Exam 11: Decision Making With a Strategic Emphasis

Exam 1: Cost Management and Strategy79 Questions

Exam 2: Implementing Strategy: the Value Chain, the Balanced Scorecard, and the Strategy Map70 Questions

Exam 3: Basic Cost Management Concepts98 Questions

Exam 4: Job Costing118 Questions

Exam 5: Activity-Based Costing and Customer Profitability Analysis149 Questions

Exam 6: Process Costing106 Questions

Exam 7: Cost Allocation: Departments, Joint Products, and By-Products96 Questions

Exam 8: Cost Estimation120 Questions

Exam 9: Short-Term Profit Planning: Cost-Volume-Profit Cvp Analysis105 Questions

Exam 10: Strategy and the Master Budget146 Questions

Exam 11: Decision Making With a Strategic Emphasis137 Questions

Exam 12: Strategy and the Analysis of Capital Investments167 Questions

Exam 13: Cost Planning for the Product Life Cycle: Target Costing, Theory of Constraints, and Strategic Pricing94 Questions

Exam 14: Operational Performance Measurement: Sales, Direct-Cost Variances, and the Role of Nonfinancial Performance Measures178 Questions

Exam 15: Operational Performance Measurement: Indirect-Cost Variances and Resource-Capacity Management167 Questions

Exam 16: Operational Performance Measurement: Further Analysis of Productivity and Sales134 Questions

Exam 17: The Management and Control of Quality147 Questions

Exam 18: Strategic Performance Measurement: Cost Centers, Profit Centers, and the Balanced Scorecard133 Questions

Exam 19: Strategic Performance Measurement: Investment Centers and Transfer Pricing151 Questions

Exam 20: Management Compensation, Business Analysis, and Business Valuation108 Questions

Select questions type

Relevant costs for a make-or-buy decision for a component part include all of the following EXCEPT:

(Multiple Choice)

4.7/5  (32)

(32)

When a decision is made in an organization, it is selected from a group of alternative courses of action. The loss associated with choosing the alternative that does not maximize the benefit is the:

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following costs would be relevant in short-term decision making?

(Multiple Choice)

5.0/5  (40)

(40)

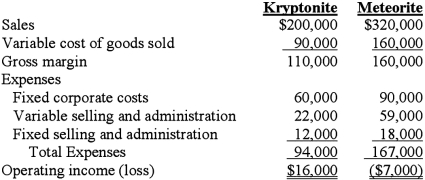

Luther Company, located in Largeville, Kansas, is a retailer of durable, light-weight luggage products known for their high-quality and innovation. Recently, the firm conducted a relevant cost analysis of one of its product lines that has only two products, Kryptonite and Meteoerite. The sales for Meteorite are decreasing and the purchase costs are increasing. The firm is considering dropping Meteorite products and only selling Kryptonite. Luther Company allocates fixed costs to products on the basis of sales revenue. When the president of Luther saw the income statement, he agreed that Meteorite should be dropped. If this is done, sales of Kryptonite are expected to increase by 15% next year; the firm's cost structure will remain the same.  Required:

1. Find the expected change in annual operating income by dropping Meteorite and selling only Kryptonite.

2. What strategic factors should be considered?

Required:

1. Find the expected change in annual operating income by dropping Meteorite and selling only Kryptonite.

2. What strategic factors should be considered?

(Essay)

4.9/5  (34)

(34)

A truck, costing $25,000 and uninsured, was wrecked the very first day it was used. It can either be disposed of for $5,000 cash and be replaced with a similar truck costing $27,000, or rebuilt for $20,000 and be brand new as far as operating characteristics and looks are concerned. The best choice provides a net cost savings of:

(Multiple Choice)

4.8/5  (49)

(49)

A decision bias is an inherent tendency of most decision makers that leads to incorrect decisions. An example of decision bias is:

(Multiple Choice)

4.9/5  (37)

(37)

Variable costs will generally be relevant for decision making because they:

(Multiple Choice)

5.0/5  (47)

(47)

A truck, costing $25,000 and uninsured, was wrecked the very first day it was used. It can either be disposed of for $5,000 cash and be replaced with a similar truck costing $27,000, or rebuilt for $20,000 and be brand new as far as operating characteristics and looks are concerned. The net relevant cost of the replacing option is:

(Multiple Choice)

4.8/5  (45)

(45)

The major problem with relevant cost determination is that it fails to recognize the:

(Multiple Choice)

4.9/5  (38)

(38)

In deciding whether to drop or keep a product line, all of the following are relevant to the decision EXCEPT:

(Multiple Choice)

4.9/5  (35)

(35)

The opportunity cost of making a component part in a factory with no excess capacity is the:

(Multiple Choice)

4.9/5  (37)

(37)

The best way to allocate scare resources to attain a specific objective, such as the maximization of operating income, is:

(Multiple Choice)

4.8/5  (32)

(32)

Calculate the expected surplus or deficit from operations given the above information.

