Exam 16: Uncertainty

Exam 1: Introduction43 Questions

Exam 2: Supply and Demand225 Questions

Exam 3: A Consumers Constrained Choice130 Questions

Exam 4: Demand123 Questions

Exam 5: Consumer Welfare and Policy Analysis73 Questions

Exam 6: Firms and Production112 Questions

Exam 7: Costs132 Questions

Exam 8: Competitive Firms and Markets112 Questions

Exam 9: Properties and Applications of the Competitive Model101 Questions

Exam 10: General Equilibrium and Economic Welfare109 Questions

Exam 11: Monopoly and Monopsony142 Questions

Exam 12: Pricing and Advertising91 Questions

Exam 13: Game Theory85 Questions

Exam 14: Oligopoly and Monopolistic Competition114 Questions

Exam 15: Factor Markets115 Questions

Exam 16: Uncertainty103 Questions

Exam 17: Property Rights, Externalities, Rivalry, and Exclusion105 Questions

Exam 18: Asymmetric Information85 Questions

Exam 19: Contracts and Moral Hazards79 Questions

Select questions type

Bob has an initial wealth of $1200 but faces a 50% chance of losing $800 to doctors' bills in the coming year.Insurance is available at a rate of 60¢ per $1 of coverage.This means that if Bob purchases $X in coverage,it costs 6X¢ and pays $X towards Bob's doctors' bills.If Bob's utility function is U(w)= 2  ,how much insurance (X)will Bob purchase?

,how much insurance (X)will Bob purchase?

(Essay)

4.9/5  (34)

(34)

Concerning an investment project,which of the following is TRUE?

(Multiple Choice)

4.9/5  (37)

(37)

Catherine is risk averse.When faced with a choice between a gamble and a certain level of wealth,she will

(Multiple Choice)

4.7/5  (37)

(37)

For a given expected value,the smaller the standard deviation of the expected value,the larger the risk.

(True/False)

4.8/5  (37)

(37)

If insurance is fairly priced,a risk-averse individual will purchase enough insurance to cover the full amount of the possible loss.

(True/False)

4.7/5  (49)

(49)

Distinguish between risk that can be reduced through diversification and risk that cannot be reduced through diversification.

(Essay)

4.9/5  (25)

(25)

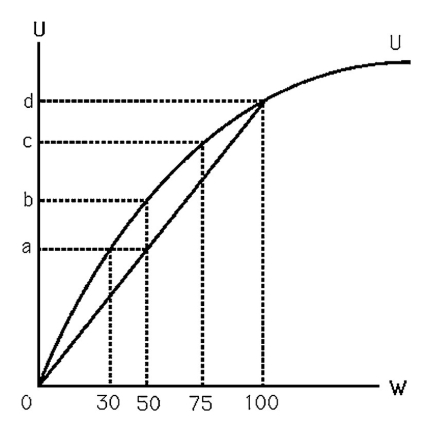

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob will buy theft insurance to cover the full $100

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob will buy theft insurance to cover the full $100

(Multiple Choice)

4.8/5  (40)

(40)

Explain why the rate of return from investing in stocks is higher than from investing in bonds.

(Essay)

4.8/5  (36)

(36)

Why does diversification fail to reduce risk when the returns of the two investments purchased are perfectly positively correlated?

(Essay)

4.8/5  (33)

(33)

If Ann's utility function is U = W0.5,and she invests in a business which can yield $6,400 with probability 1/5,and $3600 with probability 4/5,then her expected wealth is

(Multiple Choice)

4.8/5  (45)

(45)

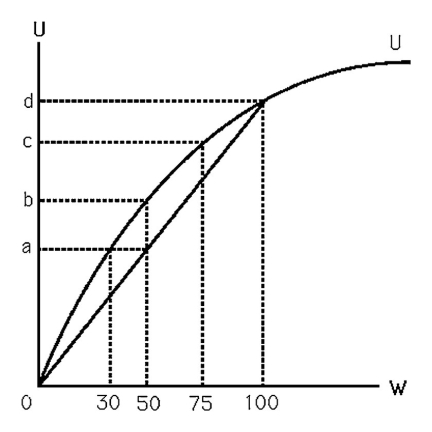

-Bob's utility function is shown in the above Figure.He currently has $100 worth of property,but there is a 50% chance that all of it will be stolen.An insurance company offers to reimburse Bob for his loss if the money is stolen.What is the most that Bob would pay for such a policy? Explain.

