Exam 27: Service Department Charges

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

For performance evaluation purposes,the actual fixed costs of a service department should be charged to the departments that consume the service in proportion to the actual services provided to the consuming departments during the period.

(True/False)

4.9/5  (40)

(40)

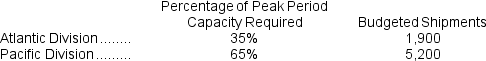

Erholm Corporation has two operating divisions--an Atlantic Division and a Pacific Division.The company's Logistics Department services both divisions.The variable costs of the Logistics Department are budgeted at $31 per shipment.The Logistics Department's fixed costs are budgeted at $411,800 for the year.The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year,actual Logistics Department variable costs totaled $290,700 and fixed costs totaled $431,950.The Atlantic Division had a total of 3,900 shipments and the Pacific Division had a total of 5,100 shipments for the year.How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?

At the end of the year,actual Logistics Department variable costs totaled $290,700 and fixed costs totaled $431,950.The Atlantic Division had a total of 3,900 shipments and the Pacific Division had a total of 5,100 shipments for the year.How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?

(Multiple Choice)

4.7/5  (29)

(29)

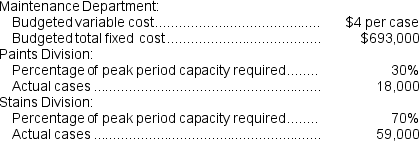

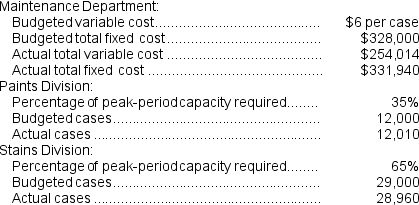

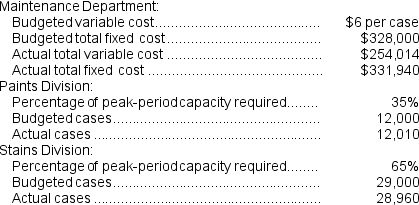

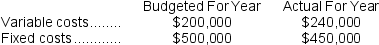

Mangiamele Corporation's Maintenance Department provides services to the company's two operating divisions--the Paints Division and the Stains Division.The variable costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments.The fixed costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments during the peak period.Data appear below:

For performance evaluation purposes,how much Maintenance Department cost should be charged to the Paints Division at the end of the year?

For performance evaluation purposes,how much Maintenance Department cost should be charged to the Paints Division at the end of the year?

(Multiple Choice)

4.9/5  (40)

(40)

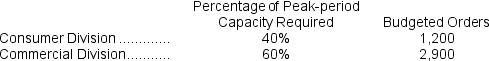

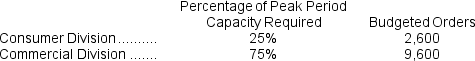

(Appendix 11B) Azotea Corporation has two operating divisions--a Consumer Division and a Commercial Division. The company's Order Fulfillment Department provides services to both divisions. The variable costs of the Order Fulfillment Department are budgeted at $56 per order. The Order Fulfillment Department's fixed costs are budgeted at $233,700 for the year. The fixed costs of the Order Fulfillment Department are budgeted based on the peak-period orders.

At the end of the year, actual Order Fulfillment Department variable costs totaled $237,390 and fixed costs totaled $239,140. The Consumer Division had a total of 1,240 orders and the Commercial Division had a total of 2,860 orders for the year.

-How much actual Order Fulfillment Department cost should not be allocated to the operating divisions at the end of the year?

At the end of the year, actual Order Fulfillment Department variable costs totaled $237,390 and fixed costs totaled $239,140. The Consumer Division had a total of 1,240 orders and the Commercial Division had a total of 2,860 orders for the year.

-How much actual Order Fulfillment Department cost should not be allocated to the operating divisions at the end of the year?

