Exam 5: Activity-Based Costing and Activity-Based Management

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

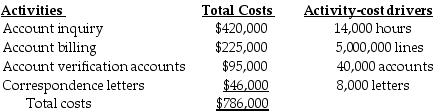

The Chapeau Company is noted for an exceptionally impressive line of one-size fits-all men's hats. Chapeau has established the following selling and distribution support activity-cost pools and their corresponding activity drivers for the year 2018:

Required:

a.Determine the activity-cost-driver rate for each of the four selling and distribution activities.

b.Under what circumstances is it appropriate to use each of the activity-cost drivers?

c.Describe at least one possible negative behavioral consequence for each of the four activity-cost drivers.

Required:

a.Determine the activity-cost-driver rate for each of the four selling and distribution activities.

b.Under what circumstances is it appropriate to use each of the activity-cost drivers?

c.Describe at least one possible negative behavioral consequence for each of the four activity-cost drivers.

(Essay)

5.0/5  (36)

(36)

Brilliant Accents Company manufactures and sells three styles of kitchen faucets: Brass, Chrome, and White. Production takes 25, 25, and 10 machine hours to manufacture 1000-unit batches of brass, chrome and white faucets, respectively. The following additional data apply:

Total overhead costs and activity levels for the year are estimated as follows:

Total overhead costs and activity levels for the year are estimated as follows:

Required:

a.Using the traditional system, determine the operating profit per unit for each style of faucet.

b.Determine the activity-cost-driver rate for setup costs and inspection costs.

c.Using the ABC system, for each style of faucet

1.compute the estimated overhead costs per unit.

2.compute the estimated operating profit per unit.

d.Explain the differences between the profits obtained from the traditional system and the ABC system. Which system provides a better estimate of profitability? Why?

Required:

a.Using the traditional system, determine the operating profit per unit for each style of faucet.

b.Determine the activity-cost-driver rate for setup costs and inspection costs.

c.Using the ABC system, for each style of faucet

1.compute the estimated overhead costs per unit.

2.compute the estimated operating profit per unit.

d.Explain the differences between the profits obtained from the traditional system and the ABC system. Which system provides a better estimate of profitability? Why?

(Essay)

4.9/5  (34)

(34)

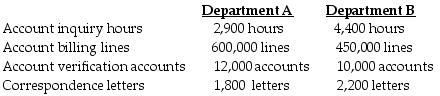

Extreme Manufacturing Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of account verification costs will be assigned to Department A?

How much of account verification costs will be assigned to Department A?

(Multiple Choice)

4.9/5  (32)

(32)

Activity-based costing is most likely to yield benefits for companies ________.

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following is a sign that an ABC system will provide benefits?

(Multiple Choice)

4.9/5  (28)

(28)

North Street Corporation manufactures two models of motorized go-carts, a standard and a deluxe model. The following activity and cost information has been compiled:

Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of overhead cost assigned to the deluxe model?

Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of overhead cost assigned to the deluxe model?

(Multiple Choice)

4.9/5  (34)

(34)

For an ABC system to be useful, it must allocated costs from all "links "of the value chain.

(True/False)

4.8/5  (41)

(41)

Brilliant Accents Company manufactures and sells three styles of kitchen faucets: Brass, Chrome, and White. Production takes 25, 25, and 10 machine hours to manufacture 1,000-unit batches of brass, chrome, and white faucets, respectively. The following additional data apply:

Total overhead costs and activity levels for the year are estimated as follows:

Total overhead costs and activity levels for the year are estimated as follows:

Required:

a.Using the traditional system, determine the operating profit per unit for the brass style of faucet.

b.Determine the activity-cost-driver rate for setup costs and inspection costs.

c.Using the ABC system, for the brass style of faucet:

1.compute the estimated overhead costs per unit.

2.compute the estimated operating profit per unit.

d.Explain the difference between the profits obtained from the traditional system and the ABC system. Which system provides a better estimate of profitability? Why?

Required:

a.Using the traditional system, determine the operating profit per unit for the brass style of faucet.

b.Determine the activity-cost-driver rate for setup costs and inspection costs.

c.Using the ABC system, for the brass style of faucet:

1.compute the estimated overhead costs per unit.

2.compute the estimated operating profit per unit.

d.Explain the difference between the profits obtained from the traditional system and the ABC system. Which system provides a better estimate of profitability? Why?

(Essay)

4.9/5  (39)

(39)

Top management compensation cost is an example of ________ in the cost hierarchy.

(Multiple Choice)

4.8/5  (30)

(30)

Managers consider the accuracy gained by converting from a traditional cost accounting system to the cost of implementation and measurement required by ABC.

(True/False)

4.7/5  (32)

(32)

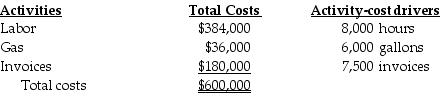

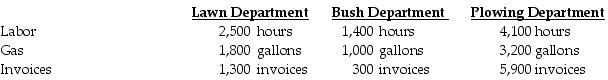

Columbus Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of invoice cost will be assigned to the Bush Department?

How much of invoice cost will be assigned to the Bush Department?

(Multiple Choice)

4.8/5  (40)

(40)

Velshi Printers has contracts to complete weekly supplements required by forty-six customers. For the year 2018, manufacturing overhead cost estimates total $1,760,000 for an annual production capacity of 16 million pages.

For 2018 Velshi Printers has decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

During 2018, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2018, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

Assuming activity-cost pools are used, what are the activity-cost driver rates for design changes, setups, and inspections cost pools?

Assuming activity-cost pools are used, what are the activity-cost driver rates for design changes, setups, and inspections cost pools?

(Multiple Choice)

4.9/5  (29)

(29)

________ are the costs of activities undertaken to support individual products or services regardless of the number of units or batches in which the units are produced.

(Multiple Choice)

4.8/5  (36)

(36)

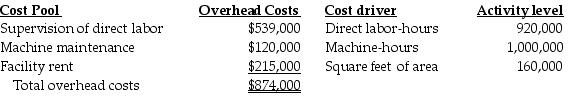

Milan Manufacturing Company has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year:

The accounting records show the Mossman Job consumed the following resources:

The accounting records show the Mossman Job consumed the following resources:

If direct labor-hours are considered the only overhead cost driver, what is the single cost driver rate for Milan?

If direct labor-hours are considered the only overhead cost driver, what is the single cost driver rate for Milan?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 161 - 176 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)