Exam 10: Responsibility Accounting,performance Evaluation,and Transfer Pricing

Exam 1: A: Basic Cost Management Concepts239 Questions

Exam 1: B: Basic Cost Management Concepts32 Questions

Exam 2: Cost Behaviour122 Questions

Exam 3: Cost-Volume-Profit Analysis107 Questions

Exam 4: Job-Order Costing Systems102 Questions

Exam 5: Process Costing132 Questions

Exam 6: Activity-Based Costing164 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products137 Questions

Exam 8: Budgeting for Planning and Control154 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach86 Questions

Exam 10: Responsibility Accounting,performance Evaluation,and Transfer Pricing110 Questions

Exam 11: Tactical Decision Making100 Questions

Exam 12: Pricing and Profitability Analysis102 Questions

Exam 13: Strategic Cost Management120 Questions

Exam 14: Activity-Based Management116 Questions

Exam 15: The Balanced Scorecard: Strategic-Based Control94 Questions

Exam 16: Quality and Environmental Cost Management157 Questions

Exam 17: Lean Accounting and Productivity Measurement138 Questions

Exam 18: Inventory Management: Economic Order Quantity,jit,and the Theory of Constraints97 Questions

Select questions type

Why might it be misleading to compare the ROI of international divisions?

Free

(Multiple Choice)

5.0/5  (28)

(28)

Correct Answer:

D

Bernie Manufacturing Company has two divisions,X and Y.Division X prepares the steel for processing.Division Y processes the steel into the final product.No inventories exist in either division at the beginning or end of the current year.During the year,Division X prepared 80,000 kgs.of steel at a cost of $800,000.All the steel was transferred to Division Y where additional operating costs of $5 per kg.were incurred.The final product was sold for $3,000,000.

a.Determine the gross profit for each division and for the company as a whole if the transfer price is $8 per kg.

b.Determine the gross profit for each division and for the company as a whole if the transfer price is $12 per kg.

Free

(Essay)

4.8/5  (33)

(33)

Correct Answer:

a.

b.

Which of the following is an example of an investment centre?

Free

(Multiple Choice)

4.7/5  (39)

(39)

Correct Answer:

B

It is important to separate the evaluation of a manager from the evaluation of his or her division in a multinational firm.What should be omitted from manager's evaluation?

(Multiple Choice)

4.8/5  (29)

(29)

Stevens Company has two divisions that report on a decentralized basis.Their results for the current year were as follows:

Halmet Ball Sales \ 150,000 \ 300,000 Income \ 15,000 \ 45,000 Asset base \ 7,000 \ 150,000 Weighted average cost of capital 12\% 12\% Compute the following amounts for each division:

a.Return on investment (ROI)if the desired rate of return is 12 percent.

b.Residual income if the desired rate of return is 20 percent.

c.EVA.

d.Turnover.

e.Margin for each division.

(Essay)

4.8/5  (38)

(38)

Under what conditions are multiple measures of performance beneficial?

(Multiple Choice)

4.8/5  (40)

(40)

The Auto Division of Big Department Store had a net income of $560,000,a net asset base of $4,000,000,and a required rate of return of 12 percent.Sales for the period totalled $3,000,000.What is the residual income for the period?

(Multiple Choice)

4.9/5  (36)

(36)

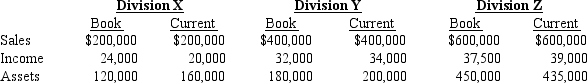

O'Neil Company requires a return on capital of 15 percent.The following information is available for the current year:

a.Compute return on investment using both book and current values for each division.(Round answer to three decimal places.)

b.Compute residual income for both book and current values for each division.

c.Does book value or current value provide the better basis for performance evaluation?

d.Which division do you consider the most successful?

a.Compute return on investment using both book and current values for each division.(Round answer to three decimal places.)

b.Compute residual income for both book and current values for each division.

c.Does book value or current value provide the better basis for performance evaluation?

d.Which division do you consider the most successful?

(Essay)

4.8/5  (37)

(37)

The following information pertains to the three divisions of Marlow Company: Sales ? ? 1,250,000 Net operating income \ 36,000 \ 25,000 \ 75,000 Average operating assets 300,000 ? ? Return on investment ? 20\% 15\% Margin 0.10 0.05 ? Turnover 1.5 ? ? Target ROI 15\% 12\% 10\% What is the residual income for Division X?

(Multiple Choice)

4.9/5  (31)

(31)

If the National Division of Canadian Products Company had a turnover ratio of 4.2 and a margin of 0.10,what would be the return on investment?

(Multiple Choice)

4.9/5  (48)

(48)

What exists when the major functions of an organization are controlled by top management?

(Multiple Choice)

4.8/5  (29)

(29)

Which of the following would be a reason for decentralization?

(Multiple Choice)

4.9/5  (33)

(33)

What is the term for the transfer price that would leave the buying division no worse off if an input is purchased from an internal division?

(Multiple Choice)

4.8/5  (39)

(39)

What type of responsibility centre would a manufacturing division of a company most likely be evaluated as?

(Multiple Choice)

4.9/5  (40)

(40)

The Engine Division provides engines for the Tractor Division of a company. The standard unit costs for Engine Division are as follows:

Direct materals \6 00 Direct labour 1,200 Variable overhead 300 Fixed overhead 150 Market price per unit 2,730

-Refer to the figure. The Engine Division has excess capacity.What is the best transfer price to avoid transfer price problems?

(Multiple Choice)

4.8/5  (33)

(33)

Showing 1 - 20 of 110

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)