Exam 16: Uncertainty

Exam 1: Introduction43 Questions

Exam 2: Supply and Demand225 Questions

Exam 3: A Consumers Constrained Choice130 Questions

Exam 4: Demand123 Questions

Exam 5: Consumer Welfare and Policy Analysis73 Questions

Exam 6: Firms and Production112 Questions

Exam 7: Costs132 Questions

Exam 8: Competitive Firms and Markets112 Questions

Exam 9: Properties and Applications of the Competitive Model101 Questions

Exam 10: General Equilibrium and Economic Welfare109 Questions

Exam 11: Monopoly and Monopsony142 Questions

Exam 12: Pricing and Advertising91 Questions

Exam 13: Game Theory85 Questions

Exam 14: Oligopoly and Monopolistic Competition114 Questions

Exam 15: Factor Markets115 Questions

Exam 16: Uncertainty103 Questions

Exam 17: Property Rights, Externalities, Rivalry, and Exclusion105 Questions

Exam 18: Asymmetric Information85 Questions

Exam 19: Contracts and Moral Hazards79 Questions

Select questions type

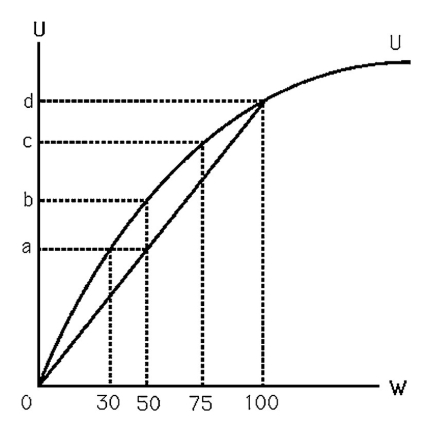

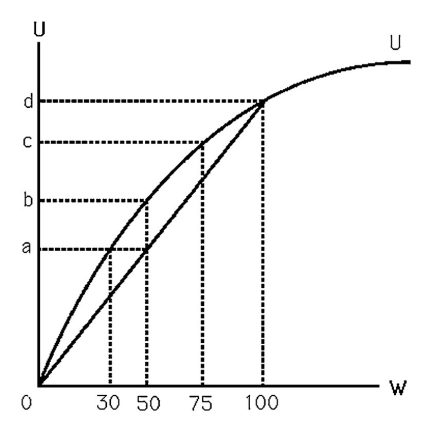

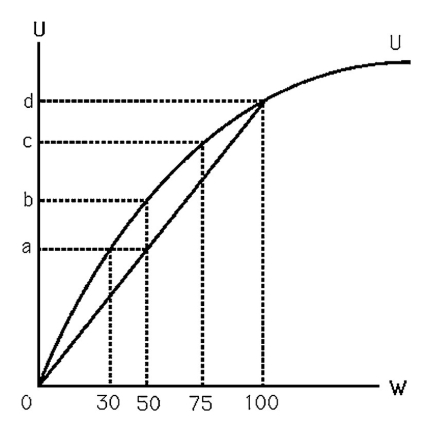

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Over and above the price of fair insurance,what is the risk premium Bob would pay to eliminate the chance of theft?

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Over and above the price of fair insurance,what is the risk premium Bob would pay to eliminate the chance of theft?

(Multiple Choice)

4.7/5  (38)

(38)

A fair game is a game in which the chances are 50-50 that you win or lose.

(True/False)

4.9/5  (32)

(32)

Bob invests $50 in an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0.From this information we can conclude that Bob is NOT

(Multiple Choice)

4.8/5  (43)

(43)

-The above figure shows Bob's utility function.He currently has $50 and is considering an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0.Bob will make the investment

-The above figure shows Bob's utility function.He currently has $50 and is considering an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0.Bob will make the investment

(Multiple Choice)

5.0/5  (38)

(38)

Johnny owns a house that would cost $100,000 to replace should it ever be destroyed by fire.There is a 0.1% chance that the house could be destroyed during the course of a year.Johnny's utility function is U = W0.5.How much would fair insurance cost that completely replaces the house if destroyed by fire? Assuming that Johnny has no other wealth,how much would Johnny be willing to pay for such an insurance policy? Why the difference?

(Essay)

4.7/5  (41)

(41)

Why would a usury law result in banks making less credit available to low-income households?

(Essay)

4.8/5  (36)

(36)

For a risk-neutral person,the expected utility associated with various levels of wealth

(Multiple Choice)

4.8/5  (44)

(44)

In terms of the stock market,systematic risk refers to the fact that

(Multiple Choice)

4.8/5  (31)

(31)

Derive the Arrow-Pratt measure of risk aversion for the following utility functions.Which represents the greatest level of risk aversion according to the measure?

a.U(X)=  b.U(X)= -e-x

c.U(X)= 1 - 1/X

b.U(X)= -e-x

c.U(X)= 1 - 1/X

(Essay)

4.9/5  (37)

(37)

John derives more utility from having $1,000 than from having $100.From this,we can conclude that John

(Multiple Choice)

4.8/5  (41)

(41)

A risk-averse investor will decide whether or not to invest by determining if the expected value of the investment is positive.

(True/False)

4.9/5  (37)

(37)

If fair insurance is offered to a risk-averse person,she will

(Multiple Choice)

4.9/5  (42)

(42)

If there are 10,000 people in your age bracket,and 10 of them died last year,an insurance company believes that the probability of someone in that age bracket dying this year would be

(Multiple Choice)

4.9/5  (38)

(38)

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is risk averse because

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is risk averse because

(Multiple Choice)

4.7/5  (37)

(37)

Bob invests $25 in an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0.From this information we can conclude that Bob is

(Multiple Choice)

4.9/5  (47)

(47)

Showing 61 - 80 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)