Exam 10: Arbitrage Pricing Theory and Multifactor Models of Risk and Return

Exam 1: The Investment Environment58 Questions

Exam 2: Asset Classes and Financial Instruments86 Questions

Exam 3: How Securities Are Traded69 Questions

Exam 4: Mutual Funds and Other Investment Companies72 Questions

Exam 5: Risk, Return, and the Historical Record85 Questions

Exam 6: Capital Allocation to Risky Assets70 Questions

Exam 7: Optimal Risky Portfolios80 Questions

Exam 8: Index Models87 Questions

Exam 9: The Capital Asset Pricing Model83 Questions

Exam 10: Arbitrage Pricing Theory and Multifactor Models of Risk and Return80 Questions

Exam 11: The Efficient Market Hypothesis71 Questions

Exam 12: Behavioral Finance and Technical Analysis54 Questions

Exam 13: Empirical Evidence on Security Returns56 Questions

Exam 14: Bond Prices and Yields129 Questions

Exam 15: The Term Structure of Interest Rates49 Questions

Exam 16: Managing Bond Portfolios84 Questions

Exam 17: Macroeconomic and Industry Analysis90 Questions

Exam 18: Equity Valuation Models130 Questions

Exam 19: Financial Statement Analysis91 Questions

Exam 20: Options Markets: Introduction108 Questions

Exam 21: Option Valuation90 Questions

Exam 22: Futures Markets91 Questions

Exam 23: Futures, Swaps, and Risk Management56 Questions

Exam 24: Portfolio Performance Evaluation83 Questions

Exam 25: International Diversification52 Questions

Exam 26: Hedge Funds49 Questions

Exam 27: The Theory of Active Portfolio Management50 Questions

Exam 28: Investment Policy and the Framework of the Cfa Institute83 Questions

Select questions type

Imposing the no-arbitrage condition on a single-factor security market implies which of the following statements

I. The expected return-beta relationship is maintained for all but a small number of well-diversified portfolios.

II. The expected return-beta relationship is maintained for all well-diversified portfolios.

III. The expected return-beta relationship is maintained for all but a small number of individual securities.

IV. The expected return-beta relationship is maintained for all individual securities.

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

C

The APT differs from the CAPM because the APT

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

D

In a multifactor APT model, the coefficients on the macro factors are often called

Free

(Multiple Choice)

4.8/5  (42)

(42)

Correct Answer:

D

Discuss arbitrage opportunities in the context of violations of the law of one price.

(Essay)

4.8/5  (40)

(40)

Consider the one-factor APT.The variance of returns on the factor portfolio is 6%.The beta of a well-diversified portfolio on the factor is 1.1.The variance of returns on the well-diversified portfolio is approximately

(Multiple Choice)

4.7/5  (39)

(39)

Consider the one-factor APT.The standard deviation of returns on a well-diversified portfolio is 22%.The standard deviation on the factor portfolio is 14%.The beta of the well-diversified portfolio is approximately

(Multiple Choice)

4.8/5  (29)

(29)

A _________ portfolio is a well-diversified portfolio constructed to have a beta of 1 on one of the factors and a beta of 0 on any other factor.

(Multiple Choice)

4.7/5  (48)

(48)

In the APT model, what is the nonsystematic standard deviation of an equally weighted portfolio that has an average value of σ(ei) equal to 18% and 250 securities

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following is(are) true regarding the APT

I. The security market line does not apply to the APT.

II. More than one factor can be important in determining returns.

III. Almost all individual securities satisfy the APT relationship.

IV. It doesn't rely on the market portfolio that contains all assets.

(Multiple Choice)

4.9/5  (39)

(39)

Consider a well-diversified portfolio, A, in a two-factor economy.The risk-free rate is 6%, the risk premium on the first factor portfolio is 4% and the risk premium on the second factor portfolio is 3%.If portfolio A has a beta of 1.2 on the first factor and .8 on the second factor, what is its expected return

(Multiple Choice)

4.9/5  (38)

(38)

A professional who searches for mispriced securities in specific areas such as merger-target stocks, rather than one who seeks strict (risk-free) arbitrage opportunities is engaged in

(Multiple Choice)

4.8/5  (31)

(31)

The ____________ provides an unequivocal statement on the expected return-beta relationship for all assets, whereas the _____________ implies that this relationship holds for all but perhaps a small number of securities.

(Multiple Choice)

4.9/5  (28)

(28)

Consider a single factor APT.Portfolio A has a beta of 1.0 and an expected return of 16%.Portfolio B has a beta of 0.8 and an expected return of 12%.The risk-free rate of return is 6%.If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio __________ and a long position in portfolio _______.

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following is true about the security market line (SML) derived from the APT

(Multiple Choice)

4.9/5  (35)

(35)

Consider the one-factor APT.The variance of returns on the factor portfolio is 11%.The beta of a well-diversified portfolio on the factor is 1.45.The variance of returns on the well-diversified portfolio is approximately

(Multiple Choice)

4.8/5  (35)

(35)

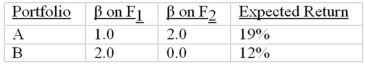

Consider the multifactor APT.There are two independent economic factors, F1 and F2.The risk-free rate of return is 6%.The following information is available about two well-diversified portfolios:  Assuming no arbitrage opportunities exist, the risk premium on the factor F1 portfolio should be

Assuming no arbitrage opportunities exist, the risk premium on the factor F1 portfolio should be

(Multiple Choice)

5.0/5  (45)

(45)

In a multifactor APT model, the coefficients on the macro factors are often called

(Multiple Choice)

4.8/5  (42)

(42)

Consider the one-factor APT.The standard deviation of returns on a well-diversified portfolio is 19%.The standard deviation on the factor portfolio is 12%.The beta of the well-diversified portfolio is approximately

(Multiple Choice)

4.9/5  (28)

(28)

Showing 1 - 20 of 80

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)