Exam 10: Capital-Budgeting Techniques and Practice

Exam 1: An Introduction to the Foundations of Financial Management144 Questions

Exam 2: The Financial Markets and Interest Rates160 Questions

Exam 3: Understanding Financial Statements and Cash Flows127 Questions

Exam 4: Evaluating a Firms Financial Performance151 Questions

Exam 5: The Time Value of Money164 Questions

Exam 6: The Meaning and Measurement of Risk and Return151 Questions

Exam 7: The Valuation and Characteristics of Bonds151 Questions

Exam 8: The Valuation and Characteristics of Stock130 Questions

Exam 9: The Cost of Capital134 Questions

Exam 10: Capital-Budgeting Techniques and Practice158 Questions

Exam 11: Cash Flows and Other Topics in Capital Budgeting160 Questions

Exam 12: Determining the Financing Mix156 Questions

Exam 13: Dividend Policy and Internal Financing171 Questions

Exam 14: Short-Term Financial Planning144 Questions

Exam 15: Working-Capital Management168 Questions

Exam 16: International Business Finance114 Questions

Exam 17: Cash,receivables,and Inventory Management187 Questions

Select questions type

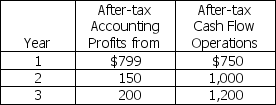

Consider a project with the following information:

Initial outlay = $1,500

Compute the profitability index if the company's discount rate is 10%.

Initial outlay = $1,500

Compute the profitability index if the company's discount rate is 10%.

(Multiple Choice)

4.8/5  (36)

(36)

For the net present value (NPV)criteria,a project is acceptable if NPV is ________,while for the profitability index a project is acceptable if PI is ________.

(Multiple Choice)

4.8/5  (40)

(40)

If a project is acceptable using the NPV criterion,then it will also be acceptable using the discounted payback period since both methods use discounted cash flows to make the accept/reject decision.

(True/False)

4.8/5  (38)

(38)

Lithium,Inc.is considering two mutually exclusive projects,A and B.Project A costs $95,000 and is expected to generate $65,000 in year one and $75,000 in year two.Project B costs $120,000 and is expected to generate $64,000 in year one,$67,000 in year two,$56,000 in year three,and $45,000 in year four.Lithium,Inc.'s required rate of return for these projects is 10%.The net present value for Project B is

(Multiple Choice)

4.8/5  (31)

(31)

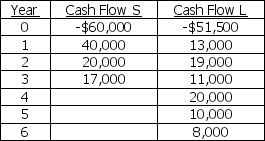

The Dickerson PR Firm is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

(Essay)

4.9/5  (40)

(40)

If a firm imposes a capital constraint on investment projects,the appropriate decision criterion is to select the set of projects that has the highest positive net present value subject to the capital constraint.

(True/False)

4.9/5  (43)

(43)

Project W requires a net investment of $1,000,000 and has a payback period of 5.6 years.You analyze Project W and decide that Year 1 free cash flow is $100,000 too low,and Year 3 free cash flow is $100,000 too high.After making the necessary adjustments,

(Multiple Choice)

4.8/5  (38)

(38)

If two projects are mutually exclusive,then the IRR is more important than the NPV in deciding the project that should be chosen.

(True/False)

4.8/5  (36)

(36)

You are considering investing in a project with the following year-end after-tax cash flows:

Year 1: $57,000

Year 2: $72,000

Year 3: $78,000

If the initial outlay for the project is $185,000,compute the project's internal rate of return.

(Multiple Choice)

4.8/5  (44)

(44)

The most critical aspect in determining the acceptability of a capital budgeting project is the impact the project will have on the company's net income over the projects entire useful life.

(True/False)

5.0/5  (36)

(36)

Your firm is considering investing in one of two mutually exclusive projects.Project A requires an initial outlay of $3,500 with expected future cash flows of $2,000 per year for the next three years.Project B requires an initial outlay of $2,500 with expected future cash flows of $1,500 per year for the next two years.The appropriate discount rate for your firm is 12% and it is not subject to capital rationing.Assuming both projects can be replaced with a similar investment at the end of their respective lives,compute the NPV of the two chain cycle for Project A and three chain cycle for Project B.

(Multiple Choice)

4.8/5  (24)

(24)

The profitability index is the ratio of the present value of the future free cash flows to the initial investment.

(True/False)

4.9/5  (41)

(41)

A significant disadvantage of the payback period is that it

(Multiple Choice)

4.8/5  (37)

(37)

When capital rationing exists,the divisibility of projects is ignored and projects are funded in order of their PI's or IRR's.

(True/False)

4.8/5  (37)

(37)

The net present value of a project will increase as the required rate of return is decreased (assume only one sign reversal).

(True/False)

4.8/5  (48)

(48)

Calculating the modified internal rate of return on an Excel spreadsheet involves the use of the IRR function multiple times,once using the financing rate,and once using the reinvestment rate.

(True/False)

4.8/5  (42)

(42)

D&B Contracting plans to purchase a new backhoe.The one under consideration costs $233,000,and has a useful life of 8 years.After-tax cash flows are expected to be $31,384 in each of the 8 years and nothing thereafter.Calculate the internal rate of return for the grader.

(Essay)

4.7/5  (36)

(36)

Showing 101 - 120 of 158

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)