Exam 5: Extension: Decision Theory

Exam 1: Introduction to Operations Management74 Questions

Exam 2: Competitiveness, Strategy, and Productivity72 Questions

Exam 3: Forecasting164 Questions

Exam 4: Product and Service Design76 Questions

Exam 4: Extension: Reliability12 Questions

Exam 5: Strategic Capacity Planning for Products and Services106 Questions

Exam 5: Extension: Decision Theory123 Questions

Exam 6: Process Selection and Facility Layout150 Questions

Exam 7: Work Design and Measurement151 Questions

Exam 7: Extension: Learning Curves68 Questions

Exam 8: Location Planning and Analysis80 Questions

Exam 8: Extension: The Transportation Model20 Questions

Exam 9: Management of Quality102 Questions

Exam 10: Quality Control141 Questions

Exam 10: Extension: Acceptance Sampling65 Questions

Exam 11: Aggregate Planning and Master Scheduling88 Questions

Exam 12: MRP and ERP89 Questions

Exam 13: Inventory Management161 Questions

Exam 14: Jit and Lean Operations87 Questions

Exam 14: Extension: Maintenance38 Questions

Exam 15: Supply Chain Management89 Questions

Exam 16: Scheduling134 Questions

Exam 17: Project Management137 Questions

Exam 18: Management of Waiting Lines81 Questions

Exam 19: Linear Programming111 Questions

Select questions type

Consider the following decision scenario: Alternative State of Nature \#1 \#2 \#3 \#4 A 1 0 1 6 B 1 5 4 2 C 3 2 2 3 If you feel that P(#1) = .4, P(#2) = .3, P(#3) = .2, and P(#4) = .1, what is your expected payoff under certainty?

Free

(Short Answer)

4.9/5  (38)

(38)

Correct Answer:

EPC = 4.1

Consider the following decision scenario: State of Nature Yes No Small \ 1 30 Medium 20 40 Med.-Large 30 45 Large 40 35 Ex-Large 60 20 *PV for profits ($000) If yes and no are equally likely, which alternative has the largest expected monetary value?

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

E

Option A has a payoff of $10,000 in environment 1 and $20,000 in environment 2. Option B has a payoff of $5,000 in environment 1 and $27,500 in environment 2. Once the probability of environment 1 exceeds ______, option A becomes the better choice.

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

E

In a decision-making setting, if the manager has to contend with limits on the amount of information he or she can consider, this __________ can lead to a poor decision.

(Multiple Choice)

4.8/5  (44)

(44)

Option A has an expected value of $2,000, a minimum payoff of -$4,000, and a maximum payoff of $18,000. Option B has an expected value of $2,200, a minimum payoff of -$1,000, and a maximum payoff of $6,000. Option C has an expected value of $1,900, a minimum payoff of $100, and a maximum payoff of $2,000. In this situation, a risk-averse decision maker would pay __________ for his risk aversion, and a risk-seeking decision maker would pay __________ for his risk seeking.

(Multiple Choice)

4.9/5  (38)

(38)

Consider the following decision scenario: Alternative State of Nature \#1 \#2 \#3 \#4 A 1 0 1 6 B 1 5 4 2 C 3 2 2 3 If you feel that P(#1) = .4, P(#2) = .3, P(#3) = .2, and P(#4) = .1, which alternative will you select?

(Short Answer)

4.9/5  (30)

(30)

The operations manager for a local bus company wants to decide whether he should purchase a small, medium, or large new bus for his company. He estimates that the annual profits (in $000) will vary depending upon whether passenger demand is low, medium, or high, as follows: Bus DEMAND LOW MEDIUM HIGH Small 50 60 70 Medium 40 80 90 Large 20 50 120 If he feels the chances of low, medium, and high demand are 30 percent, 30 percent, and 40 percent respectively, what is the expected annual profit for the bus that he will decide to purchase?

(Multiple Choice)

4.8/5  (41)

(41)

Among decision environments, uncertainty implies that states of nature have wide-ranging probabilities associated with them.

(True/False)

4.9/5  (34)

(34)

The term "sensitivity analysis" is most closely associated with:

(Multiple Choice)

4.8/5  (41)

(41)

Decision trees, with their predetermined analysis of a situation, are really not useful in making health care decisions since every person is unique.

