Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes

Exam 1: The Equity Method of Accounting for Investments121 Questions

Exam 1: A: the Equity Method of Accounting for Investments121 Questions

Exam 2: Consolidation of Financial Information116 Questions

Exam 2: A: Consolidation of Financial Information116 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 3: A: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 4: A: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 5: A: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 6: A: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 7: A: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 8: Segment and Interim Reporting105 Questions

Exam 8: A: Segment and Interim Reporting115 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 9: A: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 10: Translation of Foreign Currency Financial Statements96 Questions

Exam 10: A: Translation of Foreign Currency Financial Statements96 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 11: A: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 12: A: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations75 Questions

Exam 13: A: Accounting for Legal Reorganizations and Liquidations78 Questions

Exam 14: Partnerships: Formation and Operation89 Questions

Exam 14: A: Partnerships: Formation and Operation89 Questions

Exam 15: Partnerships: Termination and Liquidation69 Questions

Exam 15: A: Partnerships: Termination and Liquidation69 Questions

Exam 16: Accounting for State and Local Governments, Part I83 Questions

Exam 16: A: Accounting for State and Local Governments, Part I83 Questions

Exam 17: Accounting for State and Local Governments, Part II42 Questions

Exam 17: A: Accounting for State and Local Governments, Part II47 Questions

Exam 18: Accounting for Not-For-Profit Entities72 Questions

Exam 18: A: Accounting for Not-For-Profit Entities72 Questions

Exam 19: Accounting for Estates and Trusts81 Questions

Exam 19: A: Accounting for Estates and Trusts81 Questions

Select questions type

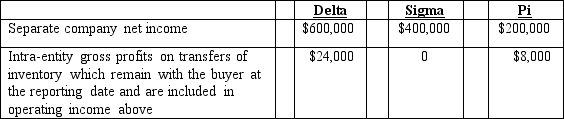

-What is the net income attributable to the noncontrolling interest in Sigma for 2018?

-What is the net income attributable to the noncontrolling interest in Sigma for 2018?

(Multiple Choice)

4.7/5  (28)

(28)

Strong Company has had poor operating results in recent years and has a $160,000 net operating loss carryforward.Leader Corp.pays $700,000 to acquire Strong and is optimistic about its future profitability potential.The book value and fair value of Strong's identifiable net assets is $500,000 at date of acquisition.Strong's tax rate is 30% and Leader's tax rate is 40%.What is goodwill resulting from this business acquisition?

(Multiple Choice)

4.8/5  (40)

(40)

On January 1, 2018, Youder Inc.bought 120,000 shares of Nopple Co.for $384,000, giving Youder 30% ownership and the ability to apply significant influence to the operating and financing decisions of Nopple.Youder anticipated holding this investment for an indefinite time.In making this acquisition, Youder paid an amount equal to the book value for these shares.The fair value of each asset and liability was the same as its book value.Dividends and income for Nopple for 2018 were as follows:

Dividends declared and paid: $ .40 per share

Income before income tax provision: $400,000

Required:

Assume a 40% income tax rate.Prepare all necessary journal entries for Youder for 2018 beginning at acquisition and ending at tax accrual.

(Essay)

4.9/5  (36)

(36)

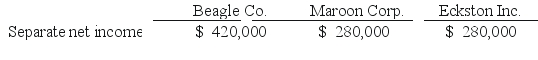

-The accrual-based net income of Maroon Corp.is calculated to be

-The accrual-based net income of Maroon Corp.is calculated to be

(Multiple Choice)

4.8/5  (33)

(33)

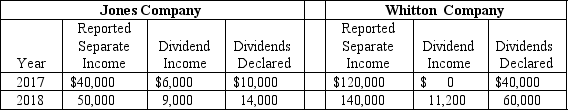

-What is the total net income attributable to the noncontrolling interests for 2018?

-What is the total net income attributable to the noncontrolling interests for 2018?

