Exam 13: A Macroeconomic Theory of the Open Economy

Exam 1: Ten Principles of Economics205 Questions

Exam 2: Thinking Like an Economist230 Questions

Exam 3: Interdependence and the Gains From Trade200 Questions

Exam 4: The Market Forces of Supply and Demand303 Questions

Exam 5: Measuring a Nations Income168 Questions

Exam 6: Measuring the Cost of Living176 Questions

Exam 7: Production and Growth185 Questions

Exam 8: Saving, Investment, and the Financial System208 Questions

Exam 9: Unemployment and Its Natural Rate186 Questions

Exam 10: The Monetary System196 Questions

Exam 11: Money Growth and Inflation193 Questions

Exam 12: Open-Economy Macroeconomics: Basic Concepts215 Questions

Exam 13: A Macroeconomic Theory of the Open Economy184 Questions

Exam 14: Aggregate Demand and Aggregate Supply241 Questions

Exam 15: The Influence of Monetary and Fiscal Policy on Aggregate Demand219 Questions

Exam 16: The Short-Run Tradeoff Between Inflation and Unemployment203 Questions

Exam 17: Five Debates Over Macroeconomic Policy118 Questions

Select questions type

When Mexico suffered from capital flight in 1994, what happened to Mexico's net capital outflow and net exports?

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following is most likely to result if foreigners decide to withdraw the funds that they have loaned to Canada over the past two decades?

(Multiple Choice)

4.7/5  (29)

(29)

In 1995, Newt Gingrich, the Speaker of the U.S. House of Representatives, threatened to send the United States into default on its debt. During the day of this announcement, U.S. interest rates rose and the real exchange rate of the U.S. dollar depreciated. Which of the following changes is consistent with the results of the open-economy macroeconomic model?

(Multiple Choice)

4.7/5  (36)

(36)

When a country suffers from capital flight, which of the following best explains the effects?

(Multiple Choice)

4.9/5  (36)

(36)

What effect does a fall in the real interest rate have on the quantity of loanable funds?

(Multiple Choice)

4.8/5  (35)

(35)

What changes will a shortage of loanable funds induce in a Savings-Investment diagram in a closed economy?

(Multiple Choice)

4.8/5  (24)

(24)

Suppose the Canadian government imposed import quotas on agricultural products. According to the foreign currency exchange market diagram, which of the following outcomes would most likely result?

(Multiple Choice)

4.7/5  (34)

(34)

How are the identities S = NCO + I and NCO = NX related to the foreign currency exchange market and the loanable funds market?

(Essay)

4.9/5  (37)

(37)

In an open economy, the demand for loanable funds comes from both domestic investment and net capital outflow.

(True/False)

4.9/5  (32)

(32)

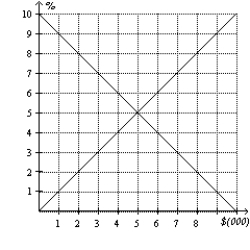

Figure 32-1  -Refer to Figure 32-1. In the figure shown, if the real interest rate is 4 percent, what is the quantity of loanable funds demanded?

-Refer to Figure 32-1. In the figure shown, if the real interest rate is 4 percent, what is the quantity of loanable funds demanded?

(Multiple Choice)

4.8/5  (36)

(36)

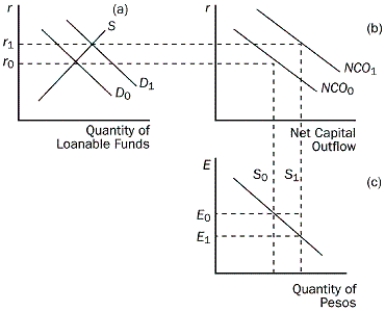

Figure 32-3  -Refer to Figure 32-3. Which of the following is consistent with capital flight from Mexico?

-Refer to Figure 32-3. Which of the following is consistent with capital flight from Mexico?

(Multiple Choice)

4.9/5  (35)

(35)

Net capital outflow represents the quantity of dollars supplied in the foreign-currency exchange market.

(True/False)

4.8/5  (35)

(35)

If the Canadian government imposes an import quota on French wine, which of the following best predicts the consequences?

(Multiple Choice)

4.8/5  (34)

(34)

If policymakers impose import restrictions on automobiles, the Canadian trade deficit would shrink.

(True/False)

4.8/5  (33)

(33)

If Canada imposes an import quota on clothing, which of the following best predicts the consequences?

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following is consistent with a below-the-equilibrium exchange rate of the dollar?

(Multiple Choice)

5.0/5  (31)

(31)

Which of the following does the open-economy macroeconomic model include?

(Multiple Choice)

4.8/5  (32)

(32)

Suppose that in the 1990s, Canadian net capital outflow fell. Which of the following could explain this?

(Multiple Choice)

4.7/5  (36)

(36)

Suppose the Federal Reserve, which is the central bank in the United States, decided to lower the bank interest rate. Use the macroeconomic model studied in this chapter to analyze the possible effects of this event on Canada's net capital outflow, net exports, and exchange rate. (Hint: Consider the United States a large economy, which is able to influence the world interest rate.)

(Essay)

4.7/5  (44)

(44)

Showing 101 - 120 of 184

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)