Exam 10: Capital-Budgeting Techniques and Practice

Exam 1: An Introduction to the Foundations of Financial Management144 Questions

Exam 2: The Financial Markets and Interest Rates160 Questions

Exam 3: Understanding Financial Statements and Cash Flows127 Questions

Exam 4: Evaluating a Firms Financial Performance151 Questions

Exam 5: The Time Value of Money164 Questions

Exam 6: The Meaning and Measurement of Risk and Return151 Questions

Exam 7: The Valuation and Characteristics of Bonds151 Questions

Exam 8: The Valuation and Characteristics of Stock130 Questions

Exam 9: The Cost of Capital134 Questions

Exam 10: Capital-Budgeting Techniques and Practice158 Questions

Exam 11: Cash Flows and Other Topics in Capital Budgeting160 Questions

Exam 12: Determining the Financing Mix156 Questions

Exam 13: Dividend Policy and Internal Financing171 Questions

Exam 14: Short-Term Financial Planning144 Questions

Exam 15: Working-Capital Management168 Questions

Exam 16: International Business Finance114 Questions

Exam 17: Cash,receivables,and Inventory Management187 Questions

Select questions type

Lithium,Inc.is considering two mutually exclusive projects,A and B.Project A costs $95,000 and is expected to generate $65,000 in year one and $75,000 in year two.Project B costs $120,000 and is expected to generate $64,000 in year one,$67,000 in year two,$56,000 in year three,and $45,000 in year four.Lithium,Inc.'s required rate of return for these projects is 10%.The profitability index for Project A is

(Multiple Choice)

4.8/5  (43)

(43)

Advantages of the payback period include that it is easy to calculate,easy to understand,and that it is based on cash flows rather than on accounting profits.

(True/False)

5.0/5  (25)

(25)

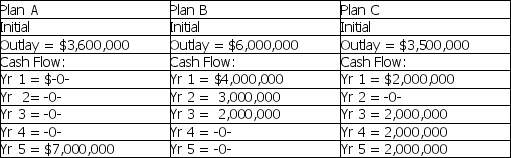

Interstate Appliance Inc.is considering the following 3 mutually exclusive projects.Projected cash flows for these ventures are as follows:

If Interstate Appliance has a 12% cost of capital,what decision should be made regarding the projects above?

If Interstate Appliance has a 12% cost of capital,what decision should be made regarding the projects above?

(Multiple Choice)

4.9/5  (37)

(37)

A significant disadvantage of the internal rate of return is that it

(Multiple Choice)

4.8/5  (42)

(42)

If the net present value of a project is zero,then the profitability index will equal one.

(True/False)

4.9/5  (32)

(32)

Which of the following statements about the internal rate of return (IRR)is true?

(Multiple Choice)

4.8/5  (35)

(35)

The internal rate of return is the discount rate that equates the present value of the project's future free cash flows with the project's initial outlay.

(True/False)

4.7/5  (43)

(43)

Because the NPV and PI methods both yield the same accept/reject decision,a company attempting to rank capital budgeting projects for funding consideration can use either method and get the same results.

(True/False)

4.8/5  (36)

(36)

DYI Construction Co.is considering a new inventory system that will cost $750,000.The system is expected to generate positive cash flows over the next four years in the amounts of $350,000 in year one,$325,000 in year two,$150,000 in year three,and $180,000 in year four.DYI's required rate of return is 8%.What is the payback period of this project?

(Multiple Choice)

4.8/5  (36)

(36)

What is the internal rate of return's assumption about how cash flows are reinvested?

(Multiple Choice)

4.9/5  (33)

(33)

For a project with multiple sign reversals in its cash flows,the net present value can be the same for two entirely different discount rates.

(True/False)

4.8/5  (33)

(33)

Lithium,Inc.is considering two mutually exclusive projects,A and B.Project A costs $95,000 and is expected to generate $65,000 in year one and $75,000 in year two.Project B costs $120,000 and is expected to generate $64,000 in year one,$67,000 in year two,$56,000 in year three,and $45,000 in year four.Lithium,Inc.'s required rate of return for these projects is 10%.The internal rate of return for Project B is

(Multiple Choice)

4.8/5  (36)

(36)

The Net Present Value (or NPV)criteria for capital budgeting decisions assumes that expected future cash flows are reinvested at ________,and the Internal Rate of Return (or IRR)criteria assumes that expected future cash flows are reinvested at ________.

(Multiple Choice)

4.7/5  (34)

(34)

Arguments against using the net present value and internal rate of return methods include that

(Multiple Choice)

4.8/5  (45)

(45)

A project that requires an initial investment of $340,000 is expected to have an after-tax cash flow of $70,000 per year for the first two years,$90,000 per year for the next two years,and $150,000 for the fifth year? Assume the required return for this project is 10%.

a.What is the NPV of the project%?

b.What is the IRR of the project?

c.What is the MIRR of the project?

d.What is the PI of the project?

e.What decision would you make regarding this project if the required rate of return is 10%?

f.What is the equivalent annual annuity using a 10% required rate of return?

(Essay)

4.9/5  (37)

(37)

A project requires an initial investment of $389,600.The project generates free cash flow of $540,000 at the end of year 4.What is the internal rate of return for the project?

(Multiple Choice)

4.8/5  (34)

(34)

NPV is the most theoretically correct capital budgeting decision tool examined in the text.

(True/False)

4.9/5  (41)

(41)

Showing 61 - 80 of 158

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)