Exam 5: Activity-Based Costing and Activity-Based Management

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

ABC reveals opportunities to reduce costs on nonvalue added activities.

(True/False)

4.9/5  (29)

(29)

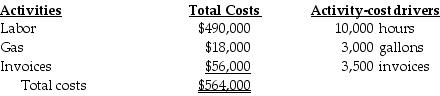

Columbus Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the total cost will be assigned to the Plowing Department?

How much of the total cost will be assigned to the Plowing Department?

(Multiple Choice)

4.9/5  (40)

(40)

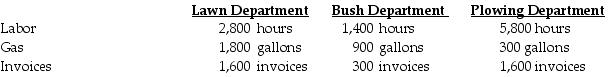

Answer the following questions using the information below:

Eagle Eye Company produces two types of lenses-L7 and L9.

What is the total costs assigned to L9 (b) under single indirect-cost pool system?

What is the total costs assigned to L9 (b) under single indirect-cost pool system?

(Multiple Choice)

4.9/5  (37)

(37)

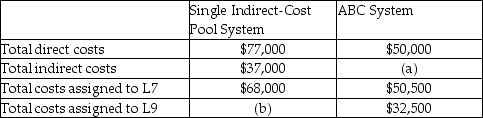

Tiger Pride produces two product lines: T-shirts and Sweatshirts. Product profitability is analyzed as follows:

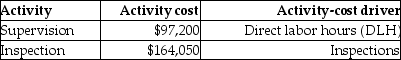

Tiger Pride's managers have decided to revise their current assignment of overhead costs to reflect the following ABC cost information:

Tiger Pride's managers have decided to revise their current assignment of overhead costs to reflect the following ABC cost information:

Under the revised ABC system, the activity-cost driver rate for the supervision activity is ________.

Under the revised ABC system, the activity-cost driver rate for the supervision activity is ________.

(Multiple Choice)

4.8/5  (34)

(34)

When allocating the total indirect cost pool to cost pools such as setup costs including depreciation and maintenance costs of setup equipment, wages of setup employees, and allocation of supervisors is called a second-stage allocation.

(True/False)

4.8/5  (31)

(31)

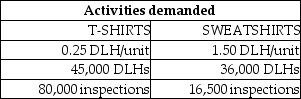

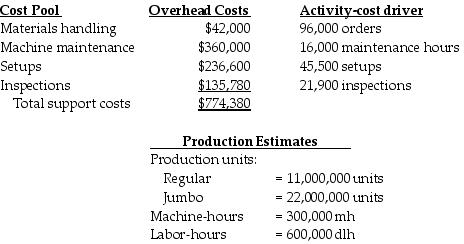

Canton Corp. manufactures two sizes of ceramic paperweights, regular and jumbo. The following information applies to their expectations for the planning period:

Expected direct costs amounts to $942,000 for the period. Support cost requirements of both products are substantially different from one another. Canton uses an ABC costing system.

The setups activity-cost driver rate is ________.

Expected direct costs amounts to $942,000 for the period. Support cost requirements of both products are substantially different from one another. Canton uses an ABC costing system.

The setups activity-cost driver rate is ________.

(Multiple Choice)

4.8/5  (28)

(28)

For a business that offers customers a store where product can be purchased and picked up or a delivery service that can ship the product directly to the customer, which of the following would most likely be the best cost allocation base for distribution costs?

(Multiple Choice)

4.8/5  (44)

(44)

Department costing systems always properly recognize how resources are used by products as they require the creation of multiple indirect cost pools.

(True/False)

4.7/5  (36)

(36)

Recognizing ABC information is not always perfect because ________.

(Multiple Choice)

4.9/5  (43)

(43)

If companies increase market share in a given product line because their reported costs are less than their actual costs, they will become more profitable in the long run.

(True/False)

4.7/5  (38)

(38)

ABC system are likely to provide the most benefits to a company with significant amounts of indirect costs that are allocated using just one or two costs pools and products that make diverse demands on resources.

(True/False)

4.9/5  (29)

(29)

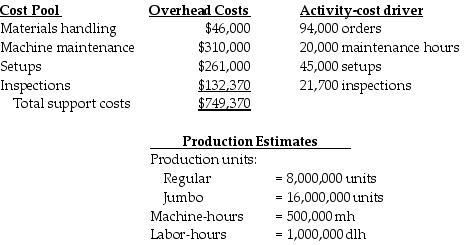

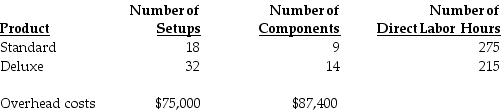

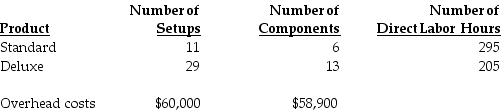

Dartmouth Corporation manufactures two models of office chairs, a standard and a deluxe model. The following activity and cost information has been compiled:

Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of overhead costs assigned to the standard model?

Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of overhead costs assigned to the standard model?

(Multiple Choice)

4.8/5  (35)

(35)

Canton's Corp. manufactures two sizes of ceramic paperweights, regular and jumbo. The following information applies to their expectations for the planning period:

Expected direct costs amounts to $928,000 for the period. Support cost requirements of both products are substantially different from one another. Canton's uses an ABC costing system.

The inspections activity-cost driver rate is ________.

Expected direct costs amounts to $928,000 for the period. Support cost requirements of both products are substantially different from one another. Canton's uses an ABC costing system.

The inspections activity-cost driver rate is ________.

(Multiple Choice)

4.8/5  (37)

(37)

Explain how activity-based costing systems can provide more accurate product costs than traditional cost systems.

(Essay)

4.9/5  (34)

(34)

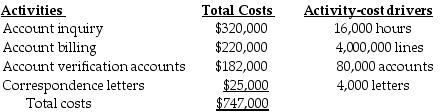

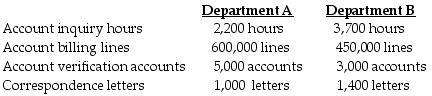

Extreme Manufacturing Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of the account billing cost will be assigned to Department B?

How much of the account billing cost will be assigned to Department B?

(Multiple Choice)

4.8/5  (31)

(31)

The risk of peanut-butter costing rises when broad averages are used across multiple products without managers considering the true amounts of resources consumed in the making of each product.

(True/False)

4.7/5  (38)

(38)

________ is considered while choosing a cost allocation base for activity costs in ABC costing.

(Multiple Choice)

4.9/5  (36)

(36)

Dartmouth Corporation manufactures two models of office chairs, a standard and a deluxe model. The following activity and cost information has been compiled:

Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of overhead costs assigned to the deluxe model?

Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of overhead costs assigned to the deluxe model?

(Multiple Choice)

4.7/5  (39)

(39)

Showing 21 - 40 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)