Exam 10: Capital-Budgeting Techniques and Practice

Exam 1: An Introduction to the Foundations of Financial Management144 Questions

Exam 2: The Financial Markets and Interest Rates160 Questions

Exam 3: Understanding Financial Statements and Cash Flows127 Questions

Exam 4: Evaluating a Firms Financial Performance151 Questions

Exam 5: The Time Value of Money164 Questions

Exam 6: The Meaning and Measurement of Risk and Return151 Questions

Exam 7: The Valuation and Characteristics of Bonds151 Questions

Exam 8: The Valuation and Characteristics of Stock130 Questions

Exam 9: The Cost of Capital134 Questions

Exam 10: Capital-Budgeting Techniques and Practice158 Questions

Exam 11: Cash Flows and Other Topics in Capital Budgeting160 Questions

Exam 12: Determining the Financing Mix156 Questions

Exam 13: Dividend Policy and Internal Financing171 Questions

Exam 14: Short-Term Financial Planning144 Questions

Exam 15: Working-Capital Management168 Questions

Exam 16: International Business Finance114 Questions

Exam 17: Cash,receivables,and Inventory Management187 Questions

Select questions type

Capital rationing may be imposed because of all of the following EXCEPT

(Multiple Choice)

4.7/5  (31)

(31)

Marketing is crucial to capital budgeting success because the goal of a good capital budgeting project is to maximize the company's sales.

(True/False)

4.9/5  (34)

(34)

A project that is very sensitive to the selection of a discount rate will have a steep net present value profile.

(True/False)

4.8/5  (46)

(46)

The main disadvantage of the NPV method is the need for detailed,long-term forecasts of free cash flows generated by prospective projects.

(True/False)

4.8/5  (38)

(38)

Two projects are mutually exclusive if the accept/reject decision for one project has no impact on the accept/reject decision for the other project.

(True/False)

4.7/5  (34)

(34)

Your firm is considering an investment that will cost $920,000 today.The investment will produce cash flows of $450,000 in year 1,$270,000 in years 2 through 4,and $200,000 in year 5.The discount rate that your firm uses for projects of this type is 11.25%.What is the investment's profitability index?

(Multiple Choice)

4.8/5  (34)

(34)

Under what condition would you NOT accept a project that has a positive net present value?

(Multiple Choice)

4.9/5  (36)

(36)

Many firms today continue to use the payback method but also employ the NPV or IRR methods,especially when large projects are being analyzed.

(True/False)

4.8/5  (42)

(42)

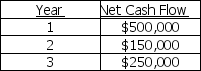

Given the following annual net cash flows,determine the internal rate of return to the nearest whole percent of a project with an initial outlay of $750,000.

(Multiple Choice)

4.8/5  (45)

(45)

Your firm is considering an investment that will cost $920,000 today.The investment will produce cash flows of $450,000 in year 1,$270,000 in years 2 through 4,and $200,000 in year 5.The discount rate that your firm uses for projects of this type is 11.25%.What is the investment's net present value?

(Multiple Choice)

4.8/5  (32)

(32)

Project LMK requires an initial outlay of $500,000 and has a profitability index of 1.4.The project is expected to generate equal annual cash flows over the next ten years.The required return for this project is 16%.What is project LMK's internal rate of return?

(Multiple Choice)

4.8/5  (39)

(39)

If a project's internal rate of return is greater than the project's required return,then the project's profitability index will be greater than one.

(True/False)

4.8/5  (41)

(41)

The mutually exclusive project with the highest positive NPV will also have the highest IRR.

(True/False)

4.9/5  (44)

(44)

Which of the following statements about the net present value is true?

(Multiple Choice)

4.8/5  (40)

(40)

The net present value profile clearly demonstrates that the NPV of a project increases as the discount rate increases.

(True/False)

4.8/5  (41)

(41)

NPV assumes reinvestment of intermediate free cash flows at the cost of capital,while IRR assumes reinvestment of intermediate free cash flows at the IRR.

(True/False)

4.8/5  (40)

(40)

One positive feature of the payback period is it emphasizes the earliest forecasted free cash flows,which are less uncertain than later cash flows and provide for the liquidity needs of the firm.

(True/False)

4.7/5  (34)

(34)

The net present value always provides the correct decision provided that

(Multiple Choice)

4.8/5  (35)

(35)

Showing 81 - 100 of 158

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)