Exam 6: International Parity Relationships and Forecasting Foreign Exchange Rates

Exam 1: Globalization and the Multinational Firm100 Questions

Exam 2: International Monetary System100 Questions

Exam 3: Balance of Payments100 Questions

Exam 4: Corporate Governance Around the World100 Questions

Exam 5: The Market for Foreign Exchange98 Questions

Exam 6: International Parity Relationships and Forecasting Foreign Exchange Rates100 Questions

Exam 7: Futures and Options on Foreign Exchange100 Questions

Exam 8: Management of Transaction Exposure98 Questions

Exam 9: Management of Economic Exposure100 Questions

Exam 10: Management of Translation Exposure81 Questions

Exam 11: International Banking and Money Market103 Questions

Exam 12: International Bond Market100 Questions

Exam 13: International Equity Markets100 Questions

Exam 14: Interest Rate and Currency Swaps100 Questions

Exam 15: International Portfolio Investment101 Questions

Exam 16: Foreign Direct Investment and Cross-Border Acquisitions100 Questions

Exam 17: International Capital Structure and the Cost of Capital100 Questions

Exam 18: International Capital Budgeting102 Questions

Exam 19: Multinational Cash Management100 Questions

Exam 20: International Trade Finance100 Questions

Exam 21: International Tax Environment and Transfer Pricing99 Questions

Select questions type

As of today, the spot exchange rate is €1.00 = $1.25 and the rates of inflation expected to prevail for the next year in the U.S. is 2% and 3% in the euro zone. What is the one-year forward rate that should prevail?

(Multiple Choice)

4.9/5  (42)

(42)

With regard to fundamental forecasting versus technical forecasting of exchange rates

(Multiple Choice)

4.8/5  (37)

(37)

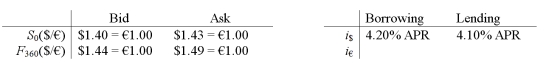

If you borrowed $1,000,000 for one year, how much money would you owe at maturity?

(Essay)

4.8/5  (35)

(35)

If you had borrowed $1,000,000 and traded for euro at the spot rate, how many € do you receive?

(Essay)

5.0/5  (39)

(39)

How high does the lending rate in the euro zone have to be before an arbitrageur would NOT consider borrowing dollars, trading for euro at the spot, investing in the euro zone and hedging with a short position in the forward contract?

(Multiple Choice)

4.8/5  (38)

(38)

There is (at least) one profitable arbitrage at these prices. What is it?

(Essay)

4.9/5  (36)

(36)

If you had borrowed $1,000,000 and traded for euro at the spot rate, how many € do you receive?

(Essay)

4.9/5  (33)

(33)

USING YOUR PREVIOUS ANSWERS and a bit more work, find the 1-year forward exchange rate in $ per € that satisfies IRP from the perspective of a customer that borrowed $1m traded for € at the spot and invested at i€ = 4%.

(Essay)

4.8/5  (38)

(38)

If you borrowed €1,000,000 for one year, how much money would you owe at maturity?

(Essay)

4.7/5  (32)

(32)

If you had €1,000,000 and traded it for USD at the spot rate, how many USD will you get?

(Essay)

4.7/5  (38)

(38)

According to the research in the accuracy of paid exchange rate forecasters,

(Multiple Choice)

4.9/5  (45)

(45)

USING YOUR PREVIOUS ANSWERS and a bit more work, find the 1-year forward ASK exchange rate in $ per € that that satisfies IRP from the perspective of a customer.

(Essay)

4.9/5  (37)

(37)

An Italian currency dealer has good credit and can borrow €800,000 for one year. The one-year interest rate in the U.S. is i$ = 2% and in the euro zone the one-year interest rate is i€ = 6%. The spot exchange rate is $1.25 = €1.00 and the one-year forward exchange rate is $1.20 = €1.00. Show how to realize a certain euro-denominated profit via covered interest arbitrage.

(Multiple Choice)

4.9/5  (33)

(33)

There is (at least) one profitable arbitrage at these prices. What is it?

(Essay)

4.9/5  (27)

(27)

Some commodities never enter into international trade. Examples include

(Multiple Choice)

4.7/5  (46)

(46)

Showing 21 - 40 of 100

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)