Exam 5: Activity-Based Costing and Activity-Based Management

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

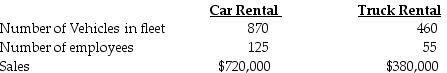

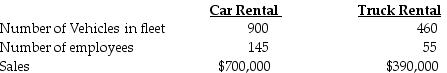

Stark Corporation has two departments, Car Rental and Truck Rental. Central costs may be allocated to the two departments in various ways.

If the facility lease expense of $381,000 is allocated on the basis of vehicles in the fleet, the amount allocated to the Car Rental Department would be ________. (Do not round interim calculations. Round the final answer to the nearest whole dollar.)

If the facility lease expense of $381,000 is allocated on the basis of vehicles in the fleet, the amount allocated to the Car Rental Department would be ________. (Do not round interim calculations. Round the final answer to the nearest whole dollar.)

(Multiple Choice)

4.9/5  (32)

(32)

With traditional costing systems, products manufactured in small batches and in small annual volumes may be ________ because batch-related and product-sustaining costs are assigned using unit-related drivers.

(Multiple Choice)

4.9/5  (27)

(27)

An effective activity-based cost system always ignores facility-sustaining cost drivers.

(True/False)

4.8/5  (35)

(35)

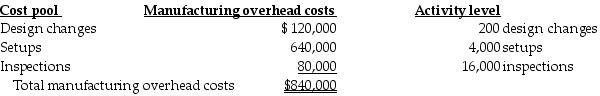

Excellent Printing has contracts to complete weekly supplements required by forty-six customers. For the year 2018, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

For 2018, Excellent Printing decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

During 2018, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2018, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

When costs are assigned using the single cost driver, number of pages printed, then Hospital Systems ________.

When costs are assigned using the single cost driver, number of pages printed, then Hospital Systems ________.

(Multiple Choice)

4.8/5  (40)

(40)

Facility-sustaining costs are the costs of activities ________.

(Multiple Choice)

4.8/5  (40)

(40)

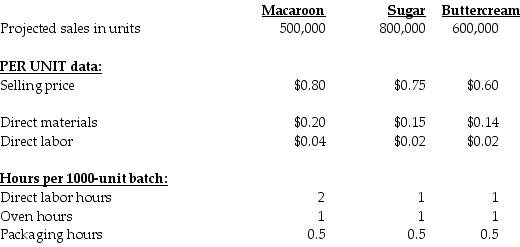

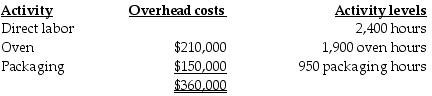

Aunt Ethel's Fancy Cookie Company manufactures and sells three flavors of cookies: Macaroon, Sugar, and Buttercream. The batch size for the cookies is limited to 1,000 cookies based on the size of the ovens and cookie molds owned by the company. Based on budgetary projections, the information listed below is available:

Total overhead costs and activity levels for the year are estimated as follows:

Total overhead costs and activity levels for the year are estimated as follows:

Required:

a.Determine the activity-cost-driver rate for packaging costs.

b.Using the ABC system, for the sugar cookie:

1.compute the estimated overhead costs per thousand cookies.

2.compute the estimated operating profit per thousand cookies.

c.Using a traditional system (with direct labor hours as the overhead allocation base), for the sugar cookie:.

1.compute the estimated overhead costs per thousand cookies.

2.compute the estimated operating profit per thousand cookies.

d.Explain the difference between the profits obtained from the traditional system and the ABC system. Which system provides a better estimate of profitability? Why?

Required:

a.Determine the activity-cost-driver rate for packaging costs.

b.Using the ABC system, for the sugar cookie:

1.compute the estimated overhead costs per thousand cookies.

2.compute the estimated operating profit per thousand cookies.

c.Using a traditional system (with direct labor hours as the overhead allocation base), for the sugar cookie:.

1.compute the estimated overhead costs per thousand cookies.

2.compute the estimated operating profit per thousand cookies.

d.Explain the difference between the profits obtained from the traditional system and the ABC system. Which system provides a better estimate of profitability? Why?

(Essay)

4.8/5  (35)

(35)

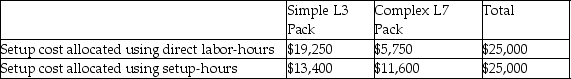

Extracts from cost information of Hebar Corp.:

Assuming that setup-hours is considered a more effective cost drive for allocating setup costs than direct labor-hours. Which of the following statements is true of Hebar's setup costs under traditional costing?

Assuming that setup-hours is considered a more effective cost drive for allocating setup costs than direct labor-hours. Which of the following statements is true of Hebar's setup costs under traditional costing?

