Exam 3: Basic Cost Management Concepts

Exam 1: Cost Management and Strategy67 Questions

Exam 2: Implementing Strategy: The Value Chain, the Balanced Scorecard, and the Strategy Map53 Questions

Exam 3: Basic Cost Management Concepts86 Questions

Exam 4: Job Costing103 Questions

Exam 5: Activity-Based Costing and Customer Profitability Analysis148 Questions

Exam 6: Process Costing90 Questions

Exam 7: Cost Allocation: Departments, Joint Products, and By-Products85 Questions

Exam 8: Cost Estimation110 Questions

Exam 9: Profit Planning: Cost-Volume-Profit Analysis98 Questions

Exam 10: Strategy and the Master Budget132 Questions

Exam 11: Decision Making With a Strategic Emphasis103 Questions

Exam 12: Strategy and the Analysis of Capital Investments150 Questions

Exam 13: Cost Planning for the Product Life Cycle: Target Costing,Theory of Constraints,and Strategic Pricing83 Questions

Exam 14: Operational Performance Measurement: Sales and Direct-Cost Variances, and the Role of Nonfinancial Performance Measures177 Questions

Exam 15: Operational Performance Measurement: Indirect-Cost Variances and Resource- Capacity Management166 Questions

Exam 16: Operational Performance Measurement: Further Analysis of Productivity and Sales124 Questions

Exam 17: The Management and Control of Quality118 Questions

Exam 18: Strategic Performance Measurement: Cost Centers, Profit Centers, and the Balanced Scorecard121 Questions

Exam 19: Strategic Performance Measurement: Investment Centers129 Questions

Exam 20: Management Compensation, Business Analysis, and Business Valuation87 Questions

Select questions type

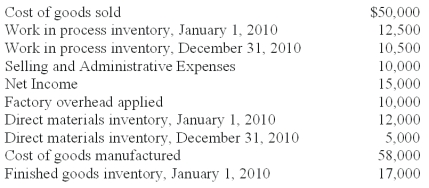

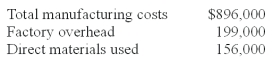

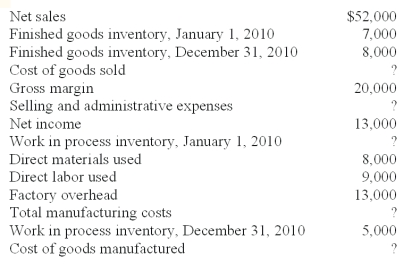

Fisher,Inc.recently lost a portion of its records in an office fire.The following information was salvaged from the accounting records.  Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount in the finished goods inventory at December 31,2010?

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount in the finished goods inventory at December 31,2010?

(Multiple Choice)

4.8/5  (32)

(32)

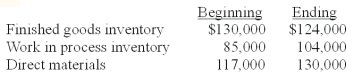

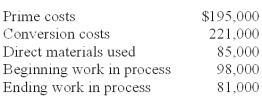

Assume the following information pertaining to Moonbeam Company:  Costs incurred during the period are as follows:

Costs incurred during the period are as follows:  Materials purchases are calculated to be:

Materials purchases are calculated to be:

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following is normally considered to be a product cost?

(Multiple Choice)

4.7/5  (38)

(38)

Assume the following information pertaining to Moonbeam Company:  Costs incurred during the period are as follows:

Costs incurred during the period are as follows:  Cost of goods sold is calculated to be:

Cost of goods sold is calculated to be:

(Multiple Choice)

4.7/5  (39)

(39)

Direct materials and direct labor costs total $70,000 and factory overhead costs total $100 per machine hour.If 300 machine hours were used for Job #222,what is the total manufacturing cost for Job #222?

(Multiple Choice)

4.8/5  (31)

(31)

Advanced Technical Services,Ltd.has many products and services in the medical field.The Clinical Division of the company does research and testing of consumer products on human participants in controlled clinical studies.

Required: Determine for each cost below whether it is best classified as a fixed,variable,or step-fixed cost.

