Exam 16: Decreases in Ownership Interest

Exam 1: Setting the Stage40 Questions

Exam 2: Intercorporate Equity Investments: an Introduction42 Questions

Exam 3: Business Combinations40 Questions

Exam 4: Wholly-Owned Subsidiaries: Reporting Subsequent to Acquisition37 Questions

Exam 5: Consolidation of Non-Wholly Owned Subsidiaries36 Questions

Exam 6: Subsequent-Year Consolidations: General Approach36 Questions

Exam 7: Segmented and Interim Reporting41 Questions

Exam 8: Foreign Currency Transactions and Hedges49 Questions

Exam 9: Reporting Foreign Operations43 Questions

Exam 10: Financial Reporting for Not-For-Profit Organizations46 Questions

Exam 11: Public Sector Financial Reporting41 Questions

Exam 12: Income Tax Allocation4 Questions

Exam 13: Income Tax Allocation Subsequent to Acquisition4 Questions

Exam 14: Good will Impairment Test6 Questions

Exam 15: Step Purchases6 Questions

Exam 16: Decreases in Ownership Interest4 Questions

Exam 18: Intercompany Bond Holdings6 Questions

Exam 19: Fund Accounting5 Questions

Select questions type

When a subsidiary issues shares,________.

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

D

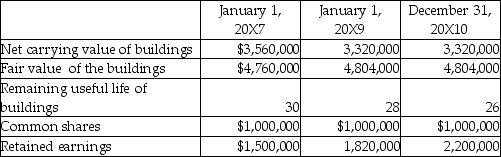

On January 1,20X7,Water Limited purchased 700,000 shares of Bottle Inc.for $2.8 million.On January 1,20X9,Water sold 150,000 shares of Bottle for $700,000.During the entire period Bottle had 1,000,000 shares outstanding.Water accounts for its investment in Bottle under the equity method.The following information was extracted from the financial records of Bottle:

All net identifiable assets had a fair value equal to their carrying value on the date of acquisition except the buildings.There is no goodwill reported on the separate entity financial statements of Water or Bottle.There have been no intercompany transactions between Water and Bottle.

Required:

Calculate the balances of following accounts on the consolidated statement of financial position at December 31,20X10,under the parent-company extension method:

a.Goodwill

b.NCI

Determine the adjustment to equity required.

All net identifiable assets had a fair value equal to their carrying value on the date of acquisition except the buildings.There is no goodwill reported on the separate entity financial statements of Water or Bottle.There have been no intercompany transactions between Water and Bottle.

Required:

Calculate the balances of following accounts on the consolidated statement of financial position at December 31,20X10,under the parent-company extension method:

a.Goodwill

b.NCI

Determine the adjustment to equity required.

Free

(Essay)

4.7/5  (44)

(44)

Correct Answer:

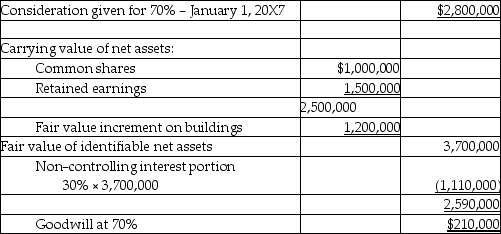

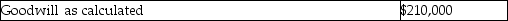

Measure: Determine goodwill

Building Fair value increment Amortization per year:

Building Fair value increment Amortization per year:

Fair value increment = $1,200,000 / 30 = $40,000 annually.

a.

Note- this balance will not change as percentage ownership is added as long as control is maintained.

Note- this balance will not change as percentage ownership is added as long as control is maintained.

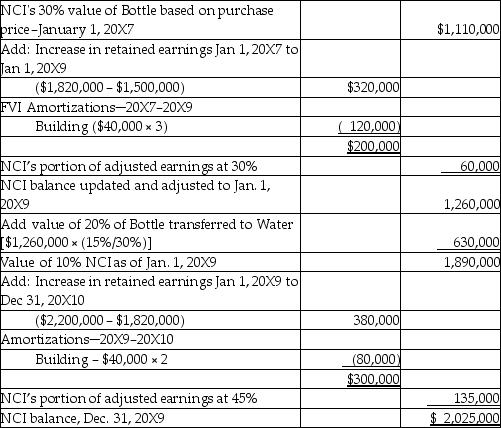

b)

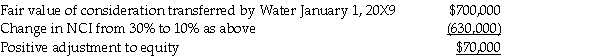

Adjustment to equity:

Adjustment to equity:

Gumble Ltd.has owned 65% of the common shares of Lopez for several years.This year,Gumble reduced its interest in Lopez to 10%.Which of the following statements is true?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

B

Frey Ltd.acquired 70% of Sabo Ltd.several years ago.On January 1,20X8,Frey reduced its holding in Sabo by 10%.The shares were sold for $160,000.At December 31,20X7,under the entity method,the balance of Frey's share of Sabo's net assets was $84,000.What adjustment should be made to the consolidated shareholders' equity to reflect Frey's reduction in interest in Sabo to 60%?

(Multiple Choice)

4.7/5  (38)

(38)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)