Exam 10: Applications of Fair Value to Non-Current Assets

Exam 1: Fundamentals of Financial Accounting Theory33 Questions

Exam 2: Conceptual Frameworks for Financial Reporting60 Questions

Exam 3: Accrual Accounting159 Questions

Exam 4: Revenue Recognition110 Questions

Exam 5: Cash and Receivables120 Questions

Exam 6: Inventories156 Questions

Exam 7: Financial Assets141 Questions

Exam 8: Property, Plant, and Equipment127 Questions

Exam 9: Intangible Assets, Goodwill, Mineral Resources, and Government Grants81 Questions

Exam 10: Applications of Fair Value to Non-Current Assets120 Questions

Select questions type

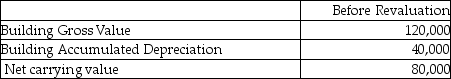

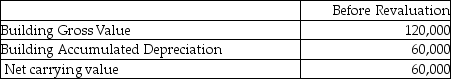

Grover Inc wishes to use the revaluation model for this property:  The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

(Multiple Choice)

4.9/5  (38)

(38)

How is "discontinued operations" information presented in the financial statements?

(Multiple Choice)

4.7/5  (39)

(39)

Which of the following is correct with respect to the "impairment loss"?

(Multiple Choice)

4.7/5  (40)

(40)

Which of the following is correct with respect to when the impairment test must be performed?

(Multiple Choice)

4.8/5  (37)

(37)

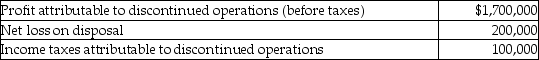

The following information is available about Fred Inc's discontinued operations:  What single amount will be presented on Fred's statement of comprehensive income?

What single amount will be presented on Fred's statement of comprehensive income?

(Multiple Choice)

5.0/5  (39)

(39)

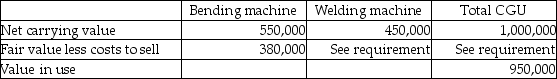

Adam's Bikes produces specialized bicycle frames. The production process uses two machines, which together form a cash generating unit (CGU). The following information is relevant to the evaluation of impairment for these machines.

Required:

a. Assume that the welding machine has a fair value less costs to sell of $420,000. Determine the amount of impairment that should be recorded for the cash generating unit and for each of the two machines.

b. Assume that the welding machine has a fair value less costs to sell of $455,000. Determine the amount of impairment that should be recorded for the cash generating unit and for each of the two machines.

Required:

a. Assume that the welding machine has a fair value less costs to sell of $420,000. Determine the amount of impairment that should be recorded for the cash generating unit and for each of the two machines.

b. Assume that the welding machine has a fair value less costs to sell of $455,000. Determine the amount of impairment that should be recorded for the cash generating unit and for each of the two machines.

(Essay)

4.9/5  (32)

(32)

Where are gains and losses on agricultural activity reported in the financial statements?

(Multiple Choice)

4.9/5  (34)

(34)

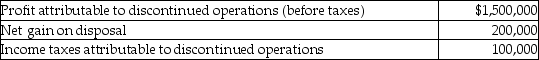

The following information is available about George Inc's discontinued operations:  What single amount will be presented on George's statement of comprehensive income?

What single amount will be presented on George's statement of comprehensive income?

(Multiple Choice)

4.9/5  (43)

(43)

Which is an exception to the rule: "test for impairment only if there are indicators for impairment"?

(Multiple Choice)

4.7/5  (42)

(42)

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

(Multiple Choice)

4.9/5  (32)

(32)

Explain how non-current assets such as definite lived intangibles, indefinite lived intangibles and goodwill are tested for impairment under IFRS.

(Essay)

4.8/5  (38)

(38)

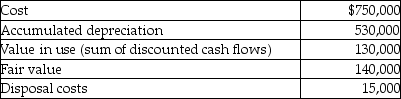

Based on the following information, what is the impairment amount to be recorded?

(Multiple Choice)

4.9/5  (39)

(39)

Explain the accounting for assets related to the agricultural industry.

(Essay)

4.8/5  (28)

(28)

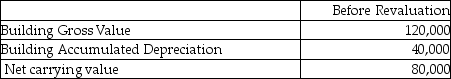

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the proportional method to record the revaluation?

The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the proportional method to record the revaluation?

(Multiple Choice)

4.8/5  (31)

(31)

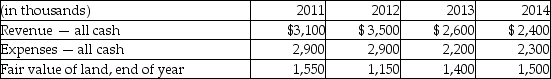

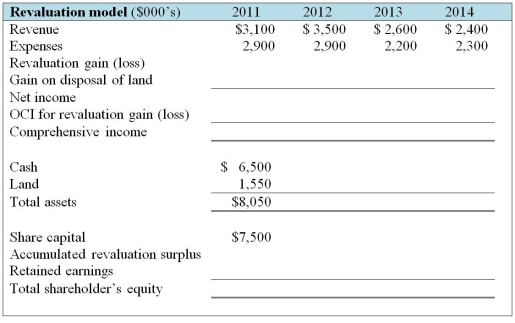

Wright Now Limited (WNL)was incorporated on January 1, 2011 when the sole shareholder invested $7,500,000. This is the only financing the firm needed. WNL used $1,200,000 of the funds to purchase land. The company has a single project that it developed over four years. Below are details of the four years of operations. At the end of 2014 the land was sold for its fair value.

Required:

Complete the following table, assuming that WNL uses the revaluation model of measurement. OCI refers to other comprehensive income.

Required:

Complete the following table, assuming that WNL uses the revaluation model of measurement. OCI refers to other comprehensive income.

(Essay)

4.9/5  (38)

(38)

Showing 21 - 40 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)