(1)Director's salary

(2)Part-time help

(3)Payment on purchase of medical equipment

(4)Allocation of company-wide advertising

(5)Patches used on participants' arms during the study

(6)Stipends paid to participants

(Essay)

5.0/5  (33)

(33)

Which of the following should be considered with structural cost drivers?

(Multiple Choice)

4.7/5  (37)

(37)

If finished goods inventory has increased during the period,which of the following is always true?

(Multiple Choice)

5.0/5  (38)

(38)

The cost of goods that were finished and transferred out of work-in-process during the current period is:

(Multiple Choice)

4.8/5  (37)

(37)

The additional cost incurred as the cost driver increases by one unit is:

(Multiple Choice)

4.9/5  (38)

(38)

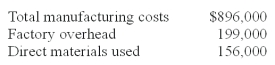

Assume the following information pertaining to Cub Company:  Cost of goods manufactured is calculated to be:

Cost of goods manufactured is calculated to be:

(Multiple Choice)

4.9/5  (39)

(39)

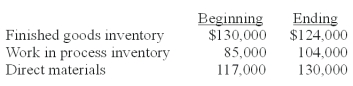

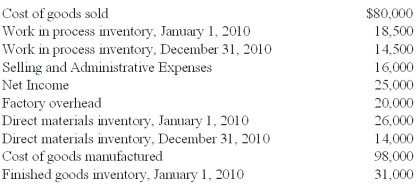

Tierney Construction,Inc.recently lost a portion of its financial records in an office theft.The following accounting information remained in the office files:  Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount of direct materials purchased?

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount of direct materials purchased?

(Multiple Choice)

4.8/5  (44)

(44)

Direct materials and direct labor costs total $40,000 and factory overhead costs total $100 per machine hour.If 200 machine hours were used for Job #202,what is the total manufacturing cost for Job #202?

(Multiple Choice)

4.9/5  (37)

(37)

Which one of the following would not be found in a merchandising company?

(Multiple Choice)

4.9/5  (51)

(51)

Stephenson Company's computer system recently crashed,erasing much of the Company's financial data.The following accounting information was discovered soon afterwards on the CFO's backup computer disk.  Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.What should be the amount of direct materials purchased?

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.What should be the amount of direct materials purchased?

(Multiple Choice)

4.8/5  (36)

(36)

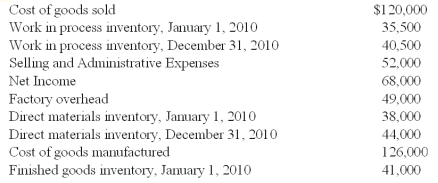

The following information was taken from the accounting records of Elliott Manufacturing Corp.Unfortunately,some of the data were destroyed by a computer malfunction.  Cost of goods sold is calculated to be:

Cost of goods sold is calculated to be:

(Multiple Choice)

4.7/5  (41)

(41)

Any product,service,or organizational unit to which costs are assigned for some management purpose is a(n):

(Multiple Choice)

4.9/5  (44)

(44)

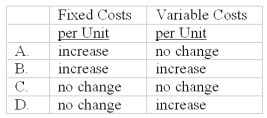

When production levels are expected to decline within a relevant range,what effects would be anticipated with respect to each of the following?

(Multiple Choice)

4.8/5  (36)

(36)

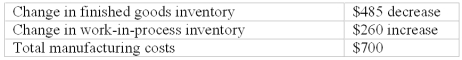

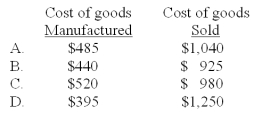

Consider the following for Neil Wood Manufacturing:  What are the cost of goods manufactured and cost of goods sold?

What are the cost of goods manufactured and cost of goods sold?

(Multiple Choice)

5.0/5  (41)

(41)

The term relevant range as used in cost accounting means the range over which:

(Multiple Choice)

4.8/5  (35)

(35)

Showing 21 - 40 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)