Exam 11: Performance and Strategy in Competitive Markets

Exam 1: Nature and Scope of Managerial Economics25 Questions

Exam 2: Economic Optimization45 Questions

Exam 3: Demand and Supply50 Questions

Exam 4: Demand Analysis46 Questions

Exam 5: Demand Estimation49 Questions

Exam 6: Forecasting50 Questions

Exam 7: Production Analysis and Compensation Policy50 Questions

Exam 8: Cost Analysis and Estimation50 Questions

Exam 9: Linear Programming32 Questions

Exam 10: Competitive Markets50 Questions

Exam 11: Performance and Strategy in Competitive Markets50 Questions

Exam 12: Monopoly and Monopsony50 Questions

Exam 13: Monopolistic Competition and Oligopoly48 Questions

Exam 14: Game Theory and Competitive Strategy37 Questions

Exam 15: Pricing Practices47 Questions

Exam 16: Risk Analysis47 Questions

Exam 17: Capital Budgeting50 Questions

Exam 18: Organization Structure and Corporate Governance50 Questions

Exam 19: Government in the Market Economy50 Questions

Select questions type

Who pays the economic cost of a tax is answered at the point of tax:

Free

(Multiple Choice)

5.0/5  (34)

(34)

Correct Answer:

A

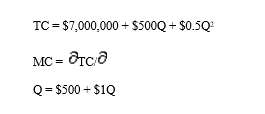

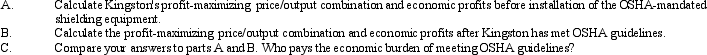

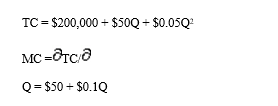

Regulation Costs. Kingston Components, Inc., produces electronic components for cable TV systems. Given vigorous import competition, prices are stable at $4,500 per unit in this dynamic and very competitive market. Kingston's annual total cost (TC) and marginal cost (MC) relations are:

where Q is output.

Suppose the Occupational Health and Safety Administration (OSHA) has recently ruled that the company must install expensive new shielding equipment to guard against worker injuries. This will increase the marginal cost of manufacturing by $100 per unit. Kingston's fixed expenses, which include a required return on investment, will be unaffected.

where Q is output.

Suppose the Occupational Health and Safety Administration (OSHA) has recently ruled that the company must install expensive new shielding equipment to guard against worker injuries. This will increase the marginal cost of manufacturing by $100 per unit. Kingston's fixed expenses, which include a required return on investment, will be unaffected.

(Essay)

4.8/5  (39)

(39)

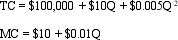

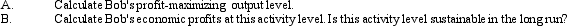

Competitive Strategy. Bob Ice owns and operates Bob's Music Center, Ltd., a small firm that offers music lessons in Huntsville, Alabama. Given the large number of competitors and the lack of entry barriers, it is reasonable to assume that the market for music lessons is perfectly competitive and that the average $60 per hour price equals marginal revenue, P = MR = $60. Assume that Bob's annual operating expenses are typical of several such firms and individuals operating in the local market, and can be expressed by the following total and marginal cost functions:

where TC is total cost per year, MC is marginal cost, and Q is the number lessons given. Total costs include a normal profit and allow for Bob's employment opportunity costs.

where TC is total cost per year, MC is marginal cost, and Q is the number lessons given. Total costs include a normal profit and allow for Bob's employment opportunity costs.

(Essay)

4.9/5  (31)

(31)

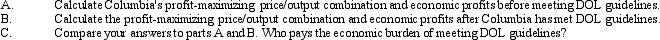

Compulsory Benefit Costs. Columbia Federal Savings & Loan, Inc. offers low-cost home mortgage refinancing services on the Internet. Each refinancing brings the company $250 in fees, and these fees are stable given the competitive nature of Internet marketing. Columbia's relies upon independent contractors (sales associates) who work on a commission-only basis. Weekly total cost (TC) and marginal cost (MC) relations are:

where Q is thousands of refinancing applications processed.

Suppose the US Department of Labor recently ruled that Columbia's sales associates must be considered employees entitled to benefits under the Employee Retirement Income Security Act (ERISA). As a result, Columbia's marginal cost of doing business will rise by $25 per unit. Columbia's fixed expenses, which include a required return on investment, will be unaffected.

where Q is thousands of refinancing applications processed.

Suppose the US Department of Labor recently ruled that Columbia's sales associates must be considered employees entitled to benefits under the Employee Retirement Income Security Act (ERISA). As a result, Columbia's marginal cost of doing business will rise by $25 per unit. Columbia's fixed expenses, which include a required return on investment, will be unaffected.

(Essay)

4.8/5  (30)

(30)

Social Welfare Concepts. Indicate whether each of the following statements is true or false, and explain why.

A. Producer surplus tends to fall as the supply curve becomes more elastic.

B. Consumer surplus tends to rise as demand becomes more elastic.

C. The market demand curve indicates the minimum price buyers are willing to pay at each level of production.

D. The market supply curve indicates the minimum price required by sellers as a group to bring forth production.

E. Consumer surplus is the amount that consumers are willing to pay for a given good or service above and beyond the amount actually paid.

