Exam 16: Recording and Evaluating Capital Resource Process Activities: Investing

Exam 1: Accounting and Business104 Questions

Exam 2: Business Processes and Accounting Information85 Questions

Exam 3: Operating Processes: Planning and Control69 Questions

Exam 4: Short-Term Decision Making103 Questions

Exam 5: Strategic Planning Regarding Operating Processes54 Questions

Exam 6: Planning, The Balanced Scorecard, and Budgeting70 Questions

Exam 7: Accounting Information Systems115 Questions

Exam 8: Purchasinghuman Resourcespayment Process: Recording and Evaluating Expenditure Process Activities62 Questions

Exam 9: Recording and Evaluating Conversion Process Activities98 Questions

Exam 10: Recording and Evaluating Revenue Process Activities92 Questions

Exam 11: Time Value of Money88 Questions

Exam 12: Planning Investments: Capital Budgeting78 Questions

Exam 13: Planning Equity Financing98 Questions

Exam 14: Planning Debt Financing74 Questions

Exam 15: Recording and Evaluating Capital Resource Process Activities: Financing122 Questions

Exam 16: Recording and Evaluating Capital Resource Process Activities: Investing89 Questions

Exam 17: Company Performance: Profitability63 Questions

Exam 18: Company Performance: Owners Equity and Financial Position85 Questions

Exam 19: Company Performance: Cash Flows99 Questions

Exam 20: Company Performance: Comprehensive Evaluation94 Questions

Select questions type

All of the following are characteristics of plant assets except:

(Multiple Choice)

4.8/5  (33)

(33)

Laguna Enterprises is trading in its old schooner for a new model.The old schooner is on the books at a cost of $535,000 with accumulated depreciation of $384,300.The new schooner has a list price of $765,000 but the manufacturer has agreed to reduce this by $125,000 in return for Laguna's old schooner.The new schooner should be recorded on the books at a cost of:

(Multiple Choice)

4.7/5  (33)

(33)

Use the following to answer questions

Oceanside Enterprises is trading in its old fishing vessel for a new model. The old fishing vessel is on the books at a cost of $364,000 with accumulated depreciation of $314,600. The new fishing vessel has a list price of $538,000 but the manufacturer has agreed to reduce this by $75,000 in return for Oceanside's old fishing vessel.

-The gain or loss recognized on the exchange would be:

(Multiple Choice)

4.8/5  (38)

(38)

Nanotech Inc owns a machine with an original cost of $200,000 and a book value of $60,000.Give the entries to record the following

(a) Sold the machine for $72,000 cash.

(b) Discarded the machine

(c) Sold the machine for $5,000 cash and a $40,000 note

(Essay)

4.8/5  (31)

(31)

Olympic Products,Inc.acquired some land,several buildings,and various pieces of equipment at a total cost of $5,600,000.Independent appraisals valued the land at $2,100,000,the buildings at $3,400,000,and the equipment at $500,000.The owner of the company thinks the land should be valued at $1,000,000,the buildings at $3,850,000 and the equipment at $750,000.Using the most appropriate method,what dollar amount should be assigned to each category of asset? Is there any reason the owner might want a higher or lower value assigned to any of the three asset categories?

(Essay)

4.8/5  (34)

(34)

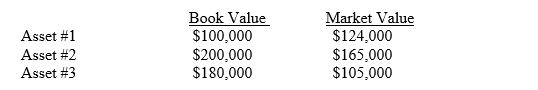

Julia Corp has three asset whose market values differ from their book values.

The market value of the first asset is expected to remain above the book value of Asset #1

for the life of the asset.

The market value of the second asset moves above and below the book value from year to

year.

The market value of the last asset is viewed as a permanent decline below the book value

of the asset.

Required:

A.Make the entry(ies) necessary to record the differences between the market and book values of the assets.

B.If the book values are adjusted to market values what impact will this have on the depreciation of the adjusted asset?