(True/False)

4.9/5  (44)

(44)

The operations manager for a well-drilling company must recommend whether to build a new facility, expand his existing one, or do nothing. He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows: ALTERNATIVE PRECIPITATION LOW NORMAL HIGH Do Nothing -100 100 300 Expand 350 500 200 Build New 750 300 0 If he uses the maximax criterion, which alternative will he decide to select?

(Multiple Choice)

4.7/5  (32)

(32)

The local operations manager for the Internal Revenue Service must decide whether to hire one, two, or three temporary tax examiners for the upcoming tax season. She estimates that net revenues (in thousands of dollars) will vary with how well taxpayers comply with the new tax code just passed by Congress, as follows: NUMBER OF EXAMINERS COMPLIANCE LOW NORMAL HIGH One 50 50 50 Two 100 60 20 Three 150 70 -10 If she uses the minimax regret criterion, how many new examiners will she decide to hire?

(Multiple Choice)

4.9/5  (39)

(39)

One local hospital has just enough space and funds currently available to start either a cancer or heart research lab. If administration decides on the cancer lab, there is a 20 percent chance of getting $100,000 in outside funding from the American Cancer Society next year, and an 80 percent chance of getting nothing. If the cancer research lab is funded the first year, no additional outside funding will be available the second year. However, if it is not funded the first year, then management estimates the chances are 50 percent it will get $100,000 the following year, and 50 percent that it will get nothing again. If, however, the hospital's management decides to go with the heart lab, then there is a 50 percent chance of getting $50,000 in outside funding from the American Heart Association the first year and a 50 percent change of getting nothing. If the heart lab is funded the first year, management estimates a 40 percent chance of getting another $50,000 and a 60 percent chance of getting nothing additional the second year. If it is not funded the first year, then management estimates a 60 percent chance for getting $50,000 and a 40 percent chance for getting nothing in the following year. For both the cancer and heart research labs, no further possible funding is anticipated beyond the first two years. What is the expected value for the optimum decision alternative?

(Multiple Choice)

4.7/5  (30)

(30)

Consider the following decision scenario: Alternative State of Nature \#1 \#2 \#3 \#4 A 1 0 1 6 B 1 5 4 2 C 3 2 2 3 If you feel that P(#1) = .4, P(#2) = .3, P(#3) = .2, and P(#4) = .1, what is your expected value of perfect information?

(Short Answer)

4.9/5  (41)

(41)

Expected monetary value gives the long-run average payoff if a large number of identical decisions could be made.

(True/False)

4.7/5  (41)

(41)

The new owner of a beauty shop is trying to decide whether to hire one, two, or three beauticians. She estimates that profits next year (in thousands of dollars) will vary with demand for her services, and she has estimated demand in three categories, low, medium, and high. NUMBER OF BEAUTICIANS DEMAND LOW MEDIUM HIGH One 50 75 100 Two 0 100 100 Three -100 70 300 If she uses the maximax criterion, how many beauticians will she decide to hire?

(Multiple Choice)

4.8/5  (41)

(41)

Consider the following decision scenario: State of Nature Yes No Small \ 1 30 Medium 20 40 Med.-Large 30 45 Large 40 35 Ex-Large 60 20 *PV for profits ($000) The maximin strategy would be:

(Multiple Choice)

4.8/5  (35)

(35)

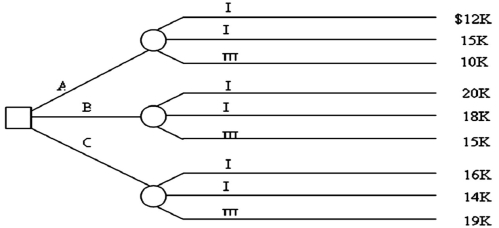

A manager is quite concerned about the recent deterioration of a section of the roof on a building that houses her firm's computer operations. According to her assistant there are three options which merit consideration: A, B, and C. Moreover, there are three possible future conditions that must be included in the analysis: I, which has a probability of occurrence of .5; II, which has a probability of .3; and III, which has a probability of .2.

If condition I materializes, A will cost $12,000, B will cost $20,000, and C will cost $16,000. If condition II materializes, the costs will be $15,000 for A, $18,000 for B, and $14,000 for C. If condition III materializes, the costs will be $10,000 for A, $15,000 for B, and $19,000 for C.

(A) Draw a decision tree for this problem.

(B) Using expected monetary value, which alternative should be chosen?

(Short Answer)

4.9/5  (34)

(34)

Showing 1 - 20 of 123

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)