Exam 13: A Macroeconomic Theory of the Open Economy

Exam 1: Ten Principles of Economics205 Questions

Exam 2: Thinking Like an Economist230 Questions

Exam 3: Interdependence and the Gains From Trade200 Questions

Exam 4: The Market Forces of Supply and Demand303 Questions

Exam 5: Measuring a Nations Income168 Questions

Exam 6: Measuring the Cost of Living176 Questions

Exam 7: Production and Growth185 Questions

Exam 8: Saving, Investment, and the Financial System208 Questions

Exam 9: Unemployment and Its Natural Rate186 Questions

Exam 10: The Monetary System196 Questions

Exam 11: Money Growth and Inflation193 Questions

Exam 12: Open-Economy Macroeconomics: Basic Concepts215 Questions

Exam 13: A Macroeconomic Theory of the Open Economy184 Questions

Exam 14: Aggregate Demand and Aggregate Supply241 Questions

Exam 15: The Influence of Monetary and Fiscal Policy on Aggregate Demand219 Questions

Exam 16: The Short-Run Tradeoff Between Inflation and Unemployment203 Questions

Exam 17: Five Debates Over Macroeconomic Policy118 Questions

Select questions type

In an open economy, where does the demand for loanable funds come from?

Free

(Multiple Choice)

4.8/5  (24)

(24)

Correct Answer:

C

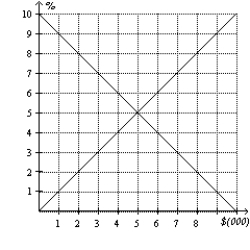

Figure 32-1  -Refer to Figure 32-1. In the figure shown, if the real interest rate is 4 percent, there will be pressure for which of the following changes?

-Refer to Figure 32-1. In the figure shown, if the real interest rate is 4 percent, there will be pressure for which of the following changes?

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

A

Which of the following is the effect of an increase in the Canadian real interest rate?

Free

(Multiple Choice)

4.9/5  (32)

(32)

Correct Answer:

C

Using the macroeconomic model studied, analyze the impact of the following events on the Canadian economy.

a.a voluntary export restraint (VER) by Japanese car producers

b.an export subsidy by Canadian government for Canadian lumber producers

c.an increase in U.S. GDP

(Essay)

4.8/5  (37)

(37)

Which of the following would tend to shift the supply of dollars in the foreign-currency exchange market model to the right?

(Multiple Choice)

4.9/5  (30)

(30)

Which of the following best predicts the effects of an increase in the Canadian real interest rate?

(Multiple Choice)

4.8/5  (28)

(28)

Suppose that from 1980 to 1987, Canadian net capital outflows decreased. According to the open-economy macroeconomic model, which of the following could have caused this?

(Multiple Choice)

4.8/5  (33)

(33)

What does a higher real interest rate lowers the quantity of?

(Multiple Choice)

4.9/5  (28)

(28)

What does the market for foreign-currency exchange coordinate?

(Multiple Choice)

4.9/5  (28)

(28)

In an open economy, which of the following best identifies the sources of loanable funds?

(Multiple Choice)

4.7/5  (40)

(40)

In the open-economy macroeconomic model, at the equilibrium real interest rate, the amount that people (including government) want to save exactly balances desired domestic investment.

(True/False)

4.9/5  (32)

(32)

If there is capital flight from Canada, how does the open economy macroeconomic model change?

(Multiple Choice)

4.9/5  (37)

(37)

In the open-economy macroeconomic model, other things the same, when a Canadian resident imports a foreign good, our model treats this as a decrease in the demand for dollars in the foreign-currency exchange market.

(True/False)

4.8/5  (40)

(40)

In the open-economy macroeconomic model, what does the quantity of dollars demanded in the foreign-currency exchange market depend on?

(Multiple Choice)

4.8/5  (30)

(30)

If Canadian citizens decide to save a larger fraction of their incomes, which of the following best identifies the effects?

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following best predicts the effects of an increase in the supply of loanable funds?

(Multiple Choice)

4.9/5  (26)

(26)

According to the open-economy macroeconomic model, which of the following would NOT be a consequence of an increase in the Canadian government budget deficit?

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following lists contains only things that decrease when the budget deficit of the Canadian government increases?

(Multiple Choice)

5.0/5  (27)

(27)

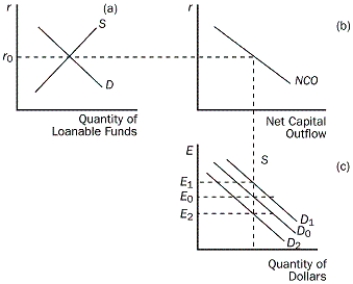

Use the figure below to answer the following questions.

Figure 32-2  -Refer to Figure 32-2. Suppose that these diagrams refer to Canada. Which of the following shifts show the effect of a voluntary export restriction by the government of China?

-Refer to Figure 32-2. Suppose that these diagrams refer to Canada. Which of the following shifts show the effect of a voluntary export restriction by the government of China?

(Multiple Choice)

4.9/5  (39)

(39)

Using the macroeconomic model of a foreign-currency exchange market, (a) analyze the situation in which a government imposes a fixed exchange rate, and (b) determine what that government should do in order to maintain the fixed exchange.

(Essay)

4.7/5  (35)

(35)

Showing 1 - 20 of 184

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)