The market value of the first asset is expected to remain above the book value of Asset #1

for the life of the asset.

The market value of the second asset moves above and below the book value from year to

year.

The market value of the last asset is viewed as a permanent decline below the book value

of the asset.

Required:

A.Make the entry(ies) necessary to record the differences between the market and book values of the assets.

B.If the book values are adjusted to market values what impact will this have on the depreciation of the adjusted asset?

(Essay)

4.8/5  (31)

(31)

Spataro Industries owns some equipment with an original cost of $53,800 and accumulated depreciation of $26,350.If the equipment is sold for $25,500,the gain or loss recognized on the sale would be:

(Multiple Choice)

4.8/5  (29)

(29)

Match the following classifications with the accounts listed below.

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (28)

(28)

Orkney Company has 2-year-old machinery with a book value of $300,000,based on straight-line depreciation.The machinery has a 5 year economic life and $30,000 salvage value.What was the original cost?

(Multiple Choice)

4.7/5  (31)

(31)

Healy Fabrication Corp wants to trade in its old drill press for a new one.The old drill press is on the books at a cost of $44,500,and it has a carrying value of $9,300.The new drill press has a list price of $78,700.Make the entry for Healy to acquire the new drill press under each of the following situations:

(

A)Healy accepts the dealers offer to buy the new drill press by trading in the old drill press and paying the difference in cash.The dealer values the old drill press at $8,000.

(b)Healy will trade in the old drill press with a trade in allowance of $30,000 and pay the difference in cash.

(Essay)

4.8/5  (30)

(30)

Match the following with the definitions and descriptions below.

Correct Answer:

Premises:

Responses:

(Matching)

4.7/5  (39)

(39)

Kenyon Company purchased land and a building for $270,000.The appraised values of the land and building were $100,000 and $200,000,respectively.The purchase price allocated to the land should be:

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following would be classified as an intangible asset?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is different for straight-line depreciation and declining balance depreciation?

(Multiple Choice)

5.0/5  (45)

(45)

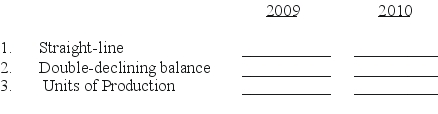

Calculate the depreciation for a $246,000 asset with a $10,000 salvage value that can produce 400,000 units over its 10-year life using the following methods.Assume the asset was purchased Oct 1 ,2009.During 2009 the asset produced 13,000 units and in 2010 it produced 28,000 units.How much depreciation expense will be recorded for 2009 and 2010.Write answers in the spaces below.YOU MUST SHOW YOUR WORK TO RECEIVE ANY CREDIT!

(Essay)

4.9/5  (32)

(32)

Which of the following would be considered a capital expenditure?

(Multiple Choice)

4.8/5  (34)

(34)

Comptel Corporation purchased land,a building and equipment for a total cost of $525,000.The appraised values of the land,building and equipment were $150,000,$375,000 and $75,000,respectively.The purchase price allocated to the land should be:

(Multiple Choice)

4.8/5  (37)

(37)

Horizons,Inc.purchased a machine 3 years ago at a price of $64,500.At that time,useful life was estimated at 12 years with a $6,900 salvage value,and straight-line depreciation was used.After recording depreciation for the 3rd year,Horizons decided that for future years it would revise its original estimates from 12 to 8 years and from $6,900 to $5,500.The depreciation expense to be recorded in year 4 of the machine's life is:

(Multiple Choice)

4.8/5  (30)

(30)

O'Conner Corporation purchased land with a building on it.It removed the old building and constructed a new one.Which of the following costs would not be included in the cost of the building?

(Multiple Choice)

4.7/5  (44)

(44)

Would a firm prefer straight-line or accelerated depreciation for financial reporting purposes? For tax purposes? Explain.

(Essay)

4.8/5  (36)

(36)

Showing 41 - 60 of 89

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)