Exam 12: Differential Analysis: The Key to Decision Making

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

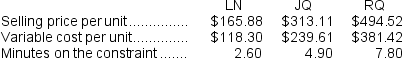

An automated turning machine is the current constraint at Jordison Corporation.Three products use this constrained resource.Data concerning those products appear below:

Rank the products in order of their current profitability from most profitable to least profitable.In other words,rank the products in the order in which they should be emphasized.

Rank the products in order of their current profitability from most profitable to least profitable.In other words,rank the products in the order in which they should be emphasized.

(Multiple Choice)

4.9/5  (37)

(37)

Holton Company makes three products in a single facility.Data concerning these products follow:

The mixing machines are potentially the constraint in the production facility.A total of 14,700 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

Required:

a.How many minutes of mixing machine time would be required to satisfy demand for all three products?

b.How much of each product should be produced to maximize net operating income? (Round off to the nearest whole unit.)

c.Up to how much should the company be willing to pay for one additional hour of mixing machine time if the company has made the best use of the existing mixing machine capacity? (Round off to the nearest whole cent.)

The mixing machines are potentially the constraint in the production facility.A total of 14,700 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

Required:

a.How many minutes of mixing machine time would be required to satisfy demand for all three products?

b.How much of each product should be produced to maximize net operating income? (Round off to the nearest whole unit.)

c.Up to how much should the company be willing to pay for one additional hour of mixing machine time if the company has made the best use of the existing mixing machine capacity? (Round off to the nearest whole cent.)

(Essay)

4.7/5  (40)

(40)

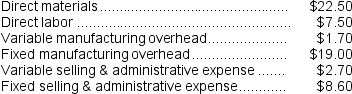

Bruce Corporation makes four products in a single facility. These products have the following unit product costs:

Additional data concerning these products are listed below.

Additional data concerning these products are listed below.

The grinding machines are potentially the constraint in the production facility. A total of 9,800 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

-Which product makes the MOST profitable use of the grinding machines?

The grinding machines are potentially the constraint in the production facility. A total of 9,800 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

-Which product makes the MOST profitable use of the grinding machines?

(Multiple Choice)

4.7/5  (36)

(36)

CoolAir Corporation manufactures portable window air conditioners.CoolAir has the capacity to manufacture and sell 80,000 air conditioners each year but is currently only manufacturing and selling 60,000.The following per unit numbers relate to annual operations at 60,000 units:

The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each.Variable selling and administrative costs on this special order will drop down to $2 per unit.This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs.The annual financial advantage (disadvantage)for the company as a result of accepting this special order from the City of Clearwater should be:

The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each.Variable selling and administrative costs on this special order will drop down to $2 per unit.This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs.The annual financial advantage (disadvantage)for the company as a result of accepting this special order from the City of Clearwater should be:

(Multiple Choice)

4.9/5  (35)

(35)

Hodge Inc.has some material that originally cost $74,600.The material has a scrap value of $57,400 as is,but if reworked at a cost of $1,500,it could be sold for $54,400.What would be the financial advantage (disadvantage)of reworking and selling the material rather than selling it as is as scrap?

(Multiple Choice)

4.9/5  (40)

(40)

In a factory operating at capacity,every machine and person should be working at the maximum possible rate.

(True/False)

4.8/5  (40)

(40)

The Wyeth Corporation produces three products,A,B,and C,from a single raw material input.Product A can be sold at the splitoff point for $40,000,or it can be processed further at a total cost of $15,000 and then sold for $58,000.Joint costs total $60,000 annually.Product A should be:

(Multiple Choice)

4.9/5  (41)

(41)

Elfalan Corporation produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 80,000 units per month is as follows:

The normal selling price of the product is $67.80 per unit.

An order has been received from an overseas customer for 3,000 units to be delivered this month at a special discounted price. This order would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $1.90 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

-What is the contribution margin per unit on normal sales?

The normal selling price of the product is $67.80 per unit.

An order has been received from an overseas customer for 3,000 units to be delivered this month at a special discounted price. This order would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $1.90 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

-What is the contribution margin per unit on normal sales?

(Multiple Choice)

4.9/5  (38)

(38)

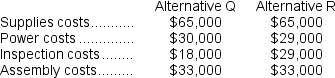

Costs associated with two alternatives,code-named Q and R,being considered by Albiston Corporation are listed below:

Required:

a.Which costs are relevant and which are not relevant in the choice between these two alternatives?

b.What is the differential cost between the two alternatives?

Required:

a.Which costs are relevant and which are not relevant in the choice between these two alternatives?

b.What is the differential cost between the two alternatives?

(Essay)

4.9/5  (33)

(33)

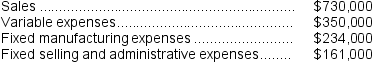

Product U23N has been considered a drag on profits at Jinkerson Corporation for some time and management is considering discontinuing the product altogether.Data from the company's budget for the upcoming year appear below:

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage)for the company of eliminating this product for the upcoming year would be:

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage)for the company of eliminating this product for the upcoming year would be:

(Multiple Choice)

4.7/5  (43)

(43)

Key Corporation is considering the addition of a new product. The expected cost and revenue data for the new product are as follows:

If the new product is added, the combined contribution margin of the other, existing products is expected to drop $65,000 per year. Total common fixed corporate costs would be unaffected by the decision of whether to add the new product.