(Short Answer)

4.9/5  (42)

(42)

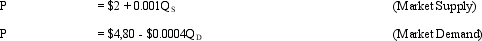

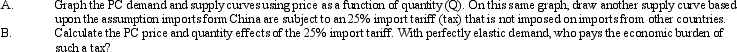

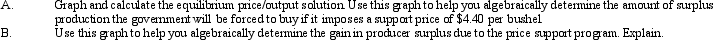

Price Floors and Consumer Surplus. The U. S. wheat crop averages about 2 billion bushels per year, and is about 10 percent of the 20 billion-bushel foreign wheat crop. Typically, the market has a relatively good estimate of the wheat crop from the United States and Canada, but wheat crops from the Southern Hemisphere are much harder to predict. Argentina's wheat acreage varies dramatically from one year to another, for example, and Australia has hard-to-predict rainfall in key wheat production areas. To illustrate some of the cost in social welfare from agricultural price supports, assume the following market supply and demand conditions for wheat:

where Q is output in bushels of wheat (in millions), and P is the market price per bushel.

where Q is output in bushels of wheat (in millions), and P is the market price per bushel.

(Essay)

4.9/5  (31)

(31)

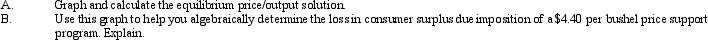

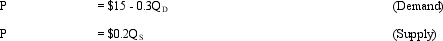

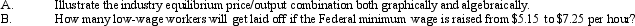

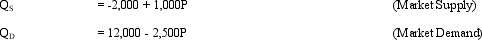

Competitive Market Equilibrium. Assume demand and supply conditions in the competitive market for unskilled labor are as follows:

where Q is millions of hours of unskilled labor and P is the wage rate per hour.

where Q is millions of hours of unskilled labor and P is the wage rate per hour.

(Essay)

4.9/5  (43)

(43)

The burden of a per unit tax on a product will fall primarily on producers when:

(Multiple Choice)

4.8/5  (36)

(36)

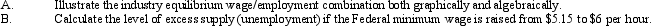

Percentage Tariff and Elastic Demand. Assume that the supply of imported personal computers (PCs) from China is given by the expression:

where Q is the number of PCs sold (in thousands) and P is the PC price. Given the availability of PCs on the Internet, assume that the demand for PCs is perfectly elastic at a price of $800. This means that the PC demand curve can be drawn as a horizontal line that passes through $800 on the Y-axis.

where Q is the number of PCs sold (in thousands) and P is the PC price. Given the availability of PCs on the Internet, assume that the demand for PCs is perfectly elastic at a price of $800. This means that the PC demand curve can be drawn as a horizontal line that passes through $800 on the Y-axis.

(Essay)

4.7/5  (36)

(36)

A per unit tax will cause output prices to increase least when:

(Multiple Choice)

4.7/5  (40)

(40)

From an economic perspective, imposition of a per unit tax is only advantageous if:

(Multiple Choice)

4.7/5  (42)

(42)

Competitive Market Surplus. Assume demand and supply conditions in the competitive market for unskilled labor are as follows:

where Q is millions of hours of unskilled labor and P is the wage rate per hour.

where Q is millions of hours of unskilled labor and P is the wage rate per hour.

(Essay)

4.8/5  (30)

(30)

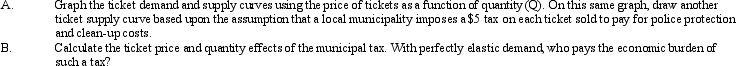

Per Unit Tax and Elastic Demand. Assume that the supply of tickets to an outdoor music festival in Thousand Oaks, California, is a function of price such that:

where Q is the number of tickets (in thousands) and P is the ticket price. Also assume that the demand for such concert tickets is perfectly elastic at a price of $30. This means that the ticket demand curve can be drawn as a horizontal line that passes through $30 on the Y-axis.

where Q is the number of tickets (in thousands) and P is the ticket price. Also assume that the demand for such concert tickets is perfectly elastic at a price of $30. This means that the ticket demand curve can be drawn as a horizontal line that passes through $30 on the Y-axis.

(Essay)

4.8/5  (39)

(39)

Price Floors and Producer Surplus. The U. S. wheat crop averages about 2 billion bushels per year, and is about 10 percent of the 20 billion-bushel foreign wheat crop. Typically, the market has a relatively good estimate of the wheat crop from the United States and Canada, but wheat crops from the Southern Hemisphere are much harder to predict. Argentina's wheat acreage varies dramatically from one year to another, for example, and Australia has hard-to-predict rainfall in key wheat production areas. To illustrate some of the cost in social welfare from agricultural price supports, assume the following market supply and demand conditions for wheat:

where Q is output in bushels of wheat (in millions), and P is the market price per bushel.

where Q is output in bushels of wheat (in millions), and P is the market price per bushel.

(Essay)

4.8/5  (34)

(34)

Showing 1 - 20 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)