(Multiple Choice)

4.9/5  (33)

(33)

In a father-son-grandson combination, which of the following statements is true?

(Multiple Choice)

4.9/5  (36)

(36)

What ownership pattern is referred to as mutual ownership? Describe briefly or illustrate with a diagram.

(Essay)

4.8/5  (25)

(25)

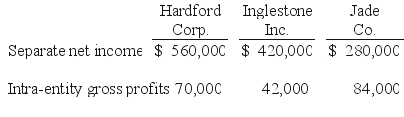

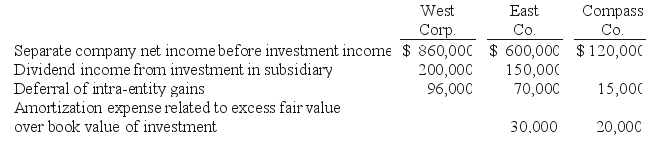

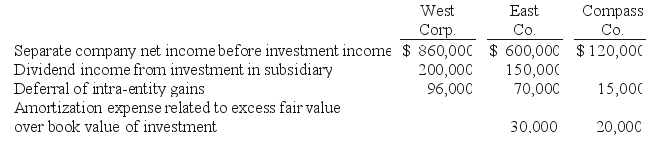

Hardford Corp. held 80% of Inglestone Inc., which, in turn, owned 80% of Jade Co. Excess amortization expense was not required by any of these acquisitions. Separate net income figures (without investment income) as well as upstream intra-entity gross profits (before deferral) included in the income for the current year follow:

-Which of the following statements is true regarding a subsidiary's investment in the parent company's stock?

-Which of the following statements is true regarding a subsidiary's investment in the parent company's stock?

(Multiple Choice)

4.7/5  (30)

(30)

How is the amortization of goodwill treated for income tax purposes? How does the amortization of goodwill affect deferred income taxes?

(Essay)

4.9/5  (39)

(39)

Required:

Determine the total amount of goodwill for the January 1, 2017 acquisition of Curle Co.and for the acquisition of Lance Co.on the same date.

(Essay)

4.9/5  (43)

(43)

-The accrual-based net income of West Corp.is calculated to be

-The accrual-based net income of West Corp.is calculated to be

(Multiple Choice)

4.8/5  (37)

(37)

Explain how the treasury stock approach treats shares of the parent's common stock that are owned by the subsidiary and the rationale behind the approach.

(Essay)

4.9/5  (39)

(39)

B Co.owned 70% of the voting common stock of C Corp.; C Corp.owned 20% of B Co.There were no excess-value allocations at the dates the investments were acquired.For 2018, B Co.and C Corp.reported net income (not including the investment) of $600,000 and $300,000, respectively.B Co.and C Corp.declared dividends of $80,000 and $60,000, respectively.

Required:

Prepare a schedule showing net income attributable to B Co.'s controlling interest for 2018 using the treasury stock approach.

(Essay)

4.8/5  (48)

(48)

Which of the following statements is true concerning connecting affiliations and mutual ownerships?

(Multiple Choice)

4.9/5  (36)

(36)

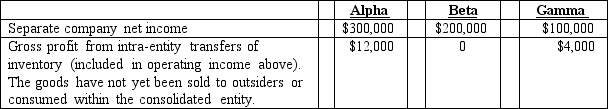

-For West Corp.and consolidated subsidiaries, what total amount would be reported for the net income attributable to the noncontrolling interest?

-For West Corp.and consolidated subsidiaries, what total amount would be reported for the net income attributable to the noncontrolling interest?

(Multiple Choice)

4.8/5  (29)

(29)

Why might a consolidated group file separate income tax returns?

(Multiple Choice)

4.8/5  (43)

(43)

-Compute the net income attributable to the noncontrolling interest for 2018.

-Compute the net income attributable to the noncontrolling interest for 2018.

(Multiple Choice)

4.7/5  (31)

(31)

Showing 41 - 60 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)