-Bob's utility function is shown in the above Figure.He currently has $100 worth of property,but there is a 50% chance that all of it will be stolen.An insurance company offers to reimburse Bob for his loss if the money is stolen.What is the most that Bob would pay for such a policy? Explain.

(Essay)

4.7/5  (36)

(36)

If Ann's utility function is U = W0.5,and she invests in a business which can yield $6,400 with probability 1/5,and $3600 with probability 4/5,then her expected utility is

(Multiple Choice)

4.8/5  (42)

(42)

If a payout is certain to occur,then the variance of that payout equals

(Multiple Choice)

4.9/5  (34)

(34)

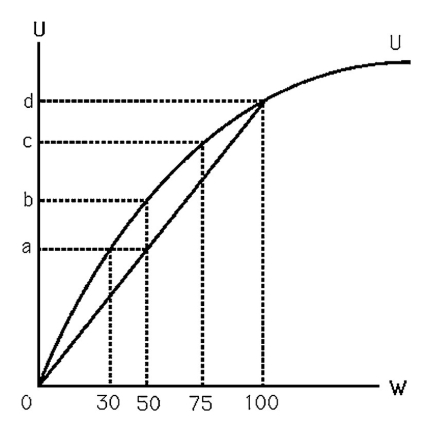

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is risk averse because

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is risk averse because

(Multiple Choice)

4.8/5  (34)

(34)

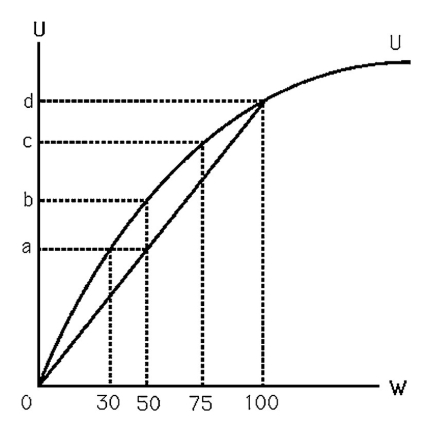

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.If Bob could keep $50 with certainty,his utility would be

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.If Bob could keep $50 with certainty,his utility would be

(Multiple Choice)

4.9/5  (40)

(40)

Stephan has the utility function U(w)= 3  ,where w is his wealth.Initially,Stephan has

w = $100.Would Stephan pay $5 to take the following gamble: With probability 0.03 he wins $25;otherwise,he wins nothing.

,where w is his wealth.Initially,Stephan has

w = $100.Would Stephan pay $5 to take the following gamble: With probability 0.03 he wins $25;otherwise,he wins nothing.

(Essay)

4.8/5  (38)

(38)

Sarah buys little stuffed animals for $5 each.They come in different varieties.If the producer stops making (retires)a certain variety,a stuffed animal of that variety will be worth $100;otherwise it is worth $0.There is 50% chance that any variety will be retired.When Sarah buys her next stuffed animal,the expected profit is

(Multiple Choice)

4.9/5  (32)

(32)

Alvin's utility function is U = W.Barry's utility function is U = W2.Carl's utility function is U = W0.5.Each has wealth of only $100.An investment of that $100 has a 10% chance of netting $1,000 and a 90% chance of netting a loss of that $100.Who among the three will make the investment?

(Essay)

4.8/5  (36)

(36)

Showing 81 - 100 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)