a shortage of trained personnel,a limit of $1,250,000 has been placed on the capital budget for this year.Which of the projects listed below should be included in this year's capital budget? Explain your answer.

(Essay)

4.9/5  (46)

(46)

Showing 1 - 20 of 158

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)