(Multiple Choice)

4.9/5  (46)

(46)

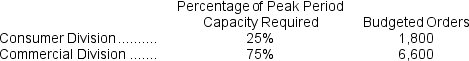

Levar Corporation has two operating divisions--a Consumer Division and a Commercial Division.The company's Order Fulfillment Department provides services to both divisions.The variable costs of the Order Fulfillment Department are budgeted at $73 per order.The Order Fulfillment Department's fixed costs are budgeted at $470,400 for the year.The fixed costs of the Order Fulfillment Department are determined based on the peak period orders.  At the end of the year,actual Order Fulfillment Department variable costs totaled $621,600 and fixed costs totaled $473,970.The Consumer Division had a total of 1,840 orders and the Commercial Division had a total of 6,560 orders for the year.For purposes of evaluation performance,how much Order Fulfillment Department cost should be charged to the Commercial Division at the end of the year?

At the end of the year,actual Order Fulfillment Department variable costs totaled $621,600 and fixed costs totaled $473,970.The Consumer Division had a total of 1,840 orders and the Commercial Division had a total of 6,560 orders for the year.For purposes of evaluation performance,how much Order Fulfillment Department cost should be charged to the Commercial Division at the end of the year?

(Multiple Choice)

4.9/5  (42)

(42)

Schabel Corporation has two operating divisions--a Consumer Division and a Commercial Division.The company's Customer Service Department provides services to both divisions.The variable costs of the Customer Service Department are budgeted at $72 per order.The Customer Service Department's fixed costs are budgeted at $695,400 for the year.The fixed costs of the Customer Service Department are determined based on the peak period orders.  At the end of the year,actual Customer Service Department variable costs totaled $891,089 and fixed costs totaled $709,820.The Consumer Division had a total of 2,610 orders and the Commercial Division had a total of 9,580 orders for the year.For performance evaluation purposes,how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?

At the end of the year,actual Customer Service Department variable costs totaled $891,089 and fixed costs totaled $709,820.The Consumer Division had a total of 2,610 orders and the Commercial Division had a total of 9,580 orders for the year.For performance evaluation purposes,how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?

(Multiple Choice)

4.9/5  (35)

(35)

For performance evaluation purposes,the fixed costs of a service department should be charged to operating departments using:

(Multiple Choice)

5.0/5  (36)

(36)

(Appendix 11B) The Downstate Block Company has a trucking department that delivers crushed stone from the company's quarry to its two cement block production facilities--the West Plant and the East Plant. Budgeted costs for the trucking department are $700,000 per year in fixed costs and $0.50 per ton variable cost. Last year, 75,000 tons of crushed stone were budgeted to be delivered to the West Plant and 90,000 tons of crushed stone to the East Plant. During the year, the trucking department actually delivered 74,000 tons of crushed stone to the West Plant and 92,000 tons to the East Plant. Its actual costs for the year were $81,000 variable and $708,000 fixed. The level of budgeted fixed costs is determined by peak-period requirements. The West Plant requires 45% of the peak-period capacity and the East Plant requires 55%. The company allocates fixed and variable costs separately.

-How much fixed trucking department cost should be charged to the West Plant at the end of the year?

(Multiple Choice)

4.8/5  (34)

(34)

(Appendix 11B) The Downstate Block Company has a trucking department that delivers crushed stone from the company's quarry to its two cement block production facilities--the West Plant and the East Plant. Budgeted costs for the trucking department are $700,000 per year in fixed costs and $0.50 per ton variable cost. Last year, 75,000 tons of crushed stone were budgeted to be delivered to the West Plant and 90,000 tons of crushed stone to the East Plant. During the year, the trucking department actually delivered 74,000 tons of crushed stone to the West Plant and 92,000 tons to the East Plant. Its actual costs for the year were $81,000 variable and $708,000 fixed. The level of budgeted fixed costs is determined by peak-period requirements. The West Plant requires 45% of the peak-period capacity and the East Plant requires 55%. The company allocates fixed and variable costs separately.

-For performance evaluation purposes,how much of the actual trucking department cost should not be charged to the plants at the end of the year?

