Exam 16: Introduction to Management Accounting

Exam 12: Corporations: Paid-In Capital and the Balance Sheet167 Questions

Exam 13: Corporations: Effects on Retained Earnings and the Income Statement164 Questions

Exam 14: The Statement of Cash Flows157 Questions

Exam 15: Financial Statement Analysis161 Questions

Exam 16: Introduction to Management Accounting161 Questions

Exam 17: Job Order and Process Costing168 Questions

Exam 18: Activity-Based Costing and Other Cost Management Tools160 Questions

Exam 19: Cost-Volume-Profit Analysis163 Questions

Exam 20: Short-Term Business Decisions164 Questions

Exam 21: Capital Investment Decisions and the Time Value of Money152 Questions

Exam 22: The Master Budget and Responsibility Accounting155 Questions

Exam 23: Flexible Budgets and Standard Costs165 Questions

Exam 24: Performance Evaluation and the Balanced Scorecard166 Questions

Select questions type

The wages and benefits of the factory janitors are included in manufacturing overhead.

(True/False)

4.8/5  (23)

(23)

The following information was obtained from Sizzler Company:

• Advertising costs: $7,900

• Indirect labor: $9,000

• Direct Labor: $31,000

• Indirect materials: $7,200

• Direct materials: $47,000

• Factory utilities: $3,000

• Factory repair and maintenance: $700

• Factory janitorial costs: $1,900

• Manufacturing equipment depreciation: $1,600

• Delivery vehicle depreciation: $790

• Administrative wages and salaries: $19,000

-

How much was Sizzler's factory overhead?

(Multiple Choice)

4.7/5  (33)

(33)

Financial accounting is focused on which of the following objectives?

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following is NOT an objective of management accounting?

(Multiple Choice)

4.8/5  (39)

(39)

The following information was obtained from Sizzler Company:

• Advertising costs: $7,900

• Indirect labor: $9,000

• Direct Labor: $31,000

• Indirect materials: $7,200

• Direct materials: $47,000

• Factory utilities: $3,000

• Factory repair and maintenance: $700

• Factory janitorial costs: $1,900

• Manufacturing equipment depreciation: $1,600

• Delivery vehicle depreciation: $790

• Administrative wages and salaries: $19,000

-

How much were Sizzler's period costs?

(Multiple Choice)

5.0/5  (37)

(37)

The following information was obtained from Fizz Company:

• Advertising costs: $9,900

• Indirect labor: $11,000

• CEO's salary: $49,000

• Direct Labor: $41,000

• Indirect materials: $7,900

• Direct materials: $61,000

• Factory utilities: $700

• Factory janitorial costs: $2,300

• Manufacturing equipment depreciation: $2,100

• Delivery vehicle depreciation: $1,100

• Administrative wages and salaries: $21,000

How much were Fizz's inventoriable product costs?

(Multiple Choice)

4.7/5  (29)

(29)

Manufacturing businesses have inventory accounts, but service and merchandising businesses do not.

(True/False)

4.7/5  (43)

(43)

Which of the following describes the cost of goods manufactured?

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following events would NOT be considered unethical under IMA standards?

(Multiple Choice)

4.8/5  (37)

(37)

The following information pertains to Bright Toy Company's operating activities for 2012. The company sells light box toys and sold 10,000 units in 2012.

Purchases \ 126,000 Selling and Administrative Expenses 90,000 Merchandise inventory, 1/1/2012 14,000 Merchandise inventory, 12/31/2012 10,000 Sales Revenue 250,000

-

What is the operating income for 2012?

(Multiple Choice)

5.0/5  (44)

(44)

Best Company sells office supplies. The following information summarizes Best's operating activities for 2012:

Utilities for store \ 6,000 Rent for store \ 8,000 Sales commissions \ 4,500 Purchases of merchandise \ 54,000 Inventory on January 1,2012 \ 30,000 Inventory on December 31,2012 \ 20,500 Sales revenue \ 108,000

Required: Prepare an income statement for Best Company, a merchandiser, for the year ended December 31, 2012.using the format below. Please include a vertical analysis rounded to the nearest tenth of a percent.

Sales revenue Cost of goods sold Beginning inventory Purchases Cost of goods available for sale Ending inventory Cost of goods sold Gross profit Selling expenses Sales commissions General expenses Rent expense Utilities expense Total operating expenses Net income/(loss)

(Essay)

4.9/5  (39)

(39)

Which of the following properly describes the accounting for factory depreciation?

(Multiple Choice)

4.8/5  (42)

(42)

All of the following are examples of manufacturing overhead EXCEPT for:

(Multiple Choice)

4.8/5  (24)

(24)

following information for the year 2012:

Beginning balance-work in process inventory \ 12,000 Ending balance-work in process inventory \ 28,000 Beginning balance-direct materials inventory \ 42,000 Ending balance-direct materials inventory \ 30,000 Purchases-direct materials \ 180,000 Direct labor \ 235,000 Indirect materials \ 23,500 Indirect labor \ 9,500 Depreciation on factory plant \& equipment \ 12,000 Plant utilities \& insurance \ 135,000

- What was the amount of the cost of goods manufactured for the year?

(Multiple Choice)

4.9/5  (46)

(46)

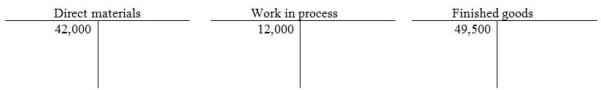

following information for the year 2012:

Beginning balance-work in process inventory \ 12,000 Ending balance-work in process inventory \ 28,000 Beginning balance-direct materials inventory \ 42,000 Ending balance-direct materials inventory \ 30,000 Purchases-direct materials \ 180,000 Direct labor \ 235,000 Indirect materials \ 23,500 Indirect labor \ 9,500 Depreciation on factory plant \& equipment \ 12,000 Plant utilities \& insurance \ 135,000

-

Please refer to the T-accounts below which show the beginning balances for the year.  Use the T-accounts to record the transactions for the year. What is the ending balance in the Direct materials account?

Use the T-accounts to record the transactions for the year. What is the ending balance in the Direct materials account?

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following costs would appear on the income statements for both a merchandiser and a manufacturer?

(Multiple Choice)

4.8/5  (35)

(35)

Best Company sells office supplies. The following information summarizes Best's operating activities for 2012:

Utilities for store \ 6,000 Rent for store \ 8,000 Sales commissions \ 4,500 Purchases of merchandise \ 54,000 Inventory on January 1,2012 \ 30,000 Inventory on December 31,2012 \ 20,500 Sales revenue \ 108,000

-

Required: Prepare an income statement for Best Company, a merchandiser, for the year ended December 31, 2012.using the format below:

Sales revenue

Cost of goods sold Beginning inventory Purchases Cost of goods available for sale Ending inventory Cost of goods sold Gross profit Selling expenses Sales commissions General expenses Rent expense Utilities expense Total operating expenses Net income/(loss)

(Essay)

4.9/5  (29)

(29)

Which of the following is an inventory account for a merchandise company?

(Multiple Choice)

4.8/5  (42)

(42)

Showing 81 - 100 of 161

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)