(Multiple Choice)

4.9/5  (35)

(35)

What are the four parts of the cost hierarchy. Briefly explain each part, and contrast this cost hierarchy to the fixed-variable dichotomy?

(Essay)

4.8/5  (38)

(38)

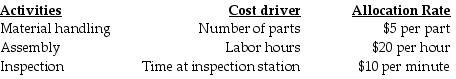

Nichols Inc. manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead. The plant manager is considering switching-over to ABC costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows:

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour.

What are the indirect manufacturing costs per remote control assuming an activity-based-costing method is used and a batch of 10 remote controls are produced? The batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour.

What are the indirect manufacturing costs per remote control assuming an activity-based-costing method is used and a batch of 10 remote controls are produced? The batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

(Multiple Choice)

4.8/5  (28)

(28)

ABC systems and department costing systems use totally different approaches towards indirect cost allocation and can never be used together.

(True/False)

4.9/5  (26)

(26)

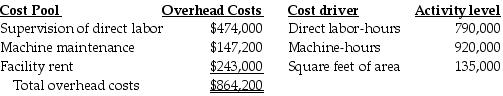

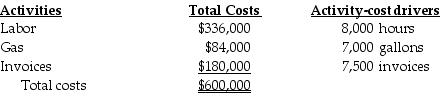

Nile Corp. has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year:

The accounting records show the Mossman Job consumed the following resources:

The accounting records show the Mossman Job consumed the following resources:

If Nile Corp. uses the three activity cost pools to allocate overhead costs, what are the activity-cost driver rates for supervision of direct labor, machine maintenance, and facility rent, respectively?

If Nile Corp. uses the three activity cost pools to allocate overhead costs, what are the activity-cost driver rates for supervision of direct labor, machine maintenance, and facility rent, respectively?

(Multiple Choice)

4.8/5  (37)

(37)

Stark Corporation has two departments, Car Rental and Truck Rental. Central costs may be allocated to the two departments in various ways.

If administrative expense of $77,500 is allocated on the basis of number of employees, the amount allocated to the Car Rental Department would be ________.

If administrative expense of $77,500 is allocated on the basis of number of employees, the amount allocated to the Car Rental Department would be ________.

(Multiple Choice)

4.9/5  (35)

(35)

Answer the following questions using the information below:

Chess Woods Limited produces two products: wooden chess pieces and wooden inlaid chess boards. Under their traditional cost system using one cost driver (direct manufacturing labor hours), the cost of a set of wooden chess pieces is $325.00. An analysis of the activities and their costs revealed that three cost drivers would be used under a new ABC system. These cost drivers would be equipment usage, storage area for the material, and type of woods used. The new cost of a set of chess pieces was determined to be $298.00 per set.

-Given this change in the cost structure ________.

(Multiple Choice)

4.7/5  (38)

(38)

Activity-based costing attempts to identify the most relevant cause-and-effect relationship for each activity pool without restricting the cost driver to only units of output or variables related to units of output.

(True/False)

4.8/5  (39)

(39)

Which of the following is a reason that has accelerated the demand for refinements to the costing system?

(Multiple Choice)

4.8/5  (36)

(36)

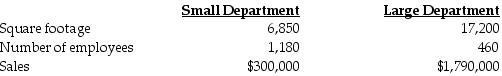

High Traffic Products Corporation has two departments, Small and Large. Central costs could be allocated to the two departments in various ways.

If total rent expense of $144,300 is allocated on the basis of square footage, the amount allocated to the Large Department would be ________. (Do not round interim calculations. Round the final answer to the nearest whole dollar.)

If total rent expense of $144,300 is allocated on the basis of square footage, the amount allocated to the Large Department would be ________. (Do not round interim calculations. Round the final answer to the nearest whole dollar.)

(Multiple Choice)

4.8/5  (35)

(35)

Stark Corporation has two departments, Car Rental and Truck Rental. Central costs may be allocated to the two departments in various ways.

If administrative expense of $62,800.00 is allocated on the basis of number of employees, the cost per cost driver rate would be ________.

If administrative expense of $62,800.00 is allocated on the basis of number of employees, the cost per cost driver rate would be ________.

(Multiple Choice)

5.0/5  (31)

(31)

For a company which produce its products in batches, the CEO's salary is a(n) ________ cost.

(Multiple Choice)

4.9/5  (32)

(32)

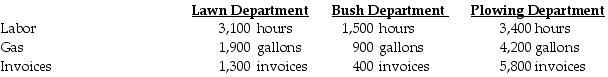

Columbus Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

If labor hours are used to allocate the non-labor, overhead costs, what is the overhead allocation rate?

If labor hours are used to allocate the non-labor, overhead costs, what is the overhead allocation rate?

(Multiple Choice)

4.9/5  (35)

(35)

Showing 61 - 80 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)