(Multiple Choice)

4.8/5  (32)

(32)

For performance evaluation purposes,variable service department costs should be charged to operating departments in predetermined,lump-sum amounts.

(True/False)

4.9/5  (40)

(40)

(Appendix 11B) Frame Corporation's Maintenance Department provides services to the company's two operating divisions--the Paints Division and the Stains Division. The variable costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments. The fixed costs of the Maintenance Department are determined by the number of cases produced by the operating departments during the peak-period. Data appear below:

-How much Maintenance Department cost should be allocated to the Stains Division at the end of the year?

-How much Maintenance Department cost should be allocated to the Stains Division at the end of the year?

(Multiple Choice)

4.7/5  (37)

(37)

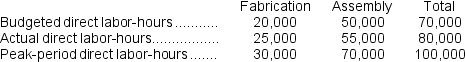

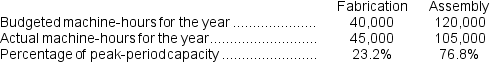

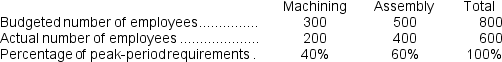

(Appendix 11B) Nafth Company has an Equipment Services Department that performs all needed maintenance work on the equipment in the company's Fabrication and Assembly Departments. Costs of the equipment Services Department are charged to the Fabrication and Assembly Departments on the basis of direct labor-hours. Data on direct labor-hours for last year follow:

For the year just ended, the company budgeted its variable maintenance costs at $210,000 for the year. Actual variable maintenance costs for the year totaled $255,000.

-How much (if any)of the $255,000 in variable maintenance cost should not be charged to the Fabrication and Assembly Departments?

For the year just ended, the company budgeted its variable maintenance costs at $210,000 for the year. Actual variable maintenance costs for the year totaled $255,000.

-How much (if any)of the $255,000 in variable maintenance cost should not be charged to the Fabrication and Assembly Departments?

(Multiple Choice)

4.8/5  (43)

(43)

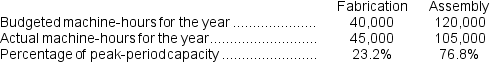

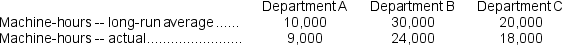

(Appendix 11B) Ghia Manufacturing Corporation charges its Maintenance Department's service costs to two operating departments, Fabrication and Assembly. Charges are made on the basis of machine-hours. Information pertaining to machine-hours for the year follows:

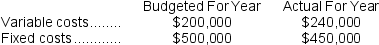

The following costs pertain to the Maintenance Department:

The following costs pertain to the Maintenance Department:

-For performance evaluation purposes,how much of the Maintenance Department's fixed cost should be charged to the Assembly Department at year-end?

-For performance evaluation purposes,how much of the Maintenance Department's fixed cost should be charged to the Assembly Department at year-end?

(Multiple Choice)

4.8/5  (36)

(36)

(Appendix 11B) Frame Corporation's Maintenance Department provides services to the company's two operating divisions--the Paints Division and the Stains Division. The variable costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments. The fixed costs of the Maintenance Department are determined by the number of cases produced by the operating departments during the peak-period. Data appear below:

-How much actual Maintenance Department cost should not be allocated to the operating divisions at the end of the year?

-How much actual Maintenance Department cost should not be allocated to the operating divisions at the end of the year?

(Multiple Choice)

4.9/5  (30)

(30)

In service department cost allocations,sales dollars should be used as an allocation base whenever possible.

(True/False)

4.8/5  (33)

(33)

Fox Company has the following data concerning the machine-hours in its operating departments:

Fixed costs of the maintenance department are budgeted at $30,000 per year.The fixed maintenance costs are incurred in order to service long-run average demand.The actual fixed maintenance cost was actually $32,000.How much fixed maintenance cost should be charged to Department B at the end of the year for performance evaluation purposes?