(Multiple Choice)

4.9/5  (40)

(40)

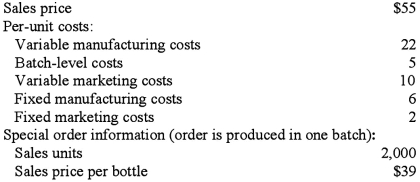

Old Vine Vineyard produces premium wine. Its success in the industry is due to its quality, although all of its customers, wine shops and specialty grocery stores, are very cost conscious and negotiate for price cuts on all large orders. Noting that the wine industry is becoming increasingly competitive, Old Vine is looking for a way to meet the challenge. It is negotiating with Eastern Seasons, a regional specialty grocery store, to purchase a large order of wine. Old Vine is currently producing at under-capacity and would like to keep its production facilities, gaining better economies of scale by increasing production. Eastern Seasons has agreed to a large order but only at a price of $39 per bottle. The special order can be purchased in one batch with available capacity. Old Vine prepared these data:

Next month's operating information (per unit, for 10,000 bottles, made in 10 batches of 1,000 each):  No variable marketing costs are associated with this order, but Old Vine has spent $2,500 during the past two months trying to get Eastern Seasons to purchase the special order.

Required:

1. How much will the special order change Old Vine's total operating income?

2. How much would the special order change Old Vine's total operating income if Old Vine is operating at full capacity and would lose the sale of the 2,000 bottles to regular customers?

3. How might the special order fit into Old Vine's competitive strategy?

No variable marketing costs are associated with this order, but Old Vine has spent $2,500 during the past two months trying to get Eastern Seasons to purchase the special order.

Required:

1. How much will the special order change Old Vine's total operating income?

2. How much would the special order change Old Vine's total operating income if Old Vine is operating at full capacity and would lose the sale of the 2,000 bottles to regular customers?

3. How might the special order fit into Old Vine's competitive strategy?

(Essay)

4.8/5  (41)

(41)

The Multi Resource Company manufactures two lines of washing machines, Regular and Deluxe. The contribution margin of a Regular model is $110 and for Deluxe Model is $175. The company has two departments, Assembly and Testing. The Regular Model requires 3 hours to assemble, while a Deluxe Model requires 4 hours. The total time available in Assembly is 12,000 hours. In the Testing Department, it requires 2.5 hours to test a Regular Model and 1.5 hours to test a Deluxe Model. A total of 6,000 hours of testing time is available. The optimum production plan for Multi Resource is:

(Multiple Choice)

4.9/5  (28)

(28)

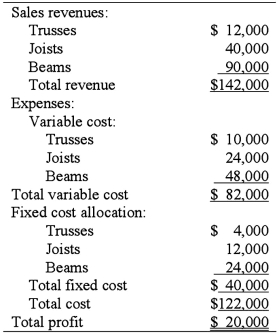

Lester-Smith Company manufactures three wood construction components: wood trusses, wood floor joists, and beams. The plant is operating at full capacity. It can produce 200 trusses, 1,000 joists, and 600 beams per month and sells everything it produces. The monthly revenues and expenses for the three products are  Required:

1. The firm makes wood trusses mainly to satisfy certain customers by offering a full line of wood components. Lately, it has had a problem making a profit on the trusses and is considering buying them from another manufacturer at $55 a truss. Based solely on a short-term financial analysis, should the firm buy these trusses or continue to make its own? (Show calculations.)

2. Lester-Smith has an opportunity to produce an additional 400 beams for a customer at a price of $100 each. If it accepts this special order, the firm cannot produce trusses because the plant will be operating at full capacity. Should the firm accept this special order? (Show calculations.)

Required:

1. The firm makes wood trusses mainly to satisfy certain customers by offering a full line of wood components. Lately, it has had a problem making a profit on the trusses and is considering buying them from another manufacturer at $55 a truss. Based solely on a short-term financial analysis, should the firm buy these trusses or continue to make its own? (Show calculations.)

2. Lester-Smith has an opportunity to produce an additional 400 beams for a customer at a price of $100 each. If it accepts this special order, the firm cannot produce trusses because the plant will be operating at full capacity. Should the firm accept this special order? (Show calculations.)

(Essay)

4.9/5  (37)

(37)

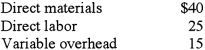

Motor Corp. manufactures machine parts for boat engines. The CEO, James Hamilton, was considering an offer from a subcontractor who would provide 3,000 units of product AB100 for Hamilton for a price of $230,000. If Motor Corp. does not purchase these parts from the subcontractor it must produce them in-house with the following per-unit costs:  In addition to the above costs, if Hamilton produces part AB100, he would also have a retooling and design cost of $10,000. Calculate the relevant costs of producing 3,000 units of product AB100.

In addition to the above costs, if Hamilton produces part AB100, he would also have a retooling and design cost of $10,000. Calculate the relevant costs of producing 3,000 units of product AB100.

(Essay)

4.9/5  (35)

(35)

Lyman Company has the opportunity to increase annual credit sales $100,000 by selling to a new, riskier group of customers. The expenses of collecting credit sales are expected to be 15 percent of credit sales. The company's manufacturing and selling expenses are 70% of sales, and its effective tax rate is 40%. If Lyman should accept this opportunity, the company's after-tax profits would increase by:

(Multiple Choice)

4.8/5  (40)

(40)

Showing 101 - 120 of 137

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)