Exam 6: Inventories

Exam 1: Fundamentals of Financial Accounting Theory33 Questions

Exam 2: Conceptual Frameworks for Financial Reporting60 Questions

Exam 3: Accrual Accounting159 Questions

Exam 4: Revenue Recognition110 Questions

Exam 5: Cash and Receivables120 Questions

Exam 6: Inventories156 Questions

Exam 7: Financial Assets141 Questions

Exam 8: Property, Plant, and Equipment127 Questions

Exam 9: Intangible Assets, Goodwill, Mineral Resources, and Government Grants81 Questions

Exam 10: Applications of Fair Value to Non-Current Assets120 Questions

Select questions type

Which statement best explains the LIFO cost flow assumption?

(Multiple Choice)

4.8/5  (29)

(29)

Compare the perpetual inventory control system and the periodic inventory control system. Which system provides better information for inventory management?

(Essay)

4.8/5  (37)

(37)

Explain how a merchandising company can manipulate earnings through its year-end inventories. What can an auditor do to detect this type of manipulation?

(Essay)

4.9/5  (39)

(39)

Which statement best explains the retail inventory method?

(Multiple Choice)

4.9/5  (41)

(41)

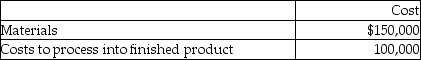

Using the following cost information regarding finished goods, what would be the ending value of the finished goods inventory if the market value of the goods is $300,000?

(Multiple Choice)

4.8/5  (30)

(30)

Assume that a purchase invoice for $1,000 was appropriately recorded in fiscal 2012, but the inventory was excluded in error during the ending inventory count. What impact will this have on fiscal 2013 financial reporting?

(Multiple Choice)

4.8/5  (38)

(38)

Assume that a purchase invoice for $1,000 was appropriately recorded in fiscal 2012, but the inventory was excluded in error during the ending inventory count. What impact will this have on fiscal 2013 financial reporting?

(Multiple Choice)

4.8/5  (29)

(29)

Assume that a $100 purchase invoice received close to year-end is not recorded in fiscal 2012, but the inventory is appropriately included in the ending inventory count. What impact will this have on fiscal 2012 financial reporting?

(Multiple Choice)

4.8/5  (42)

(42)

Which statement is not correct about the periodic inventory system for inventory management?

(Multiple Choice)

4.9/5  (38)

(38)

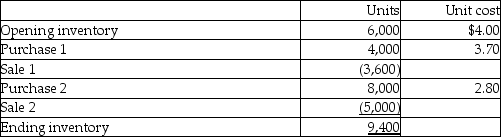

The inventory records of ZUP indicate the following regarding its best-selling product for the month of January:

Required:

Calculate the dollar amount of ending inventory and cost of goods sold under each of the following cost flow assumptions:

a. Weighted-average cost, periodic inventory.

b. First-in, first-out (FIFO), perpetual inventory.

c. Weighted-average cost, perpetual inventory.

Required:

Calculate the dollar amount of ending inventory and cost of goods sold under each of the following cost flow assumptions:

a. Weighted-average cost, periodic inventory.

b. First-in, first-out (FIFO), perpetual inventory.

c. Weighted-average cost, perpetual inventory.

(Essay)

4.9/5  (40)

(40)

Assume that a $1,000 purchase invoice received close to year-end is not recorded in fiscal 2012, but the inventory is appropriately included in the ending inventory count. What impact will this have on fiscal 2012 financial reporting?

(Multiple Choice)

4.9/5  (36)

(36)

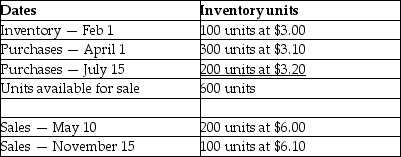

The following information was taken from the inventory records of Hope Corp.:  What would be the ending inventory, assuming that the LIFO method is used in a periodic inventory system?

What would be the ending inventory, assuming that the LIFO method is used in a periodic inventory system?

(Multiple Choice)

4.9/5  (32)

(32)

Assume that a $400 purchase invoice received close to year-end is not recorded in fiscal 2012, but the inventory is appropriately included in the ending inventory count. What impact will this have on fiscal 2013 financial reporting?

(Multiple Choice)

4.9/5  (38)

(38)

Explain how manufacturing companies can manipulate earnings through its production process. What should an auditor or financial statement user do to detect this type of manipulation?

(Essay)

4.9/5  (34)

(34)

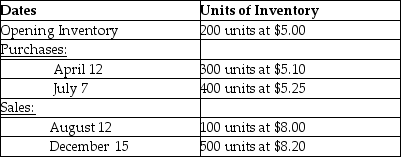

Given the following information, what would the ending inventory value be on December 31 under the LIFO method in a periodic inventory system?

(Multiple Choice)

4.8/5  (27)

(27)

Showing 141 - 156 of 156

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)