Fixed costs of the maintenance department are budgeted at $30,000 per year.The fixed maintenance costs are incurred in order to service long-run average demand.The actual fixed maintenance cost was actually $32,000.How much fixed maintenance cost should be charged to Department B at the end of the year for performance evaluation purposes?

(Multiple Choice)

4.7/5  (42)

(42)

(Appendix 11B) Ghia Manufacturing Corporation charges its Maintenance Department's service costs to two operating departments, Fabrication and Assembly. Charges are made on the basis of machine-hours. Information pertaining to machine-hours for the year follows:

The following costs pertain to the Maintenance Department:

The following costs pertain to the Maintenance Department:

-For performance evaluation purposes,how much of the Maintenance Department's variable cost should be charged to the Fabrication Department at year-end?

-For performance evaluation purposes,how much of the Maintenance Department's variable cost should be charged to the Fabrication Department at year-end?

(Multiple Choice)

4.8/5  (29)

(29)

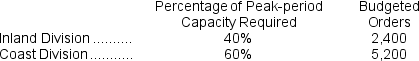

Sauseda Corporation has two operating divisions--an Inland Division and a Coast Division.The company's Customer Service Department provides services to both divisions.The variable costs of the Customer Service Department are budgeted at $38 per order.The Customer Service Department's fixed costs are budgeted at $433,200 for the year.The fixed costs of the Customer Service Department are determined based on the peak-period orders.

At the end of the year,actual Customer Service Department variable costs totaled $303,240 and fixed costs totaled $450,280.The Inland Division had a total of 2,430 orders and the Coast Division had a total of 5,170 orders for the year.

Required:

a.Prepare a report showing how much of the Customer Service Department's costs should be charged to each of the operating divisions at the end of the year.

b.How much of the actual Customer Service Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

At the end of the year,actual Customer Service Department variable costs totaled $303,240 and fixed costs totaled $450,280.The Inland Division had a total of 2,430 orders and the Coast Division had a total of 5,170 orders for the year.

Required:

a.Prepare a report showing how much of the Customer Service Department's costs should be charged to each of the operating divisions at the end of the year.

b.How much of the actual Customer Service Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

(Essay)

4.7/5  (38)

(38)

(Appendix 11B) The Downstate Block Company has a trucking department that delivers crushed stone from the company's quarry to its two cement block production facilities--the West Plant and the East Plant. Budgeted costs for the trucking department are $700,000 per year in fixed costs and $0.50 per ton variable cost. Last year, 75,000 tons of crushed stone were budgeted to be delivered to the West Plant and 90,000 tons of crushed stone to the East Plant. During the year, the trucking department actually delivered 74,000 tons of crushed stone to the West Plant and 92,000 tons to the East Plant. Its actual costs for the year were $81,000 variable and $708,000 fixed. The level of budgeted fixed costs is determined by peak-period requirements. The West Plant requires 45% of the peak-period capacity and the East Plant requires 55%. The company allocates fixed and variable costs separately.

-How much variable trucking department cost should be charged to the West Plant at the end of the year?

(Multiple Choice)

4.8/5  (36)

(36)

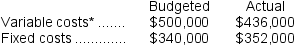

Leslie Company operates a cafeteria for the benefit of its employees.The company subsidizes the cafeteria heavily by allowing employees to purchase meals at greatly reduced prices.Budgeted and actual costs in the cafeteria for the year just ended are as follows:

*Unrecovered cost after deducting amounts received from employees.

Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments.Fixed costs are charged on the basis of the percentage of peak-period requirements.Data concerning the company's producing departments follows:

*Unrecovered cost after deducting amounts received from employees.

Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments.Fixed costs are charged on the basis of the percentage of peak-period requirements.Data concerning the company's producing departments follows:

Required:

a.Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.

b.Identify the amount,if any,of actual costs that should not be charged to the operating departments.

Required:

a.Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.

b.Identify the amount,if any,of actual costs that should not be charged to the operating departments.

(Essay)

4.7/5  (31)

(31)

Showing 21 - 40 of 44

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)