-If the new product is added next year,the financial advantage (disadvantage)resulting from this decision would be:

If the new product is added, the combined contribution margin of the other, existing products is expected to drop $65,000 per year. Total common fixed corporate costs would be unaffected by the decision of whether to add the new product.

-If the new product is added next year,the financial advantage (disadvantage)resulting from this decision would be:

(Multiple Choice)

4.9/5  (44)

(44)

A cost that will be incurred regardless of which alternative is selected is not relevant when choosing between the alternatives.

(True/False)

4.9/5  (38)

(38)

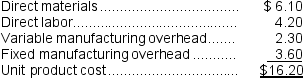

Gallerani Corporation has received a request for a special order of 6,000 units of product A90 for $21.20 each.Product A90's unit product cost is $16.20,determined as follows:

Assume that direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.The annual financial advantage (disadvantage)for the company as a result of accepting this special order should be:

Assume that direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.The annual financial advantage (disadvantage)for the company as a result of accepting this special order should be:

(Multiple Choice)

4.8/5  (24)

(24)

The Jabba Corporation manufactures the "Snack Buster" which consists of a wooden snack chip bowl with an attached porcelain dip bowl.Which of the following would be relevant in Jabba's decision to make the dip bowls or buy them from an outside supplier?

(Short Answer)

4.9/5  (30)

(30)

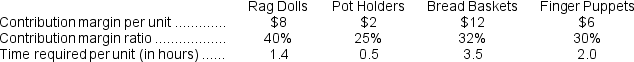

Danny Dolittle makes crafts in his spare time and always sells everything he makes at local craft shows.Danny specializes in four products.Because Danny's time is limited before the next craft show,he is trying to decide how to use his time to the best advantage.Information related to the four products that Danny produces are shown below:

Rank the products from the most profitable to the least profitable use of the constrained resource.

Rank the products from the most profitable to the least profitable use of the constrained resource.

(Multiple Choice)

4.9/5  (36)

(36)

Companies often allocate common fixed costs among segments.For example,common fixed corporate costs are often allocated to divisions and appear as part of the divisional performance reports.

Required:

What dangers are there in allocating common fixed costs to segments when involved in a decision to possibly drop a segment such as a product or a division?

(Essay)

4.8/5  (40)

(40)

The Carter Corporation makes products A and B in a joint process from a single input, R. During a typical production run, 50,000 units of R yield 20,000 units of A and 30,000 units of B at the split-off point. Joint production costs total $90,000 per production run. The unit selling price for A is $4.00 and for B is $3.80 at the split-off point. However, B can be processed further at a total cost of $60,000 and then sold for $7.00 per unit.

-In a decision between selling B at the split-off point or processing B further,which of the following items is not relevant:

(Multiple Choice)

4.8/5  (37)

(37)

United Industries manufactures a number of products at its highly automated factory.The products are very popular,with demand far exceeding the factory's capacity.To maximize profit,management should rank products based on their:

(Multiple Choice)

4.7/5  (36)

(36)

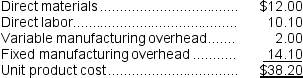

Foto Company makes 50,000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $37.30 a unit.If the company accepts this offer,the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $310,000 per year.

If the part were purchased from the outside supplier,all of the direct labor cost of the part would be avoided.However,$9.70 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

Required:

a.How much of the unit product cost of $38.20 is relevant in the decision of whether to make or buy the part?

b.What is the financial advantage (disadvantage)of purchasing the part rather than making it?

c.What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 50,000 units required each year?

An outside supplier has offered to sell the company all of these parts it needs for $37.30 a unit.If the company accepts this offer,the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $310,000 per year.

If the part were purchased from the outside supplier,all of the direct labor cost of the part would be avoided.However,$9.70 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

Required:

a.How much of the unit product cost of $38.20 is relevant in the decision of whether to make or buy the part?

b.What is the financial advantage (disadvantage)of purchasing the part rather than making it?

c.What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 50,000 units required each year?

(Essay)

4.9/5  (40)

(40)

Younes Inc. manufactures industrial components. One of its products, which is used in the construction of industrial air conditioners, is known as P06. Data concerning this product are given below:

The above per unit data are based on annual production of 4,000 units of the component. Assume that direct labor is a variable cost.

-Refer to the original data in the problem.What is the current contribution margin per unit for component P06 based on its selling price of $220 and its annual production of 4,000 units?

The above per unit data are based on annual production of 4,000 units of the component. Assume that direct labor is a variable cost.

-Refer to the original data in the problem.What is the current contribution margin per unit for component P06 based on its selling price of $220 and its annual production of 4,000 units?

(Multiple Choice)

4.9/5  (42)

(42)

Showing 81 - 100 of 203

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)