Exam 6: Inventories

Exam 1: Fundamentals of Financial Accounting Theory33 Questions

Exam 2: Conceptual Frameworks for Financial Reporting60 Questions

Exam 3: Accrual Accounting159 Questions

Exam 4: Revenue Recognition110 Questions

Exam 5: Cash and Receivables120 Questions

Exam 6: Inventories156 Questions

Exam 7: Financial Assets141 Questions

Exam 8: Property, Plant, and Equipment127 Questions

Exam 9: Intangible Assets, Goodwill, Mineral Resources, and Government Grants81 Questions

Exam 10: Applications of Fair Value to Non-Current Assets120 Questions

Select questions type

At the end of 2012, a company reported cost of goods sold of $4,800, which represented 80% of the goods available for sale. The beginning inventory amount was twice as much as the ending inventory amount. What was the amount of purchases for 2012?

(Multiple Choice)

4.9/5  (39)

(39)

Dianna Co. prepares monthly income statements. Inventory is counted only at year end; thus, month-end inventories must be estimated. All sales are made on account. The rate of mark-up on cost is 20%. The following information relates to the month of September.

Accounts receivable, September 1 $121,000

Inventory, September 1 147,000

Collections of accounts during September 184,000

Purchases during September 165,000

Accounts receivable, September 30 127,000

Required:

Calculate the estimated cost of the inventory on September 30.

(Essay)

4.9/5  (36)

(36)

Explain how items of inventory should be grouped for purposes of testing for impairment.

(Essay)

4.8/5  (34)

(34)

If the gross margin percentage used in the gross margin method were overstated (e.g., 36% instead of 32%), what would happen?

(Multiple Choice)

4.8/5  (32)

(32)

Why are inventories reported at the lower of cost and market?

(Multiple Choice)

5.0/5  (42)

(42)

What journal entry is required when inventory is sold during the year under the periodic inventory system?

(Multiple Choice)

4.9/5  (38)

(38)

Which statement is not correct about the retail inventory method?

(Multiple Choice)

4.9/5  (33)

(33)

Which statement best depicts the inventory cost flow equation?

(Multiple Choice)

4.9/5  (41)

(41)

What is the meaning of the terms "F.O.B. destination point"?

(Multiple Choice)

4.9/5  (33)

(33)

Assume that ending inventory in fiscal 2012 is overstated by $1,000.What impact will this have on fiscal 2012 financial reporting?

(Multiple Choice)

4.8/5  (43)

(43)

What journal entry is required when inventory is purchased under the periodic inventory system?

(Multiple Choice)

4.8/5  (37)

(37)

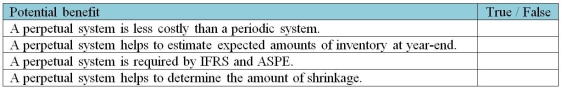

Identify whether the following are benefits of using a perpetual inventory system (in comparison to a periodic system).

(Essay)

4.7/5  (41)

(41)

Assume that a purchase invoice for $1,000 was appropriately recorded in fiscal 2012, but the inventory was excluded in error during the ending inventory count. What impact will this have on fiscal 2012 financial reporting?

(Multiple Choice)

4.8/5  (36)

(36)

Assume that ending inventory in fiscal 2012 is overstated by $1,000.What impact will this have on fiscal 2013 financial reporting?

(Multiple Choice)

4.9/5  (35)

(35)

What journal entry is required when inventory is purchased under the perpetual inventory system?

(Multiple Choice)

4.8/5  (39)

(39)

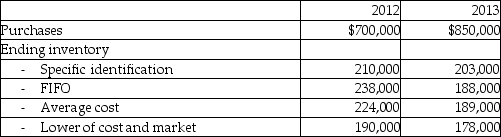

Johnson Ltd. began operations on January l, 2012. Merchandise purchases and four alternative methods of valuing inventory for the first two years of operations are summarized below:

Required:

a. Which of the four methods listed above does not apply the matching principle? Briefly explain.

b. Determine the cost flow assumption or inventory valuation method that would report the highest net income for 2012.

c. Assuming that FIFO had been used for both years, how much would the cost of goods sold be for 2013?

Required:

a. Which of the four methods listed above does not apply the matching principle? Briefly explain.

b. Determine the cost flow assumption or inventory valuation method that would report the highest net income for 2012.

c. Assuming that FIFO had been used for both years, how much would the cost of goods sold be for 2013?

(Essay)

4.9/5  (32)

(32)

Which inventory method provides the highest quality information for the income statement?

(Multiple Choice)

4.8/5  (47)

(47)

Showing 21 - 40 of 156

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)